“Diversify, diversify, diversify” is a mantra that’s well-known in investing circles. Investments in stocks, bonds, property, and mutual funds are wonderful, but unfortunately, one investment that receives scant attention is something that has stood the test of time: physical gold.

Gold is not a form of investment; it holds value. In a world that is volatile with markets shifting from one day to another and currencies weakening with each passing year, it is imperative to have gold in your investment pool.

What is a “Hard Asset”?

In contrast to paper assets, in which you’re just seeing numbers on a screen, gold is something that you can actually hold in your hand and know that it’s yours, regardless of everything that’s happening in the finance world.

“Hard assets” are assets that have value in and of themselves—such as gold, silver, or property—meaning that their value isn’t based on someone else’s promise to pay you back. When the economy is slowing or when markets decline, gold doesn’t disappear as a result of a data compromise or shrink because of inflation. It just is, just resting there while it maintains its value.

Role of Gold in a Diversified Portfolio

A balanced portfolio is a must. Stocks go up, while bonds go down. When inflation rises, currencies fall in value. But gold is one investment that performs when all else is falling apart.

Traditionally, gold’s performance has been opposite to that of the stock market, and therefore, it is a great hedging option in terms of stock market fluctuations. It ensures that fluctuations in your overall investment are smoothed out.

Having a small holding in gold, say 5-10% of your portfolio, will go a long way in safeguarding your investments against inflation, economic meltdown, and devaluation of currencies.

Global Protection Against the Unexpected

Consider just the past few years – global inflation, increased debts, and shifting economic models have all been a reminder that investors that nothing is guaranteed. Governments can print money, stock markets can collapse, and interest rates swing overnight – but gold is steady.

It’s not affiliated with a particular country, a bank, or a business. That’s why it’s so potent. This is universal wealth, known and respected all over the globe.

Physical versus Paper Gold

There are several ways in which one can invest in gold, but nothing compares to actually owning gold in terms of the ownership that a paper investment provides.

When you purchase gold in its physical form, you actually possess a real asset that is not vulnerable to digital risks or dependence upon a system. It’s a real asset that is completely free of digital threats or system reliance. No need for an investment account or passwords or “system errors.” Just straight-up wealth in your

We at AU Bullion observe an increasing number of investors choosing physical gold as a means of securing their financial futures, and it’s easy to understand why.

The Bottom Line

Gold doesn’t offer a get-rich-quick investment. It offers stability, and that’s a component of an investment that’s always needed. It doesn’t matter how well or badly the market is performing when you have gold in your investment portfolio.

You haven’t yet diversified your investment portfolio by including a tangible asset such as gold? Now is a great time to begin.

Invest with AU Bullion

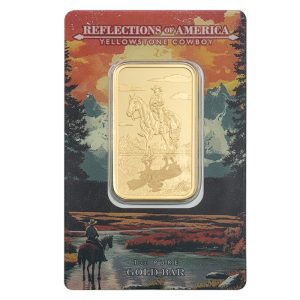

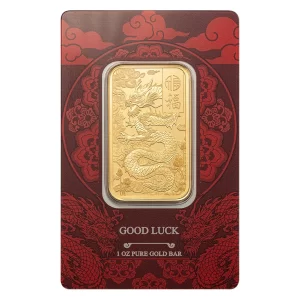

At AU Bullion, we offer you a convenient way to invest in physical gold and silver through our competitive prices, trusted brands, and secure shipping across Canada and the US. Browse through our selection of gold bars and gold coins from globally respected mints such as the Royal Canadian Mint, Asahi Refining, and PAMP Suisse. You can come to our Vancouver or Brampton offices or shop our selection online to begin creating your portfolio with gold’s timeless power.

Hi,

Hi,