The Bank of England is just one of the many world central banks that is facing major losses for the first time in decades due to their reckless Quantitative Easing (QE) programs that saw governments and central banks print trillions and trillions of dollars (or pounds, euros, etc.) since the 2008 Great Financial Crisis that sent the world economy for a loop. This printing, of course, being amplified by lockdowns that spanned 2020 through 2021, where in many countries, almost 80% of all fiat currency in circulation was printed in just those 2 years. 80%!! It is really no wonder we are seeing such drastic inflation on a world stage for the first time in over 50 years when the full fiat system was first introduced to the world in 1971.

On February 27th, 2023, the Bank of England along with the Treasury submitted a request through parliament that would put taxpayers on the hook for over $240 billion (USD) in losses suffered by the central bank due to their reckless currency printing. Months earlier, the Bank of England requested an emergency injection of liquidity or UK pension funds would go belly up, they received those funds, but now are still on the hook for over 200 billion pounds of losses. Essentially, what is being requested is to allow the Bank of England to print and draw on over 200 billion pounds worth of new funds, as they need them to cover upcoming losses. However, similar to other government spending, the taxpayer is who will be required to pay this back. Meaning, when all is said and done, the central bank printed the British Pound into oblivion, and now due to its rapid decline in value because of that, it is the taxpayer that loses, not the central bank that was initially reckless with citizenry funds. This request will be voted for in parliament on March 8th, 2023.

While timing of certain events can quite often be coincidental, the Bank of England deputy governor Jon Cunliffe speaking on how to protect consumers in the event of a bank failure on February 28th, 2023, does not seem to be one of those times after the above bailout was announced only a day earlier. What is interesting is that Jon Cunliffe focuses his energy on Central Bank Digital Currencies (CBDC) as the solution, however, if you swap silver and/or gold in every spot he mentions where a CBDC would help consumers, his statements begin to make a lot more sense.

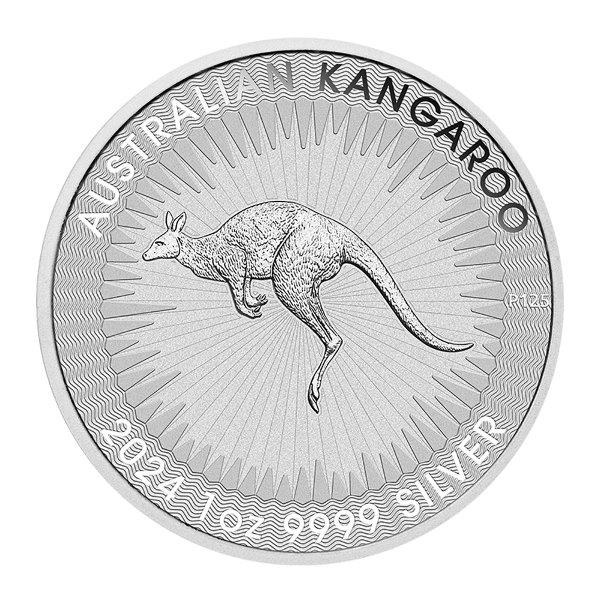

For example, Cunliffe goes on to say that we already live “in an era of instantaneous bank runs” due to consumers having the ability to go online and shift deposits from one bank to another. However, the half truth being left out, is that during a bank run, swapping funds to another bank would not help, as the goal is to actually get funds OUT of the bank in the event of widespread failure, not swapped into another dying bank. He goes onto say, that while a CBDC may intensify a run on banks, it would at least give consumers the ability to move into a “safe place” to “store value”. The argument that a CBDC provides financial stability or a store of value for the public, is the same as saying the current paper/digital fiat mix we currently have in circulation creates financial stability or a store of value. This is untrue. It is clear that any asset that can be printed at will does not have stability baked into the cake. The opposite being true for silver and/or gold because due to their scarcity and properties as money, all the above would be true if Jon Cunliffe was referring to precious metals. They would intensify bank runs because the public would truly have a “safe place” or “store of value” to move into while moving out of dying fiat, but with a limited supply, they would need to be quick. This presenting a major reason why it is important to hold a portion of your wealth outside the system in silver and/or gold before any bank failure happens, so you do not need to take place in the mad dash that will follow.

The fact that governments and central banks are trying to sell CBDCs as the future of consumer spending should be cause for concern for those that understand how the current fiat system operates. While meeting with many of the leaders from the G20, the IMF Managing Director Kristalina Georgieva, stated that crypto currencies need to be banned in order for the transition into Central Bank Digital Currencies to be more seamless. The reason given for the proposed ban was because private crypto currency is not backed by anything, where as CBDCs would be backed by confidence in the issuing central bank/government. The exact verbiage used to describe the backing of paper fiat currencies currently circulating. With that said, if these same institutions and governments are to blame for our current financial fiasco, why would the public immediately accept their solution that ultimately changes nothing other than eliminating cash, and subsequently, the ability to spend your wealth without being tracked.

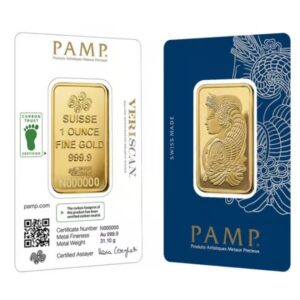

Again, silver and/or gold, provide all protections central banks are trying to convince the people are built into CBDCs. Silver and/or gold DO provide a safe place to move wealth into in the event of a bank failure (if you are lucky enough to get money out), they DO provide a store of value as fiat currencies or inevitable CBDCs get minted into the stratosphere, and they DO give you the ability to spend your wealth as you so choose without having to worry about your CBDCs being programmable allowing you to only spend them in certain places. Lastly, rather than hoping your wealth is held in an asset backed by silver and/or gold ensuring it holds value overtime or through uncertainty, holding these precious metals themselves takes you right to the source of true value, ensuring your wealth will be there when you need it.

When deciding what is best for you, rather than doing what central banks/governments say to do, why not look at what they are doing themselves? A record amount of debt being accumulated, with a record amount of precious metal buying taking place – it is our best guess that these metals will be re-valued to cover current debts held by world governments. If that is correct, it will be highly advantageous to hold silver and/or gold when that takes place. This week, below you will find a 1oz Silver Donald Trump Round that gives tribute to the 45th President of the United States, while also providing its holder wealth protection at a low premium.

Hi,

Hi,