The financial landscape is shifting before our very eyes, and the case for gold and silver as safe-haven assets has never been stronger. It seems that with each passing week the number of stories surrounding the world’s shift to precious metals continues to grow. This past week was no different and here’s a few more reasons why you should be paying attention to precious metals and questioning the stability of fiat currencies.

Trump’s Federal Reserve Stance Fuels Gold Price Surge

Recent moves by President Donald Trump to challenge the Federal Reserve’s independence have sent shockwaves through global markets. Major institutions like Goldman Sachs and JPMorgan, spooked by the potential politicization of monetary policy, are sounding the alarm and forecasting higher gold prices. Their conservative guess was we could see $5000 USD/oz gold before too long. Our thought is they are right, there final target is just far too low as whatever is done in the West, China has countered in the East pushing precious metal prices higher. Trump’s rhetoric, including threats to influence or even replace Fed Chair Jerome Powell, has raised fears of eroded confidence in U.S. monetary policy. In late August of this year, President Trump became the first president ever to fire a sitting Federal Reserve Governor as Lisa Cook was let go. This decision is currently being fought over in federal court, but as uncertainty grows, gold’s role as a hedge against instability is undeniable. When central banks lose credibility, precious metals shine as a trusted store of value—unlike fiat currencies, which can be manipulated at will. The Central Bank of Poland is a perfect example of that. Poland who already owns over 500 tonnes of gold, stated in 2024 that they would raise gold’s percentage of their overall reserves to 20%. Just recently they increased that number to 30% as they realize gold is becoming even more important than they first anticipated.

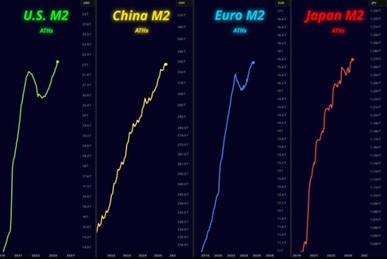

M2 Money Supply Soars, Signaling Inflation and Currency Devaluation

The M2 money supply—an indicator of cash, checking deposits, and other liquid assets—has hit record highs in the United States, China, Japan, and the Eurozone, the four largest economies in the world. Economies that should be the bedrock of world finance instead continue to get buried under mounting debts. Looking deeper, this flood of circulating currency directly correlates with rising gold and silver prices. Why? Excessive money printing dilutes the value of fiat currencies, driving inflation and eroding purchasing power along with consumer confidence. In contrast, gold and silver, with their limited supply and tangible nature, thrive in such environments. It is no wonder that gold and silver are both up over 40% this past year breaking through major psychological barriers this past week. Gold jumped past $3500 USD/oz with silver surpassing the $40 USD/oz level and both are showing that far more strength remains ready to push them higher. As central banks continue to expand money supplies to manage ballooning deficits and economic challenges, precious metals remain a staple to protect against the devaluation of paper money.

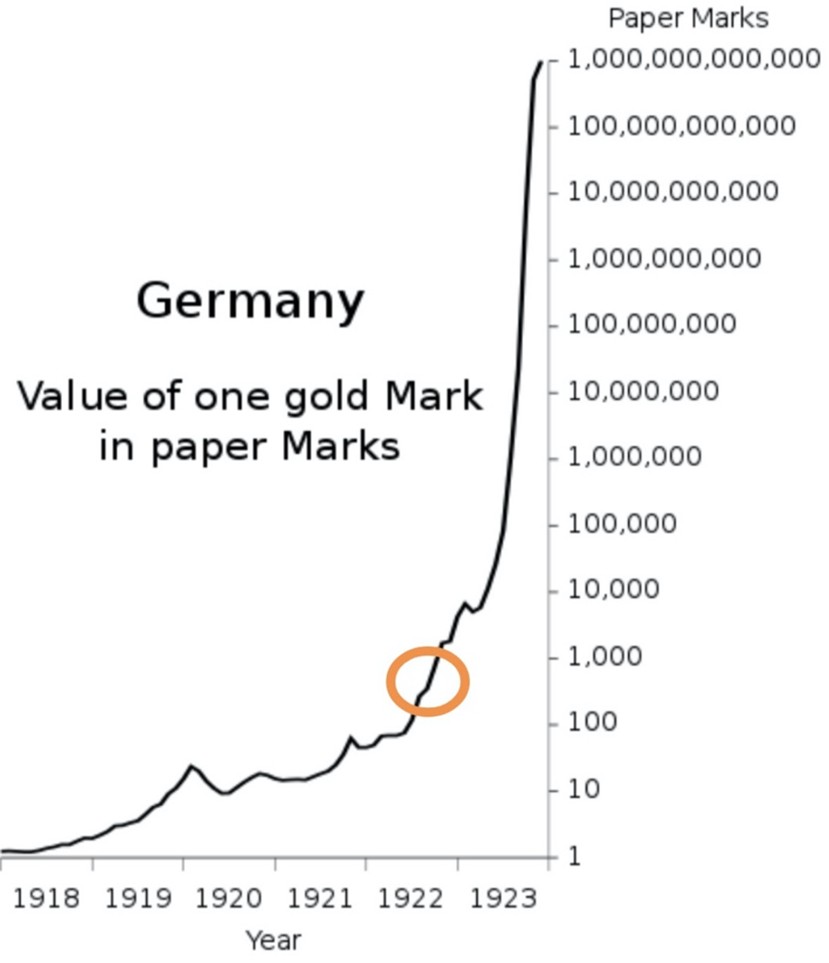

Use the Weimer Republic as a historical example showing how a once strong currency can evaporate in only a few years. During the Weimar Republic (1919–1933), particularly in the early 1920s, Germany experienced severe hyperinflation, which drastically impacted the value of gold measured in German marks. As the German mark rapidly depreciated due to excessive money printing to cover war reparations and economic instability, the price of gold in marks skyrocketed. In 1918, one ounce of gold was worth around 170 marks. By 1923, at the peak of hyperinflation, it reached approximately 87 trillion marks per ounce. This reflected the mark’s near-total collapse in purchasing power, making gold a critical store of value for those who could access it, while most citizens faced economic devastation as savings and wages became worthless. Every fist system in history has gone to zero, the only difference is the speed at which it gets there.

The Fiat Fallacy

Fiat currencies, backed only by government promises, are increasingly vulnerable in today’s world of rising deficits, trade wars, policy uncertainty, and threat of financial sanctions. The U.S. national debt has surpassed $37 trillion, with no clear path to reduction, while other global economies drown in debt. When these governments run out of buyers for their bad debt, precious metals will be all they have left to rely on and that is why central banks of all sizes continue to buy these assets rapidly. They know they will be necessary to own. Unlike gold and silver, which have held value for millennia, fiat money can be printed endlessly, leading to inevitable devaluation. The Weimar Republic’s hyperinflation, where gold soared from 170 marks per ounce in 1918 to 87 trillion marks by 1923, is a stark reminder of what happens when fiat systems collapse and it is only one of MANY examples.

Now is the time to protect your wealth with precious metals. Gold is hovering near record highs, with forecasts suggesting it could hit $5,000 USD/oz, while silver’s industrial demand adds upside potential. Don’t wait for the next crisis to act—secure your financial future with assets that governments can’t inflate away today.

Hi,

Hi,