Central banks are stockpiling precious metals, retail investors are sidelined, and emerging policies in Asia are rewriting the rules of monetary collateral. This newsletter dives into four game-changing developments: India’s bold pivot to silver monetization, a skyrocketing silver arbitrage within India, China’s gold warrant frenzy, and the stark reality of gold’s emerging inaccessibility driving a surge is silver purchases. Buckle up – this bull market isn’t slowing down, even with prices facing significant pull backs this week.

India’s Historic 10:1 Gold-Silver Ratio: Ushering in the Silver Era

In a move that sent shockwaves through global commodity desks, the Reserve Bank of India (RBI) announced last week a revolutionary banking collateral framework pegging gold and silver at a fixed 10:1 ratio. Effective as of April of 2026 for select public-sector banks, this policy allows physical silver to be used as collateral to back up loans, a first for any major economy in modern history. No longer the overlooked sidekick to gold, silver is stepping into the spotlight as a monetized asset class.

Historically, the gold-silver ratio has fluctuated wildly – peaking at 107:1 and dipping as low as 68:1 over the last 5 years. But India’s engineered 10:1 peg? That’s unprecedented territory, evoking the bimetallic standards of the 19th century when silver coins circulated alongside gold sovereigns. RBI Governor Shaktikanta Das justified the shift as a hedge against rupee volatility and import dependencies amid a projected 8% GDP growth slowdown.

Proponents of the idea argue this “Silver Standard 2.0” democratizes precious metals for a nation where 70% of households hold some form of bullion. Early data shows a 15% uptick in silver ETF inflows on the National Stock Exchange. As India, the world’s second-largest silver consumer, formalizes physical monetization, expect copycats from BRICS allies like Russia and Brazil. The era of silver as “poor man’s gold” is officially over.

India’s Silver Premium: A 16.84% Disconnect from the West

If India’s policy announcement was the spark, the fire is raging in local pricing. As of October 23, 2025, spot silver in Mumbai trades at a blistering 159 rupees per gram – equivalent to $78.68 CAD per ounce. That’s a jaw-dropping 16.84% premium over Western benchmarks like the COMEX spot at $48.14 USD per ounce (or roughly $67.50 CAD per ounce at current exchange rates). In a market where premiums typically hover under 5%, this gulf underscores supply chain fractures and cultural fervor.

Why the disparity? It very well could have been Diwali season, amplified by the new collateral rules. Jewellers in Delhi and Chennai report shelves stripped bare, with wholesale lots vanishing into bank vaults for RBI-compliant reserves. Import duties, now at 12.5% on silver dore, compound the issue, while smuggling from neighboring Nepal has surged 40% year-over-year, per customs data. With the RBI’s backing, silver’s role as a cultural and now financial staple positions India as the swing producer in a market already strained by mine strikes in Mexico and Peru. One thing is for sure, as prices dip eastern countries are going to continue to gobble up available supply.

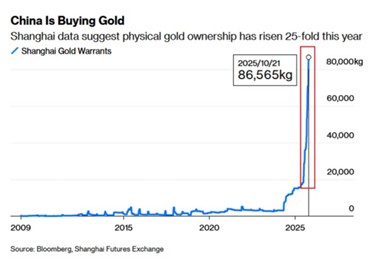

China’s Gold Warrants: 25x Ownership Spike Signals Shadow Reserves

Shifting eastward, the Shanghai Gold Exchange (SGE) is ablaze with activity. Gold warrant issuances – derivatives representing claims on physical bars in exchange vaults – exploded over the past few years, with outstanding contracts surging over 25 times. This isn’t retail froth; it’s a barometer of China’s opaque gold accumulation, hinting at state-directed hoarding on steroids ready to be unleashed at any time.

Warrants allow investors to defer delivery, sidestepping capital controls while locking in ownership. Volumes hit record highs in Q3, coinciding with Public Bank of China whispers of diversifying from U.S. Treasuries amid escalating trade frictions. Analysts at ANZ estimate this equates to a 30% bump in China’s official reserves, much of which is still underreported, per World Gold Council audits. The implications ripple globally. As the top gold producer in the world, China’s gold ownership warrant boom tightens physical supply, propping up prices across the world.

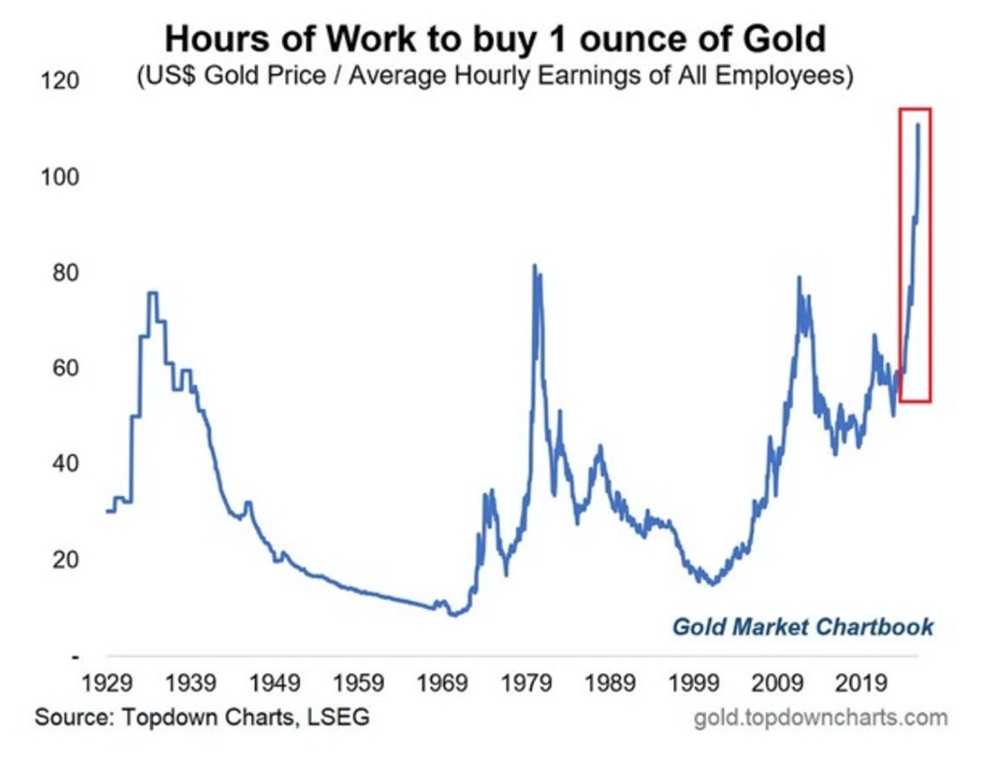

Gold’s Unaffordability: 120 Hours of Sweat for One Ounce

Finally, the elephant in the vault: gold’s retreat from the masses as it becomes more unaffordable. In 2025, the average American worker clocks nearly 120 hours – three full workweeks – to afford one ounce at $4,080 USD per ounce, and that is if they spend every penny they earn on gold itself. That’s up from 90 hours in 2020 and under 20 hours in the year 2000. In emerging markets like Indonesia, it’s 200+ hours, and rising rapidly.

This “affordability chasm” explains central banks’ binge led by Poland and India. With gold’s industrial utility capped at 10% of demand, institutions are pivoting to silver – cheaper at $49 USD per ounce, but with 50% industrial upside in EVs and 5G. We’ve long forecasted silver’s own unaffordability threshold because as deficits grow and it becomes more and more critical to civilization, supply shortages will push prices skyward.

The takeaway? Precious metals aren’t hedges; they’re lifelines in a de-dollarizing world. As gold vaults shut due to affordability, silver’s monetization wave offers a rare entry for everyday citizens. Position accordingly – history favors the prepared.

Hi,

Hi,