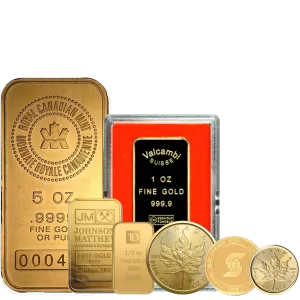

In the process of gold investment, size may play a significant role in the way you handle your portfolio and liquidity, including how well you will be able to sleep at night! Gold bars come in various sizes, right from the petite 1 gram to the hefty 1 kilogram, and each has its unique advantages…

Author: AU Bullion

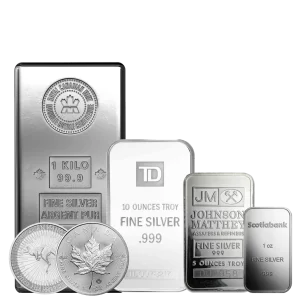

Choose the Right Size: 1 oz, 10 oz, or 1 kg Silver Bars – Which is Best for Your Investment Strategy?

When it comes to silver investment, one of the first decisions you have to make is the size of the silver bars that should fit your strategy. Whether you are an experienced investor or just starting out, learning how to benefit from different sizes, 1 oz, 10 oz, and 1 kg, can be a real…

What Are the Core Functions of Money?

At Au Bullion, we are focused on supplying the highest quality bullion products from the most reputable mints to our supportive clients for as low a premium as possible, educating our clients on precious metals themselves, as well as working to keep our clients up to date on all the latest news that impacts this…

The Future of Jewelry Lies in Recycled Gold

In a world where sustainability is becoming much more than just another buzzword, the future of jewelry is starting to sparkle with the promise of recycled gold. As more is learned about the environmental and ethical impacts of mining gold, recycled gold starts to shine with the promise not only of the same value and…

Stock Market Tremor: What Happened?

By now you have likely been made aware that this past holiday Monday saw the worst stock market selloff since Black Monday in 1987. While this did happen 5 days ago, we wanted to wait to write about it until more information had come out and we had clearer insights into what exactly caused this…

Hi,

Hi,