2025 has delivered the clearest evidence yet that the global silver market is in structural deficit. Five consecutive annual deficits have now removed nearly 900 million ounces from visible refined stocks. Mines and recycling cannot keep pace. The numbers below are verifiable, public, and accelerating.

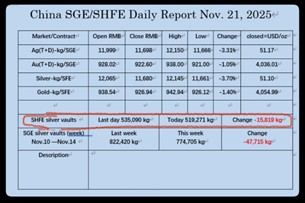

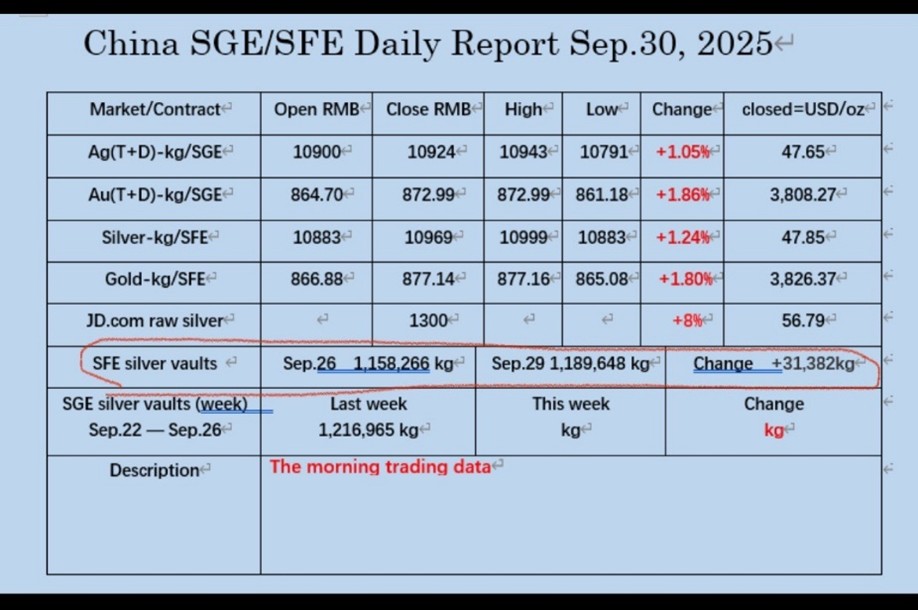

Shanghai Vaults Drained 56% in Seven Weeks

On September 30, 2025 — the final trading day before China’s week-long National Day holiday — the combined Shanghai Futures Exchange (SHFE) and Shanghai Gold Exchange (SGE) vaults held 1,189,648 kg of deliverable silver.

By November 21, 2025, only 519,271 kg remained.

That is 670,377 kg gone in 51 calendar days — a staggering 56.35% drawdown, equivalent to 21.55 million troy ounces in less than two months. On November 21 alone, another 15,819 kg was removed despite the spot price falling. This inverse relationship — lower price = faster withdrawals — is the hallmark of a physical market in distress. Chinese solar-paste producers, electronics fabricators, and state-linked entities are taking every kilo they can register while the vaults are still open, and prices remain low relative to silver’s value to an advanced civilization.

London’s Free Float Effectively Disappears

In October, the LBMA’s true “free float” — the physical silver immediately available to settle London’s vast unallocated accounts — collapsed to an estimated 155 million ounces. That is barely six weeks of world consumption and as the epicenter of global silver trading this is a warning signal that cannot be ignored. Bid-ask spreads in the loco-London market exploded from pennies to $6–$8 per ounce overnight. Silver lease rates spiked above 7% — levels not seen since the 2008 crisis — while several Tier-1 bullion banks simply withdrew all offers. Delivery lead times for new 1,000-oz good-delivery bars stretched to 8–14 weeks. One senior LBMA-market maker told Reuters anonymously: “There is no offer anywhere — only desperate bids.” The paper-to-physical leverage in London is now conservatively estimated north of 300:1 highlighting just how important it is to own real physical silver. When deliveries are demanded in bulk, there simply is not enough physical supply to go around for every paper contract holder.

Global Refinery Backlogs and Premiums Soar

The world’s largest refiners — Valcambi, Argor-Heraeus, Perth Mint, Asahi, and Johnson Matthey — are all quoting 10–14 week delays for new 1,000-oz bars, up from the normal 2–4 weeks. Kilobar (32.15 toz) production for Asia is equally backlogged. Wholesale physical premiums over COMEX/LBMA spot have jumped from the historic $1–$2 range to a sustained $6–$10 per ounce. Retail coin and small-bar premiums in North America and Europe now routinely exceed $12–$15 per ounce on generic rounds and $20+ on recognizable products. Multiple U.S. mints and European dealers have instituted allocation limits or outright suspended sales of certain items to ensure there is future supply available. In fact, the U.S. Mint itself produced 3,563,000 1 oz Silver American Eagles in January of 2025, this total dropped as low as 305,000 in July and no month since May saw more than 600,000 produced. The official reason was due to “supply constraints”, a common theme popping up across the world.

Mining Supply Remains Flat

Seventy percent of global silver production is a byproduct of copper, zinc, and lead mining — sectors that respond to their own metal prices, not silver’s. Primary silver mines account for less than 25% of supply and require 7–10 years from discovery to production meaning there is no quick supply fix coming in the near future. All-in sustaining costs for many primary producers now exceed $28–$30/oz leaving very little meat on the bone per ounce for each middleman to get their percentage profits from mine to dealer, and because of that no significant new projects are being green-lit. Global mine supply in 2025 will be essentially flat at ~820 million ounces while total demand (industrial, jewelry, investment, and photography) approaches 1.2 billion ounces — the fifth consecutive calendar-year deficit.

For the first time in modern history, the three largest transparent silver inventories — Shanghai, COMEX, and LBMA — are all draining at the same time, at record speed. Nearly a billion ounces of refined silver have vanished from visible stocks since 2021.

There is no quick fix. No new mines. No spare metal.

When the last readily available bar leaves the vault, the price discovery mechanism flips from “whatever the paper market can bear” to “whatever it takes to pry the last ounce out of private hands.”

2025 is not a correction.

It is the year the physical silver market broke — and the countdown to rationing by price alone has already begun.

Hi,

Hi,