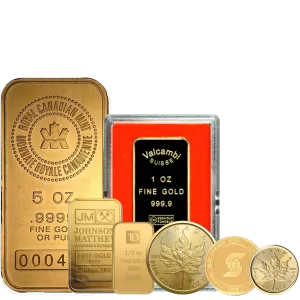

Metal in the case of investments in gold, the initial major choice isn’t how much to invest—it’s in what form. The most prevalent debate? Gold bars or gold coins. Both choices provide tangible, in-the-real-world value and conserve wealth. But based on your investment objectives, price range, and tastes, one may be preferable to the other….

Category: Buying

Key Things to Consider While Purchasing Pre-Owned Gold and Silver Coins

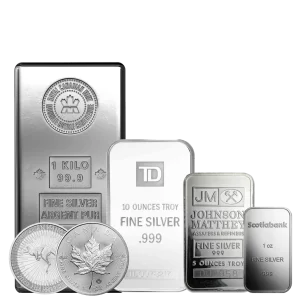

One of the best ways to invest in precious metals is to buy pre-owned gold and silver — if you want to save on premiums but don’t want to sacrifice value. Though brand-new bullion products tend to cost a bit more, used or circulated pieces share the same metal content but at a reduced cost….

Why Diversify into Precious Metals?

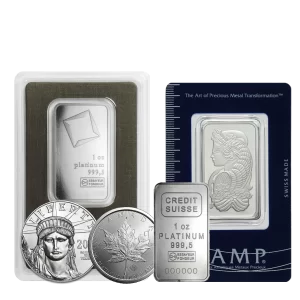

Diversification minimizes risk. Although the three metals are classified under “precious metals,” they don’t act interchangeably under market changes. Gold can climb under inflation, silver could appreciate under the demand from industries, and platinum tends to move independently under supply shocks and auto trends. A diversified bullion portfolio diversifies your risk across various categories of…

A History of the Royal Canadian Mint: Shaping Canada’s Most Iconic Coins and Bullion

Among institutions providing reputable supplies of top-grade bullion, few possess the level of esteem enjoyed by the Royal Canadian Mint (RCM). Renowned around the world for the production of some of the world’s finest and most stunning gold and silver offerings, the Mint has not only been at the forefront of Canadian monetary history but…

Why More People Are Buying 10 Gram Gold Bars

In today’s volatile economy, gold remains the tried and trusted investment. Yet while the 1 oz and 1 kg bar often attract the limelight, investors increasingly now favor 10 gram gold bars—and the reasons become very clear why. At AU Bullion, we’ve noticed an increase in 10 gram bar demand among new as well as…

Hi,

Hi,