The U.S dollar has always correlated with gold prices. Whenever one was down, the other was up. As the U.S dollar goes down, gold’s value will go up, and vice versa. There are several reasons and factors that cause this relationship.

The Commodity-Dollar Relationship

Most commodities are traded in American dollars, making it the global standard. The U.S dollar is the standard for global trade. The commodity-dollar relationship describes how the U.S dollar affects gold prices. As the U.S dollar goes up, gold prices go down. Although gold prices are down in US dollars, it becomes more expensive for countries around the world to pay with their nation’s currency. When the US dollar goes down, gold becomes more expensive in the states as it’ll cost more to reach gold’s value. However, when the US dollar loses value, gold becomes much more affordable to the rest of the world. The same goes for the opposite situations. When the US dollar increases value, gold prices drop. Even though gold prices drop, it can be more expensive globally, but cheaper in the States.

Keeping tabs on the fluctuation of the US dollar can help predict when it’s the right time to invest in gold. It can also be a good indicator as to when you should sell your gold. When the US dollar loses value, it’s the best time to purchase gold. That is when gold is relatively cheaper globally. The best time to sell gold is when the US dollar gains value because you’ll make more out of your investment.

Commodities and their Cycles

Another factor that causes gold’s value to fluctuate is the need for raw materials in the world. Commodities super-cycles have drastic impacts on all industries. When the world is hungry for raw materials, the cycle of commodities begins. It can go as far as impacting your groceries, cars, buying a house, and all sorts of markets.

Several different cycles and relations cause the gold prices to fluctuate, but understanding these cycles will allow us to predict when to buy and sell our gold. Making sure we make our investments according to the highs and lows of the market can ensure that we make the most out of our investments.

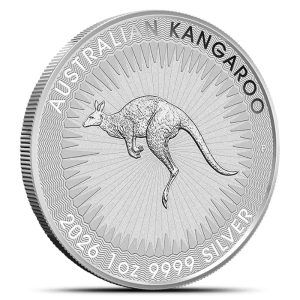

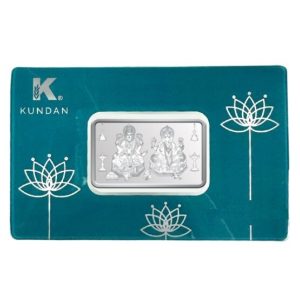

If you are looking for a solid precious metals investment to hedge against the dollar then you have come to the right place! During times of uncertainty it is always a good idea to have some of your wealth stored in Gold and Silver. Here at AU Bullion you can shop from our wide selection of products for your next precious metals investment.

Hi,

Hi,