It would not be pointing out anything unknown to say that the stock market has been in a MAJOR slump throughout the entirety of 2022. Major players like Meta are down over 70% from all-time highs (ATHs), Tesla is down just over 50% from ATHs, Netflix is almost down 60% from ATHs, even the commerce giant Amazon is down nearly 50% from ATHs. In truth, it has been a tough year for all assets that the general public invests in – tech stocks are way down, crypto is a bloodbath, bonds are tanking, and as interest rates rise, the most promising of all assets held by the public, housing, continues its gradual slide as home owners struggle to pay their increasing mortgage rate payments.

However, since September 1st of this year there has been a divergence in the gold mining sector that does not seem to be catching much mainstream attention. Since that date, the S&P 500 has continued its steady decline, dropping 3.5%; with the NASDAQ blowing that out of the water, dropping 9.92% over the same time frame. The only major index to see a gain since September 1st was the Dow Jones which is made up of the 30 most prominent companies in the United States, that index increased 4.75%. In contrast, the GDX, which is an ETF made up of senior gold miners that had previously been making new 52-week lows each month, has rallied 15.61% in complete opposition of the major indexes. The GDXJ, which is made up of junior miners has turned course as well, increasing 16.57% since September 1st. It is clear that as Jerome Powell continues to stoke the inflation fires, commenting at the most recent FOMC meeting that inflation has not come down at all even after rate hikes at a record pace, the market is beginning to price in precious metals as the safe-haven it has been for over 5000 years. The fact gold miners have turned the corner so aggressively to the upside, could very well signal a bottom is in for the paper price of the physical metal itself.

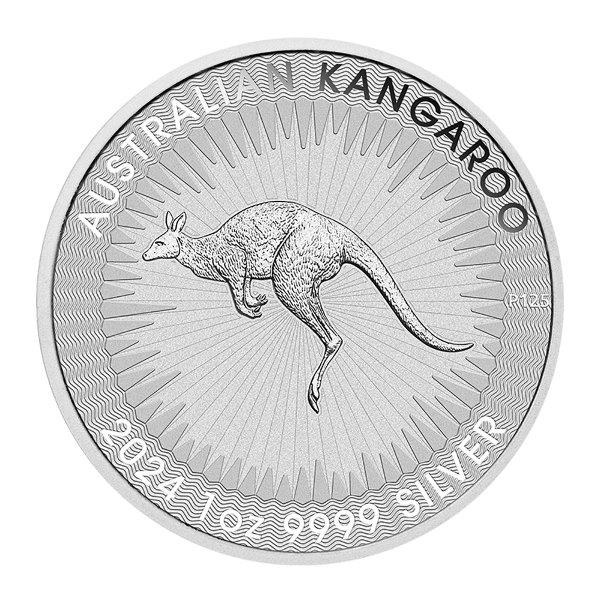

When looking at the same time frame, the theory that gold mining stocks have signalled the bottom in physical metals may ring true. Investors in physical metals know the market has been on the precipice of a major move as demand for physical product has continued to push premiums upward as supply drains, moving inversely from what the paper spot price indicates each ounce is worth. With that said, since September 1st, even the paper spot price looks to be pointing toward a new upward price pattern. Since that date, gold spot price in CAD has increased 2.93%, with a spike up 5.40% in mid-October. Alternatively, silver spot price in CAD has increased a whopping 22.17% in the same time frame. With the reasons for the aggressive moves in silver likely being tied to the COMEX future contracts currently in play. Silver has been one of, if not the most shorted assets in the last 50 years since coming off the gold standard and now with the world shifting away from digital debt based wealth, moving toward physical tangible assets led by BRICS+ as the system begins to show signs of global financial contagion – shorts have began closing their contracts as physical metals are being RAPIDLY pulled from the major vaults. They do not want to be stuck needing to buy physical silver after it runs in order to close out their short contracts – instead – they do that now. As more and more contracts close, more physical is forced out of the vaults driving the price higher. This is a look at the current status of the COMEX vaults and future contracts:

As you can see, 1206 contracts were closed yesterday, representing 6,030,000 troy ounces (5000oz per contract) that needed to be purchased and delivered. What is staggering is that 137,332 contracts still remain – each with the power to drive the physical price higher once they close out. It also clearly represents why if you want to participate in the price gains of silver and gold, you need to hold the physical metal itself or you end up sharing each ounce with hundreds of other owners. At time of writing, 137,332 contracts represent 686,660,000 troy ounces of silver – 1970% more than what is held in the COMEX registered vault. These contracts will begin to close quickly as the price continues to rise, and as a reminder, below is the current status of the largest vaults in the world the LBMA and the COMEX:

For the entirety of 2022 they have only been drained of physical silver.

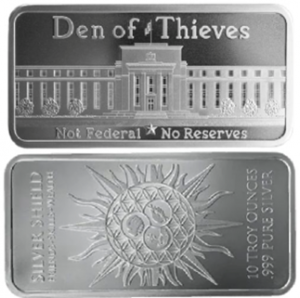

The decline of physical precious metals has been steady, and with geopolitical and financial tensions continuing to rise – they become ever more important to have in one’s portfolio in order to hedge personal wealth. To avoid falling victim to the paper contract silver scheme that will ultimately leave the every day investors in that market with a sour taste due to them thinking they own silver, when they in fact own a derivate of a physical ounce of silver along with hundreds of others, you must secure physical metals in your own possession. It will be first come first serve when it comes to delivery off exchanges, and we all know large institutions will get first bids over the public. If you want to sidestep the ETFs and secure physical silver in your own possession, below is our Den of Thieves Silver Shield Collection 10 oz Silver Bar. Not only will you be securing wealth outside the system in physical form, with the Federal Reserve (Not Federal, No Reserves) imagery dawning the front of the bar, you will be able to easily spark a conversation with someone new to silver to help them deeper understand the system they currently operate in; giving them the opportunity to reclaim financial freedom for themselves.

Hi,

Hi,