This week, the global financial landscape was rocked by a series of developments that amplified uncertainty, rattled markets, and sent investors scrambling for cover. From escalating trade tensions to central bank jitters, the events underscored the fragility of the current economic order. One that has been slowly breaking down before our eyes since the 2020 lockdowns. Amid this chaos, gold and silver have emerged as critical safe-haven assets, offering a buffer for investors seeking to mitigate losses. Let’s unpack the week’s financial turbulence and explore how precious metals have factored into softening the blow for their owners.

President Trump’s Tariff Rollercoaster Intensifies Trade War Fears

The week began with continued fallout from U.S. President Donald Trump’s unpredictable tariff policies. After a brief 90-day pause on his aggressive “reciprocal” tariffs, which include a 10% levy on all imports and a staggering 145% on Chinese goods, the World Trade Organization (WTO) issued a dire warning. The WTO projected a potential 1.5% decline in global goods trade if trade policy uncertainty spills over, with U.S.-China trade expected to plummet by 81%. The fallout caused by the two largest economies in the world splintering their trade relationship is something our interconnected world of globalization has never experienced to this scale. This uncertainty has already disrupted supply chains, with companies like PepsiCo and Kimberly-Clark reporting higher costs and Tesla citing trade-related weakness in Q1 results. The threat of renewed tariffs after the pause has kept markets on edge, with consumer confidence and global economic outlooks deteriorating. Adding to the confusion, both the United States and China continue to add to the fog of war being perpetuated. First tariffs are rising, then they are being lowered or paused. President Trump says trade talks with China are going well and that they talk every day, only for China to follow that up by saying there has been no progress in trade talks at all. Given this, uncertainty in the markets is the only thing we can currently be certain of.

Stock Market Slump and Corporate Caution

U.S. stocks endured some of their worst days in decades, with the Dow Jones and S&P 500 sliding as companies grappled with tariff impacts and broader economic fears. In the 128-year history of the Dow Jones, it has only lost -1000 points in a single day 11 times; four of those times have occurred since April 2nd, 2025; a truly staggering statistic. American Airlines withdrew its 2025 financial forecast, citing tariff pressures and government spending uncertainties, while D.R. Horton, the largest U.S. homebuilder, reported a sluggish spring selling season due to high mortgage rates and economic unease. Furthermore, it was also reported that the U.S. saw the lowest number of existing home sales in March since the 2008 Great Financial Crisis, a time that saw widespread foreclosures. The yield on the 10-year Treasury note climbed to 4.42%, reflecting bond market turmoil and rising borrowing costs. This volatility has forced corporations to adopt a cautious stance, with many, like Hasbro, opting not to revise annual forecasts amid the unpredictability due to fears of missing their projections, badly, and plummeting their stock.

Federal Reserve Under Fire

Adding fuel to the fire, President Trump’s public criticism of Federal Reserve Chair Jerome Powell intensified, raising fears of a politicized central bank. Trump’s threats to remove Powell, coupled with his frustration over the Fed’s reluctance to cut interest rates, sparked concerns about its independence. Powell himself warned of the “challenging” impacts of tariff uncertainty, signaling the Fed would hold off on rate adjustments until clarity emerges. Any move to undermine the Fed’s autonomy could trigger a crisis in global financial markets, as investors fear a less independent central bank may struggle to control inflation. Nevertheless, this feud has highlighted our fears that central banks answer to only their secret private owners that remain unnamed – another reason why owning silver and gold to protect against poor monetary policy is so important.

Geopolitical and Currency Shocks

Beyond trade and monetary policy, geopolitical tensions and currency fluctuations compounded the uncertainty. The end of the Russia-Ukraine ceasefire and a weakening U.S. dollar fueled market weariness. Meanwhile, the Bank of Japan’s surprise rate hikes in 2024 continue to reverberate, with fears of a reverse yen carry trade threatening global markets, something we covered in a previous newsletter. These developments have left investors questioning the reliability of traditional safe-haven assets like U.S. Treasury bonds, which are increasingly entangled in political negotiations, as well as the long-term value (or purchasing power) of their national currencies.

Gold and Silver: A Beacon in the Storm

Amid this financial maelstrom, gold and silver have played a pivotal role in softening the blow for investors. Gold, in particular, has been a standout performer, surging to record highs above $3,400 USD per ounce and gaining over 25% since the start of 2025. This rally, driven by a weakening dollar, trade war fears, and central bank bullion buying, has solidified gold’s status as a hedge against uncertainty. Analysts from Goldman Sachs, UBS, and JP Morgan are bullish, with forecasts predicting gold could hit $4,000 USD per ounce by mid-2026, we believe far sooner.

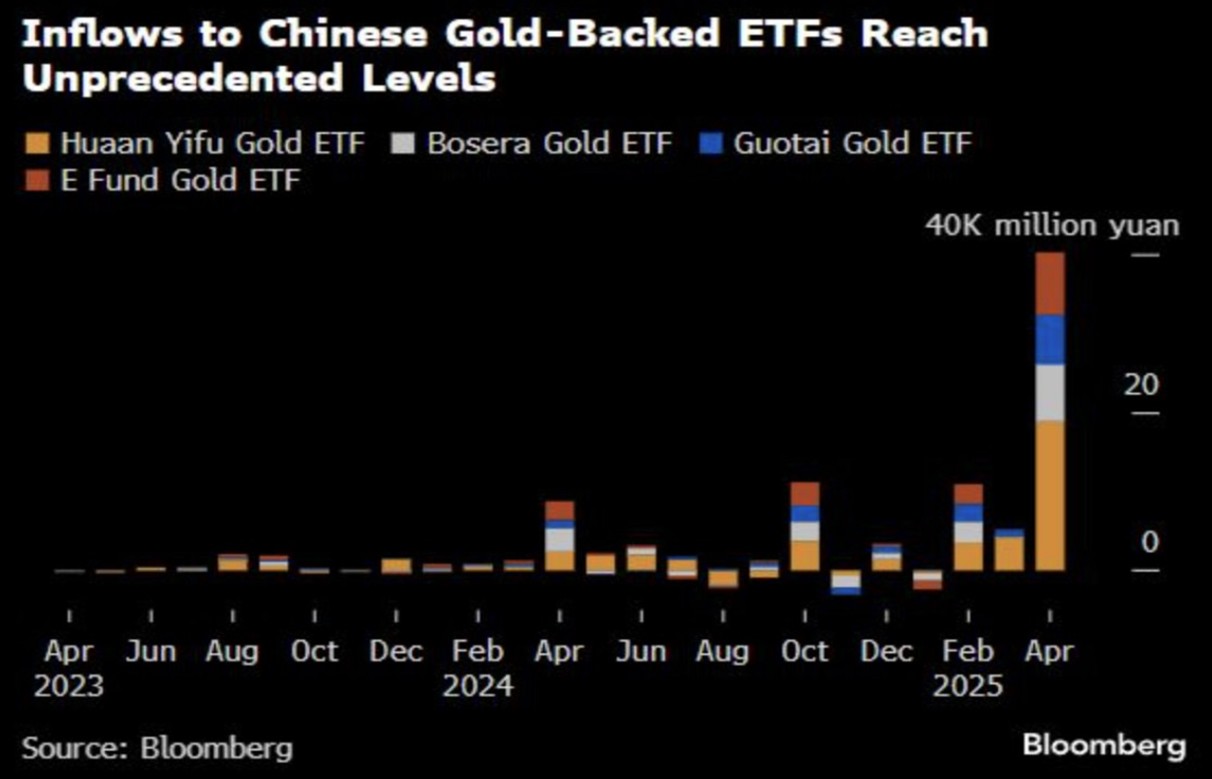

Gold’s appeal lies in its independence from equities and its resilience in low-interest-rate environments. Physical gold bullion offers a tangible asset free from counterparty risk, appealing to those wary of financial institutions. For investors holding gold, this week’s market turmoil has translated into significant gains, offsetting losses in stocks and bonds. Retail and institutional investors alike have flocked to the metal because of this, with Chinese gold ETF inflows surpassing U.S. funds and with global demand hitting record highs in 2024. More recently, in April of 2025 these inflows to Chinese gold-backed ETFs reached incredible levels as seen in the chart below. The world is quickly catching “Gold Fever”.

Silver, however, has faced near-term headwinds due to industrial demand uncertainty tied to trade disruptions. Spot silver still manages to sit at $32.92 USD per ounce, up 1.30% on the week. Looking ahead, JP Morgan predicts a “catch-up window” for silver, with prices potentially reaching $39 USD per ounce by year-end. Silver’s dual role as both a safe-haven and industrial metal makes it more volatile, but its long-term outlook remains positive for investors who weathered this week’s dip and understand it is likely the most undervalued asset in the world today. As we have long said, we believe gold will kick the door down and silver will run through it. Well, gold has been giving the door some pretty good ‘whacks’ these days.

The events of this week highlight the precarious state of global finance, with trade wars, central bank pressures, and geopolitical shocks creating a sandstorm of poor visibility and uncertainty. For investors, the volatility has been a stark reminder of the need for diversification into risk off assets. Gold’s meteoric rise and silver’s massive potential (remember it outperformed gold in 2024) have provided a lifeline, softening the blow for those with exposure to precious metals. As the tariff pause nears its end and markets brace for further turbulence, holding safe-haven assets like gold and silver may continue to be a prudent strategy in navigating the uncertain road ahead.

Hi,

Hi,