On Monday, October 3rd, 2022 silver saw a gain of nearly 9%, which registered as the highest daily gain for silver since November of 2008. The months of October/November in 2008 also registered as the bottom for silver hovering around $10 USD per/oz. From that spike in November, silver gained 400% over the next two and a half years.

The latest increase in silver price has sparked a dramatic rise in conversations surrounding what exactly caused the latest jump. Many believe the squeeze that appeared in the nickel market earlier in the year is now on the verge of occurring in silver; and this is not an outlandish claim. There is growing evidence to support a squeeze in the silver market, and a large contributor is the fact that major physical silver inventories, mainly the LBMA and COMEX vaults, have continued to see a rapid drain of physical silver.

The LBMA to start holds the title as the world’s largest silver exchange, and for the last nine months the total ounces of silver held in the LBMA vaults has decreased. Reports from August of this year show the vault currently holds 916.5 million ounces of silver – the lowest total since mid-2016. While it may seem like a lot, the LBMA vaults held nearly 1.71 billion ounces of silver this time last year, representing a 21.7% decrease in just one year – and it gets worse. Of the 916.5 million ounces held in the LBMA – 592.8 million ounces are already owned by 15 entities made up of 13 silver ETFs and private clients of Bullion Vault and GoldMoney. This leaves just 323.7 million ounces of unclaimed silver in the LBMA vaults. When considering that 254.5 million ounces were drained this past year before any dramatic price increase, what is left will not last long during any substantial rush from retail investors within the public.

In the past, it would not be uncommon for silver to leave the LBMA vaults only to then be registered within the COMEX vaults. However, this time around, that is not the case. Before outlining the decline in silver seen within the COMEX vaults, it is important to understand the difference between the two vault categories the COMEX uses. The first is ‘Registered Inventories’ which ARE available for delivery in order to fulfil a maturing commodity and options contract that has called for physical delivery of their metal because these ounces do not have an owner. The second is ‘Eligible Inventories’ and these ounces ARE NOT available for delivery; this category already has owners and only they can designate the silver to be sold and delivered, moving it into the Registered Inventory. With that said, the COMEX vaults are signalling that new buyers are flocking to the market or larger players have sped up their accumulation as there were 150 million ounces of silver registered at the end of 2020, 80 million at the end of 2021, and at present there is only a little over 41 million ounces left within the Registered Inventory.

The dramatic draw down of these major physical silver inventories really should not come as a surprise to anyone. Worldwide production of silver is 70 million ounces per year, with 15 million ounces of recycled silver bringing the yearly supply to 85 million ounces. The current demand is 95 million ounces and growing. With an over 10 million ounce shortage already, and silver being a necessity for technological advancement. This gap is only going to continue grow, exacerbating the delivery delays we have already seen and adding to the upward pressure on not only the spot price but also the premiums attached to each ounce.

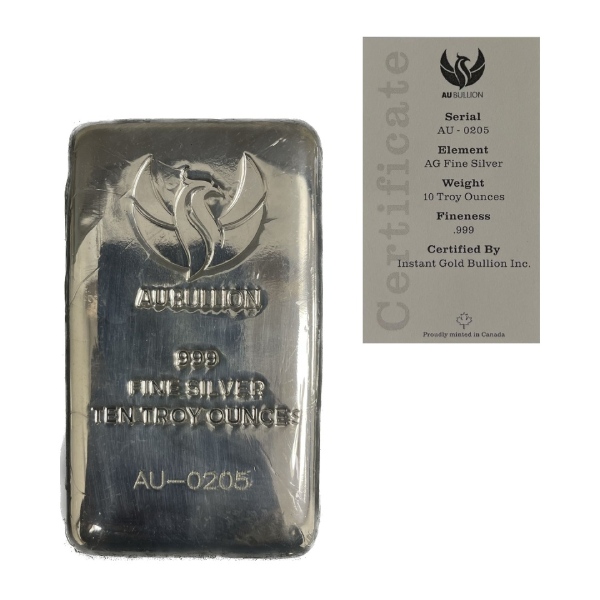

For those that have been waiting to time the ultimate bottom before adding more silver to their stack, they are now realizing how quickly prices can begin to move when they decide to run. If you want to avoid the panicked rush for physical silver and secure your wealth while supplies last – consider adding our newly released AU Bullion 5 and 10 ounce cast silver bars to your stack. These bars hold some of the lowest premiums out of any silver products you will find on our website. Physical Silver Inventories is

AU Bullion 5oz Silver Bar AU Bullion 10oz Silver Bar

Hi,

Hi,