During the height of the energy crisis this past summer due to the on-going conflict between Russia and Ukraine, increasing amounts of chatter began to flow through mainstream news outlets surrounding OPEC+ nations. Specifically about what they would do to help the U.S. with their two-fold mission to punish Russia through sanctions, as well as, lessen the raging inflation seen at home due to sky-rocketing oil prices.

However, before diving into the two incredibly important meetings that took place within the past 6 months regarding how they could impact the global power structure, we must first understand how the relationship between Saudi Arabia, other OPEC+ nations, and the United States began. After the Bretton Woods Agreement in 1944 that effectively made the U.S. Dollar as good as gold in the eyes of the world, the United States was given immense power, now having the ability to control the money supply for every nation.

It is well documented in our previous newsletters, as well as many other sources, on the abuse of the monetary system that took place in the proceeding years by the United States leading to Richard Nixon severing the USDs ties to gold with one swoop of his pen. By doing so, all currencies became fiat in a moment, meaning at their core, no poorer nation’s currency was worth any more or less than a richer nation’s currency, especially the United States; only due to previous habits and programming would people of the world still use USDs to transact. Soon, old habits and doing things a certain way because we did them in the past would be replaced by a sound and more fair system. This unfortunately, was not allowed to play out. Rather, in the early to mid 70s, then U.S. Secretary of State, Henry Kissinger set out to convince Saudi Arabia of the United States’ petrodollar plan to help continue to fuel the artificial demand for USDs the previous Bretton Woods Agreement had created. And it worked. The United States would supply The Kingdom with arms and security against their adversaries, and Saudi would accept and price their oil in no other currency than the USD, then invest excess profits back into the U.S. securities market.

Due to OPEC+ nations controlling 40% of all oil production across the world, once the other oil producing nations were on board, countries that were not commodity rich were forced to sell their goods to the U.S. for dollars, so they could in turn buy oil to fuel their economy so they could produce more goods to sell to the U.S. for more USDs to do it all over again creating a loop that benefits mainly the United States.

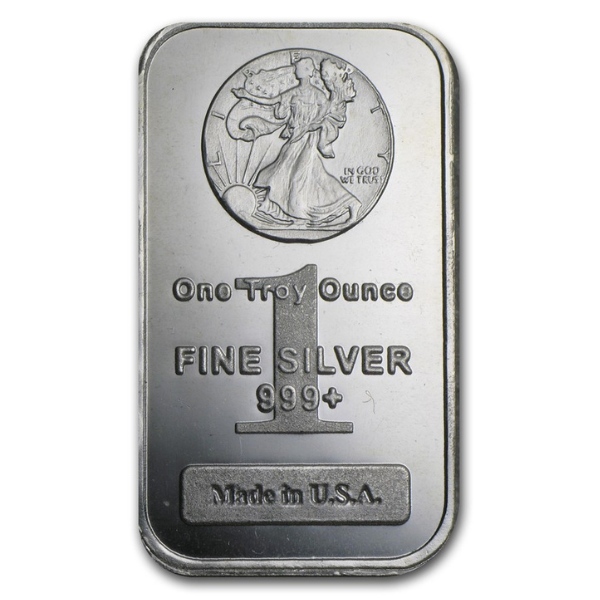

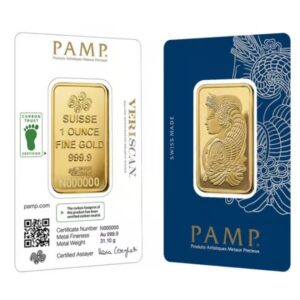

This petrodollar system that has been in place for around the last 50 years has kept the artificial demand for USDs across the world high, but the two aforementioned meetings may be signs that the end is near and that a new commodity backed system awaits, meaning those with physical assets like silver and gold, and not debt based assets like U.S. bonds or other securities, will see their wealth go much further as wealth transfers from intangible assets to tangible assets.

When President Biden of the United States visited Saudi Arabia in July in the hopes of convincing the Crown Prince, Mohammed bin Salman, to increase production of oil to help lessen demand for Russian oil (demand that was making sanctions ineffective), he was greeted by a small group of government officials, with no real warm welcome offered other than a fist bump between leaders. Reports showed OPEC+ nations could increase production of oil over 1.5 million barrels per day, rather upon Biden’s departure no increase was announced marking a failed trip.

Months later, it was announced that Saudi Arabia had interest in joining BRICS, consequently enough, around the same time President Biden made a public statement that there would be serious consequences if Saudi Arabia moved to cut oil production. A couple weeks later, oil production by OPEC+ nations was cut by 2 million barrels in complete opposition of what the United States had requested.

This brings us to the present day where President Xi of China just finished spending multiple days with Saudi’s Crown Prince and other OPEC+ nation leaders. When arriving in Saudi Arabia, President Xi was met with fighter pilots streaming red and yellow, the colours of China, and there was a grand welcoming put forth. A stark difference between the welcoming President Biden was given, and that was not the only glaring difference. Upon departure, it was announced that there was potential for Saudi Arabia to price and sell their oil in Chinese Yuan, a complete 180 from the current petrodollar system. This would in effect remove the artificial demand for USDs again, sending it into a tailspin. In conjunction with China announcing it was the secret buyer of gold in Q3 as many suspected, it is clear China is making a power move to solidify itself and BRICS nations in a powerful position moving into the next system. It is becoming more and more clear as time passes, that there has been a RUSH to physical assets in Eastern portions of the world, only question is, when will the West understand a debt based system cannot last forever, and that tangible assets will reign supreme?

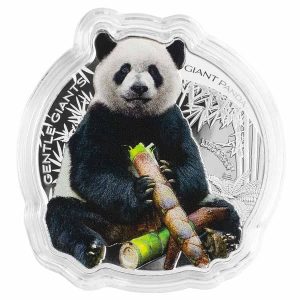

If you want to treat yourself or a loved one to one of the most beautiful pieces we have had come through our shop this holiday season, check out the Gentle Giants – Giant Panda 1 oz Coloured Silver Coin below. Not only do they make incredible gifts, they preserve value long into the future to whoever is the final holder.

Gentle Giants – Giant Panda 1oz Coloured Silver Coin

Tags: 1 oz Coloured Silver Coin

Hi,

Hi,