Investing in US Mint coins can be a rewarding and profitable venture. One of the most well-liked and collected types of coins worldwide is American. It’s also one that comes with high risks. The US Mint does not sell individual coins to the public, but they do produce circulating and non-circulating bullion versions of their coins. As such, investing in these coins is purely speculative. However, that doesn’t mean it can’t still be profitable if you do your research and know what you are doing. This blog post will explain the basics of investing in US Mint coins so that you can decide whether it’s right for you or not.

From where buy US Mint Coins?

Au Bullion carries US Mint coins from time to time. Customers can make prompt purchases both online and offline thanks to the website’s friendly and knowledgeable customer service.

How to Invest in US Mint Coins

If you want to invest in US Mint coins, the first thing you should do is decide which coins you would like to buy. Start by focusing on the fundamentals: cost, standing, and appearance. These should be arranged in your own personal hierarchy of importance. Even more unique elements, like a limited edition, can be incorporated. Limited edition bullion is rarely, in our opinion, worth the significant premium.

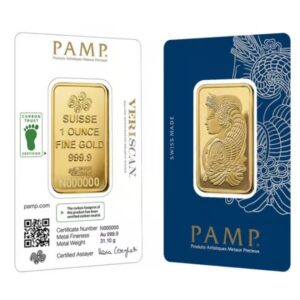

One way to invest in platinum bullion and coins is to buy products from a reputable dealer you can trust.

Involvement in the automotive sector through partnerships is another way to invest in platinum coins and bullion. For instance, platinum is used in electric cars, giving those who invest in their value for their money.

Things to Look for When Investing in US Mint Coins

When you are investing in US Mint coins, the most important thing to keep in mind is the overall long-term outlook for the coin’s worth. This is because it will help you decide which coins to buy and which to avoid. So, what do you need to keep an eye out for?

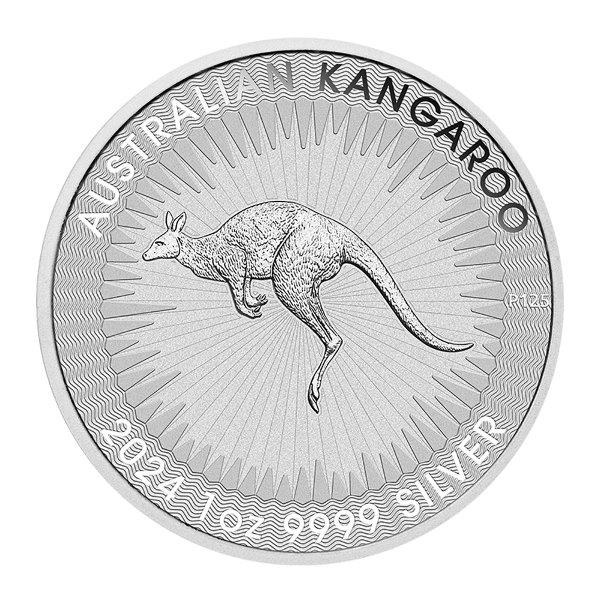

- First, you will want to keep an eye on the value of silver and gold. If the price of silver rises and gold falls, it will affect the value of US Mint coins. This is because both silver and gold make up a large portion of the price of the coins. Therefore, if either one rises in value, so will the value of your coins.

- Another thing to keep an eye on is the interest in investing in US Mint coins. Because these are not government-issued coins, they are not as popular as circulating and non-circulating coins. However, they are still just as valuable and hold the same long-term outlook as the other coins. One other thing to keep an eye out for is the collector’s value of the coins. Some US Mint coins are very collectible and have a high collector’s value.

What coin is the best investment option?

After George Washington’s signature on the Mint Act of 1792, the first official coins of the United States were struck and have been in circulation for more than 227 years. You are holding history in your hands when you hold a coin.

- A US Mint coin with historical and aesthetic value is the best one to buy. A grade from a professional will always pass the necessary inspections and sell for the highest price possible if it has such value.

- The grading of the coins depends on things like lustre, strike quality, errors, and surface preservation. Because they fetch the highest value for investors, the best coins to buy as investments are those with less wear and tear.

- You can buy US Mint palladium coins and US Mint platinum coins that pass professional grader testing. These factors determine the best coins to buy and the security of the transaction.

Benefits of Investing in US Mint Coins

One of the main reasons why investing in US Mint coins is so safe is because the coins you buy are made of precious metals.

– Precious metals are an excellent hedge against inflation.

– They are also a very safe investment because they have been used for thousands of years as money.

Bottom Line

Because of the design (Eagle Design), US Mint coins are a good choice for investments, particularly for gold bullion coins. The US Mint also creates a variety of commemorative coins that go beyond their basic metal value.

Hi,

Hi,