In the world of investing, navigating the constantly changing financial markets can sometimes be intimidating, especially during times of economic uncertainty. Whenever there is speculation of the possibility for interest rates to drop, a smart financial decision you can make is to diversify your portfolio with precious metals like Gold and Silver.

Why Gold and Silver?

For decades,Gold has been seen and referred to as a safe haven asset, and has been used as a store of wealth. Historically, whenever there was a time of economic uncertainty, or when interest rates declined, Gold tends to trend upwards. This is due to the fact that when interest rates go down, yield bearing assets offer less of a return and assets like Gold have a better opportunity cost. As a result, we typically will see Gold demand and prices increasing during these times. Moreover, Silver on the other hand follows a similar trend to Gold as it is a more affordable entry point for investors. Additionally, Silver has a huge amount of industrial demand that provides it with some additional value.

The Current Scenario – 2024 Gold Market

At the time of writing this article, Gold prices have hit a record all time high of $2930 (CAD/ Oz) or $2160 (USD/Oz). Due to these prices, many investors may be hesitant to dive into the precious metals market. However, it’s crucial to look beyond the present and consider the potential for future gains. With speculation of central banks to potentially cut rates around June, there is a huge opportunity for the possibility for potential huge upside for precious metals. Investing in precious metals now would be putting you in a position to potentially reap huge benefits in the future when prices climb.

Invest with Confidence

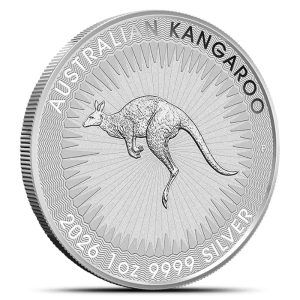

When investing in precious metals, it’s vital to choose a reputable and trustworthy partner. AU Bullion, an authorized Royal Canadian Mint Bullion DNA Dealer, is a name you can trust. With their expertise and commitment to quality, you can be confident in the authenticity and purity of your gold and silver investments.

During uncertain economic times and anticipated drops in interest rates, diversifying your portfolio with gold and silver can be a wise strategy. These precious metals offer a hedge against inflation and currency devaluation, providing a sense of security in an otherwise volatile market. By working with a trusted dealer like AU Bullion, you can embark on your precious metals investment journey with confidence, poised to capitalize on the potential for significant returns as the economic landscape evolves.

Hi,

Hi,