One thing you’ve likely noticed if you’ve done any kind of research on gold is the term “investment grade gold.” But what does this mean, and how can you ensure you get the gold that is best for you?

Alright, let’s take a closer look.

What Constitutes “Investment Grade”

Investment-grade gold corresponds to gold of a certain level of purity and recognition, which, in most cases, is gold with a purity level of 99.9 percent or higher, and which was produced either by a recognized mint or a recognized gold refinery.

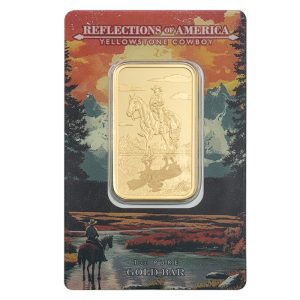

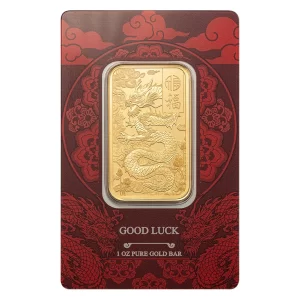

This can include popular gold coins such as 1 oz government-issued gold coins or gold bars produced by reputable gold refineries, which come packaged inside an assay card. The rationale for this choice is that such items can be easily verified, easily sold, and priced very close to the real-time gold price.

In other words, investment-grade gold is the kind of gold that bullion dealers are eager to purchase back – and with no questions asked!

Why Purity and Recognition Matter

Gold, after all, is gold at the end of the day, although not all gold is equal when it is time to sell.

Recognized bullion from reputable mints is readily trusted. The dealer doesn’t have to conduct additional checks; buyers make purchasing decisions with ease and very fast. It ensures that premiums are contained and resale is smooth.

If the gold is unmarked, or if its provenance is unknown, the process may involve delays, further testing, or lower prices–and still be real gold.

What to Avoid When Buying Gold

Not all products labeled as gold investment instruments are suitable for investing. These include:

- Mismatched gold ornamentation – Attractive but overpriced for gold’s value and hard to resell for personal gain.

- Collectibles/Novelty items – Usually carry price tags way beyond their gold value

- Unconfirmed bars or coins – Generally for unknown sellers or private parties.

“Too good to be true” deals: There’s almost always a catch when there’s a huge discount involved.

These may be more difficult to market, more readily challenged, and more illiquid when you require money.

Why Investment Grade Gold is a Source of Comfort to Investors

One of the benefits of investment-grade gold is that it is simple. It’s hard to say that about a lot of different investment opportunities. When you buy investment-grade gold, you understand what you are purchasing, you understand how much it is worth, and you understand that you will find a willing buyer to sell it to. For many investors, this peace of mind is worth as much as the precious metal.

The Bottom Line

Investment-quality gold isn’t about following a craze or premium designs but about simplicity, integrity, and sustainability. When you stick to known bullion items through reputable sellers, you won’t take chances that complicate your investment. Yes, buying gold the right way the very first time makes all the difference.

Hi,

Hi,