As we look to conclude this week in financial markets history has been made in precious metals as the U.S. stock market becomes even more disconnected from the real economy. This is increasing the rate at which investors are fleeing to safe-haven assets putting continuous upward pressure on precious metal prices as well as increasing speculation that the stock market is due for a major correction. Ultimately, each person needs to make financial decisions for themselves, so after reading this newsletter and learning more of what transpired this week, you will be able to make a more informed decision on if precious metals are for you.

Gold Shatters Records, Silver Steals the Show

In a landmark moment for investors, gold has shattered the $5,000 CAD per ounce barrier for the first time in history, reaching highs of $5,065.16 on September 9th, 2025. This milestone underscores the relentless bull run in precious metals. This push is being driven by geopolitical tensions increasing as Poland and NATO look into Russian drones entering Polish airspace, inflation fears as an increase in August pushed the rate up to 2.9%, the highest since January of this year, and a general flight to safety. Yet, remarkably, even after gold’s historic run silver has stolen the spotlight year-to-date, outperforming gold with gains of approximately 36.80% compared to gold’s 32.55% when measured in CAD. Starting the year at around $42 CAD per ounce, silver has climbed to nearly $60 as its traditional safe-haven appeal grows ever more popular amongst retail investors (the general public). As investors as a whole rotate into undervalued assets, silver’s relative strength signals broader commodity momentum, potentially setting the stage for even higher prices if economic uncertainties persist. When looking for undervalued assets, look no further than silver as it still remains the only commodity below 1980 highs when measured in USD, however, it certainly appears that silver will make new all-time highs within short notice.

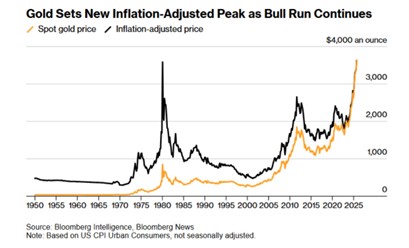

Inflation Hedge Holds Strong

Precious metals have long served as reliable inflation hedges, preserving purchasing power over decades. Recent data confirms that after gold’s record run its inflation-adjusted price has eclipsed its 1980 peak for the first time, surpassing the equivalent of $3,590 per ounce from that era’s $850 nominal high. Adjusted for U.S. CPI, today’s spot price above $3,600 USD reflects real value growth amid cumulative inflation since the 1970s oil shocks and stagflation. The chart from Bloomberg Intelligence below illustrates this vividly: while nominal gold prices fluctuate, the inflation-adjusted line has broken out to new highs. Silver follows a similar trajectory, historically outpacing inflation during monetary expansion periods. With global inflation lingering post-pandemic, these metals aren’t just rallying—they’re reclaiming lost ground, offering a stark contrast to fiat currencies eroding in value.

Central Banks Fuel the Gold Rush

Fueling this ascent is an unrelenting central bank buying spree. Institutions worldwide added substantial reserves in 2025, with the National Bank of Poland leading at 67 tonnes year-to-date. Total global central bank gold holdings now exceed 36,000 tonnes, up significantly since 2020 with central banks adding about 1000 tonnes annually since that date. The IMF reports world reserve gold at 1.1 billion ounces as of July 31, 2025, with purchases hitting record levels not seen since 1967. This structural demand—projected to continue—acts as a floor under prices, insulating gold from short-term volatility and propelling the rally higher.

Stock Bubble Looms Large

Meanwhile, the equity (stock) markets paint a glaringly different picture, with signs of the largest stock bubble in history inflating before our very eyes. The S&P 500 has surged to record levels around 6,590, up over 10.83% year-to-date, defying softening economic signals. Yet, U.S. job openings plummeted to 7.18 million in July—the lowest since September 2024—down 176,000 from prior months, indicating a cratering labor demand. Unemployment ticked up slightly to 4.3%, while hires remain tepid at 5.3 million. This massive disconnect between Wall Street’s euphoria and Main Street’s slowdown echoes pre-recession warnings: financial markets are detached from the real economy, propped up by AI hype and loose policy expectations. If cracks in the global economy continue to widen, stocks at record highs will be the first assets sold as wealthy investors flee to safety hiding behind gold and silver doors to avoid further chaos. The reason bonds won’t be included in the flight to safety is because this is all coinciding with sovereign debt being called into question as world debt has swelled to more than a jaw-dropping $325 trillion USD. An amount that can never be paid back with how our current financial system is set up, hence why countries are beginning to dump bad government debt for precious gold and silver in preparation for the next financial system.

Tech Dominance Echoes Dot-Com Peak

Exacerbating the stock bubble is the tech sector’s dominance giving shades of 1999 prior to the tech crash of 2000. Technology now comprises over 30% of the S&P 500’s weight—eclipsing one-third of the entire index—surpassing levels seen before the 2000 dot-com crash. Goldman Sachs data shows U.S. tech at 35% of total market cap in 2025, far outpacing global ex-U.S. benchmarks. This concentration risks a sharp correction if earnings disappoint or rates are not lowered enough and swiftly, reminiscent of the Y2K bust when tech imploded bringing down markets across the world. The chart below paints a glaring picture as you can clearly see how steep the correction in 2000 was when the bubble finally burst, caution needs to be taken as this bubble is significantly larger than it was two and a half decades ago.

We have been writing these newsletters for approaching two years now and gold’s swagger past $5,000 CAD and silver’s sly outperformance are only the beginning. You can clearly see with each addition of our Au Bullion newsletters that the global economy is only getting shakier and changing before our eyes as the next system is ushered in. The recent strength in precious metals courtesy of central bank buying and inflation’s relentless march—paint a glittering picture. Yet, the stock market’s tech-drenched bubble, wobbling atop a shaky real economy, winks at a potential downfall. Wise investors, let’s not be caught flat-footed, ensure you do in-depth research into precious metals as that knowledge can only serve you well in the days, months, and years ahead.

Hi,

Hi,