As the leaves turn and the global economy navigates another season of uncertainty, the quiet strength of precious metals continues to draw attention from the world’s largest players. In recent weeks, developments from Beijing to Mumbai have underscored a broader narrative: nations and investors alike are recalibrating their strategies, favoring tangible assets over the flickering promises of fiat currencies and sovereign debt. This edition explores these shifts, grounded in the data that’s reshaping portfolios and policy alike.

China’s Shift to Gold

Consider China’s evolving stance on its vast reserves. For years, the People’s Bank of China has been methodically reducing its exposure to U.S. Treasury securities, a move that’s accelerated into 2025. Holdings now stand at $730.7 billion as of July, the lowest level since 2008 and a staggering 45% below the peak reached in 2013. This isn’t a mere adjustment; it’s a signal of eroding confidence in what was once the bedrock of global finance; U.S. government debt. As radioactive government debt piles up amid geopolitical tensions and inflationary pressures, China has pivoted toward gold. Official data shows the central bank adding to its stockpiles steadily, with gold now comprising a growing slice of its foreign exchange reserves – up from negligible levels a decade ago to nearly 5% today. This transition mirrors a wider trend where countries weary of yield-chasing in bonds are turning to real assets. Analysts point to this as a harbinger of systemic change: when the second-largest economy on Earth treats gold and silver not as relics but as safeguards, it invites others to follow suit, and following they are.

Beijing’s Vault Strategy

Building on this, China is extending an olive branch – or perhaps a vault key – to the international community. Reports indicate Beijing is positioning itself as a custodian for foreign sovereign gold reserves, a direct challenge to the long-standing dominance of storage facilities in the United States and United Kingdom. The Shanghai Gold Exchange has launched offshore vaults in Hong Kong this year, complete with yuan-denominated contracts, aimed at luring nations wary of Western-centric systems. For countries like Russia or others in the BRICS+ bloc, this offers a compelling alternative: secure, geopolitically neutral storage without the overhang of sanction risks tied to London or New York vaults. It’s a subtle power play in the bullion market, where China already consumes more gold than any other nation and is now looking to hold other nation’s gold within their borders. By inviting allies to park their reserves onshore, Beijing not only bolsters its own influence but also accelerates the multi-polarization of global finance. Imagine a world where the yellow metal’s custodial status is as contested as currency itself – this is a major pivot in motion.

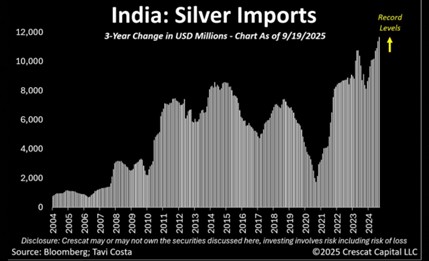

India’s Silver Boom

Across the Indian Ocean, another BRICS+ giant is making waves, this time in silver. India, the world’s top silver importer, is on track for another banner year, with projections estimating inflows between 5,500 and 6,000 metric tons by year’s end – levels that would eclipse recent records set in 2024 despite early-season fluctuations. The first eight months saw imports dip to 2,580 tons, halved from the prior year, but momentum has surged since, driven by robust investment demand and festival-season jewelry fabrication. A landmark purchase from the UAE earlier this year highlighted this appetite, with shipments feeding into battery production for electric vehicles and solar panels alongside traditional uses. Silver’s versatility shines here: it’s not just jewellery for Diwali but a critical input in the green energy transition India is championing. As domestic prices in India hit decade highs, up 57.2% in 2025 alone when measured in Indian rupees, this buying spree reflects a cultural and economic bet on enduring value. When a billion-plus population leans into silver at record paces, it tightens global supply chains immensely, nudging prices higher and underscoring the metal’s role beyond speculation.

Questioning Conventional Wisdom

These international moves stand in stark contrast to voices closer to home urging caution. On September 19, 2024, almost a year to the day, the Federal Trade Commission took to X with a stark warning: anyone peddling gold bars as a hedge against inflation is a scammer, they declared. Fast-forward a year, and the irony bites deep. Those who heeded the advice and shunned physical metals missed out on transformative gains – over 40 percent in gold alone, with silver surging even more dramatically. Central banks, meanwhile, have been on a tear, hoarding the world’s supply at unprecedented rates; the World Gold Council notes institutions added over 1,000 tons in 2024, a pace that’s held into 2025. While regulators finger retail “scams,” sovereign actors are quietly building fortresses of pure gold. It’s a disconnect that raises questions: whose interests are being protected when the establishment downplays assets that have preserved wealth through centuries of turmoil?

The Meteoric Rise of Metals

The numbers tell the tale most eloquently. As of Thursday morning, silver traded at $45.17 USD per ounce, a whisper away from its 2011 and 1980 peak of $49.95 USD per ounce. Year-to-date, it’s climbed 51.73%, outpacing gold’s robust 42.19% rise. Gold itself has etched nearly 50 new all-time highs in 2025, culminating in a record $3,784.74 USD per ounce intraday – a level that would have seemed fanciful at the year’s start. These aren’t anomalies; they’re the fruit of persistent demand against a backdrop of monetary expansion by central banks across the world. Miners can’t ramp production overnight, deficits are growing, and with industrial uses for silver exploding in photovoltaics and EVs, the squeeze intensifies.

A Glimpse of the Future

What does this all point toward? A financial landscape where trust in paper promises frays, and the allure of shiny metal money grows. China’s U.S. treasury unwind, its vault ambitions, India’s silver fervor, the FTC’s ill-timed caution, and the metals’ relentless ascent – they weave a tapestry of prudence in uncertain times. As nations diversify and prices reflect that resolve, the message is clear: in an era of flux, the steadfast endures.

Hi,

Hi,