If you were to look around social media and general precious metal communities, you are starting to see sentiment fall regarding silver and gold as many believed a massive price gain would have made itself known by now due to the economic calamity we have seen across the world. That said, while it is important to understand that silver and gold are not “get rich quick schemes” and should be purchased to secure wealth over the long-term, those hoping for higher prices sooner than later may be close to having their wish granted. When breaking down the macro and micro economic factors that lend themselves to higher gold and silver prices, you can see that an epic bull market for precious metals is on the horizon and truly is just getting started. The hope of this newsletter is to paint that picture as clearly as possible because while history does not repeat, it certainly rhymes, and it is well known that when precious metals investors begin to lose hope, that is ultimately when these assets decide to wake up. With that said, let’s dive into what we are seeing today.

Earlier this week, Janet Yellen, the U.S. Secretary of the Treasury sat in front of Congress and was grilled on what the U.S. Treasury is planning to do in the event China invades Taiwan. While this has been thrown around for some months, when you listen to Congress in their deposition of Yellen, it is becoming glaringly obvious they expect this to happen sooner than later. The question asked by Congress that stood out was when they asked what the U.S. Treasury alongside the Federal Reserve was planning to do, and if they have tabled exercises in response to a scenario where China dumps their nearly $900 billion USD of United States Treasuries onto the market in response to inventible sanctions by the United States should China invade. Yellen started her answer, stating there was no such exercise currently underway to address such a risk, and as she was starting to say that the United States National Security Council was “certainly concerned on an on going basis…” when the Congress member asking the question interrupted to state, “I would encourage the Treasury to make preparations and to be on the ready for that scenario”, eerily hinting that an invasion may be on route sooner than expected.

Of course, war is something that should not be condoned, but when looking at how silver and gold reacted to the most recent conflict in Ukraine, these precious metals consistently protect their holders when tensions increase to that of gunfire. Looking back, through February to early March when murmurs of a Russian invasion began, and then ultimately took place on February 24th, 2022, silver spiked 18.02% in that one-month span, whereas gold spiked 13.5% over the same period.

Also, Congress’ concern of U.S. Treasuries being less attractive today than they have been in recent memory is not unwarranted, as these assets have been steadily declining on foreign holders balance sheets for nearly a decade now.

Treasuries being held as a foreign reserve are at their lowest level in 19 years, and 19 years ago in the early 2000s, countries were turning to gold as gold was just starting its massive run upward peaking in 2011. When looking at gold reserves, you can see a trend beginning to form with countries and central banks rapidly accumulating gold while dumping U.S. Treasuries:

When trying to figure out why this reversal has happened, it is important to understand what makes each of those assets valuable. A U.S. Treasury holds massive counterparty risk as it requires the United States to never default (which they got close to doing recently) and it also requires them to continue to go deeper and deeper into debt, but at what point is holding someone else’s debt worthless? As opposed to gold, where it along with other precious metals hold no counterparty risk, meaning they rise as financial situations in countries worsen, which is why it has always been looked at as the ultimate safe haven. Going even further, when looking at the value of gold in compared to U.S. Treasuries, as well as how gold reacts to the ever-increasing government debt problem – you can see that gold is preparing for another incredible run:

Once the U.S. Dollar was unpegged from gold at a fixed price of $35/oz and was allowed to find its true market value, gold took off like a rocket accounting for all the debt being accumulated by the U.S. Government.

You can see that this ratio took off in favour of gold in the 1970s once the USD was removed from the gold standard, and again amidst the tech bubble crash in the early to mid 2000s. All that said regarding U.S. Treasuries, there is far more in the works today on a global economic scale pushing gold and silver higher, not just the potential for war. Look at the chart below to give you a better idea of what we are speaking to:

When looking at the history of gold cycles, you can clearly see above in our previous charts and the one directly above this paragraph that today there are a combination of factors at play that in the past have led to massive gold spikes. To name a few that stand out, we are seeing the debt problem of the 1940s, inflationary issues of the 1970s, and asset imbalances of the 1920s and 1990s.

With that said, another major factor that impacts future gold price is the amount of gold being pulled out of the ground. Of course, less gold available naturally leads to higher gold prices, and historically this has been the case:

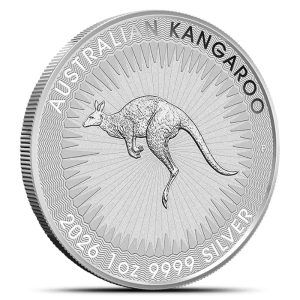

As you can see, as they predict less and less ounces coming out of the ground, there is less and less available for industry as well as wealth protection for the public causing the ounces that are above ground already to increase in value multiple times over. It is also important to remember that there is not enough physical silver and gold in the world for everyone on earth to hold A SINGLE OUNCE. These assets are incredibly rare, so as we move digital and industry uses more each year, as well as governments hoarding these valuable assets to protect themselves in the event of large economic stress – it is imperative that the public get their hands on these metals before they begin to take off, as history has shown, these metals move slowly at first, but when they want to run higher, they run QUICKLY.

If you are interested in getting ahead of what appears to be one of the most incredible runs in the gold market, check out our 1oz gold bar out of Asahi that is perfect for precious metal investment. Not only is Asahi one of the most reputable refiners in Canada, their metals come with some of the lowest premiums as well.

Hi,

Hi,