Precious metals have been having a great couple years led by silver and gold and this past week the precious metals market is buzzing with excitement as we may be seeing some significant breakouts across the board. Not only that but a fascinating theory that we have long covered in our newsletters is seemingly playing out before our eyes: gold, the steadfast leader, “kicks the door down” to higher prices, paving the way for silver and other precious metals to surge through with remarkable speed. This week’s market movements offer a compelling case study of this phenomenon, with gold’s steady climb creating opportunities for its peers to shine.

Gold Sets the Stage

Year-to-date (YTD), gold has delivered a stellar performance, climbing 28.05% in 2025. For context, a good year of gains for someone’s investment portfolio would be 7-9%, gold has averaged a 5.61% gain per month. This robust growth reflects its role as the cornerstone of the precious metals market, driven by its status as a safe-haven asset amid economic uncertainty that continues to plague the world, inflationary pressures that won’t ease, and geopolitical tensions that are on the rise. The Governor of the National Bank of Poland stated, “gold is the safest reserve asset – it’s not directly tied to any one country’s economic policy, it withstands crises, and preserves real value over the long term.” Poland has purchased 67 tonnes of gold so far in 2025; a strong statement followed up by strong action. Gold’s ability to break through resistance levels week after week—metaphorically “kicking the door down”—has signaled to investors that the precious metals sector is primed for sustained growth. When gold moves decisively higher and holds, it tends to pull other metals along, creating a violent ripple effect across the market.

However, this week tells a different story for gold’s momentum. While it posted a modest gain of 1.43%, under its monthly average, gold’s slower pace suggests that it may be catching its breath after a strong start to the year. This slowdown is not a sign of weakness but rather a natural pause, allowing other precious metals to seize the spotlight and capitalize on the open-door gold has created.

Silver, Platinum, and Palladium Race Ahead

The theory that gold’s breakout paves the way for silver and other precious metals to “run through the open door” is vividly illustrated by this week’s performances. Silver, often seen as gold’s more volatile cousin, surged an impressive 9.68% this week, outpacing gold by a wide margin. YTD, silver is up 23.47%, trailing gold slightly but showing its potential for explosive gains when market conditions align in silver’s favour as they are now.

Platinum and palladium are also charging through the door gold has opened wide. Platinum gained an eye-catching 10.56% this week, bringing its YTD increase to 27.66%, nearly eclipsing gold’s annual performance after an incredible week. Palladium, while trailing with a YTD gain of 15.23%, still posted a solid 8.03% increase this week, gaining over half of its overall percentage gains on the year in a single 5-day trading week. These metals, heavily used in industrial applications like automotive catalysts, are riding the wave of renewed investor interest and supply-demand dynamics. As gold stabilizes at higher levels and even starts pushing further ahead, silver, platinum, and palladium are poised to catch up—and fast.

Why the Surge?

The “gold kicks, silver runs” theory hinges on market psychology and economic fundamentals. Gold, as the most liquid and widely recognized precious metal, often leads the charge during bullish cycles as it is often accumulated first. Its price movements attract attention, drawing more and more capital into the sector. Once gold establishes a new price floor, investors turn to silver, platinum, and palladium, which are perceived as undervalued relative to gold after its move. This week’s data underscores this dynamic: while gold’s 1.43% gain is respectable on the week given our investment portfolio context earlier, the nearly double-digit weekly surges in silver and palladium and double-digit gain in platinum suggests a rapid reallocation of investor focus.

Additionally, silver’s lower price point makes it far more accessible to retail investors looking to pour into an increasingly crowded market, amplifying its volatility and potential for outsized gains. Platinum and palladium, meanwhile, benefit from industrial demand, particularly in the automotive sector, where tightening emissions regulations drive catalyst use in EVs and therefore higher usage of those precious metals. As gold holds the line, these metals are racing to close the performance gap, fulfilling the theory’s prediction.

Central Banks and the Gold Rush

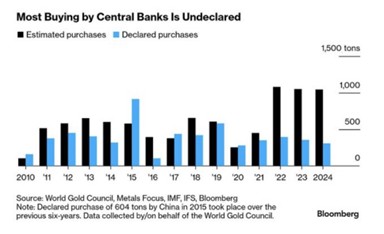

A significant driver of gold’s 2025 performance is the voracious appetite of central banks. According to industry estimates, central banks are on pace to purchase 1,000 metric tonnes of gold this year, a continuation of their aggressive buying trend. This demand reflects a strategic shift toward de-dollarization, particularly among emerging market economies looking to protect what wealth they do have. Intriguingly, much of this buying appears to be going undeclared, suggesting that the true scale of central bank accumulation may be even larger than reported figures indicate.

Undeclared purchases add a layer of opacity to the market, potentially masking the full extent of demand-driven price support. One theory is that this allows for prices to be held lower while larger entities buy up available stock before reporting these purchases and sending the value of their gold skyward. As central banks stockpile gold, they reinforce its role as the bedrock of the precious metals complex, creating a stable foundation for silver, platinum, and palladium to build upon. This dynamic further validates the “kick the door down” theory, as gold’s institutional backing sets the stage for broader market rallies.

The interplay between gold’s steady leadership and the rapid gains of silver, platinum, and palladium offers a compelling narrative for investors. Gold’s 28.05% YTD increase has established a bullish trend, and its modest 1.43% weekly gain suggests it’s consolidating before its next move. Meanwhile, silver’s 9.68% weekly surge, platinum’s 10.56%, and palladium’s 8.03% highlight their potential to outpace gold in the short term. These metals are not just catching up—they’re sprinting through the open door.

Hi,

Hi,