Silver Price Today Per Ounce - Live Silver Price

Au Bullion's Silver Price Page provides the latest real-time spot price of silver in the professional market. We offer this valuable service to empower our customers with the information they need to make informed decisions. Presently, the spot price of silver per troy ounce stands at CAD 52.53. To view silver prices in other denominations, simply scroll down this page. Moreover, consider signing up for spot price alerts to stay informed when your desired silver price is achieved.

| Calculated in | Silver spot price - Spot Change | Current silver price - Silver price today |

|---|---|---|

| Silver Price Per Ounce | CAD 0.23 | CAD 52.53 |

| Silver Price Per Gram | CAD 0.01 | CAD 1.69 |

| Silver Price Per Kilogram | CAD 7.39 | CAD 1,688.84 |

Silver Price Performance

| Change (Time Span) | Amount (In CAD/USD) | % (Percentage Change) |

|---|---|---|

| Today | 0.00 | 0.00% |

| 30 Days | 1.83 | 3.61% |

| 6 Months | 10.68 | 25.53% |

| 1 Year | 11.20 | 27.11% |

| 5 years | 25.85 | 96.92% |

📈 Live Silver Prices in Canadian Dollars (CAD)

Stay informed with real-time silver prices in Canadian dollars (CAD) updated continuously to reflect the latest spot market rates. Whether you're an experienced investor or just getting started, knowing the current price of silver per ounce, gram, and kilogram in CAD is essential for making smart buying or selling decisions. Au Bullion’s silver price feed reflects live data from global markets, ensuring you have the most accurate and up-to-date pricing at your fingertips. From daily fluctuations to long-term trends, tracking live silver prices in CAD allows investors to react promptly to market movements, lock in favourable rates, and plan strategic purchases of silver bullion, bars, rounds, and coins. Looking for specific denominations? Scroll down to view the silver spot price per:- 1 Ounce

- 1 Gram

- 1 Kilogram – You can also sign up for price alerts to receive instant notifications when silver hits your desired price target.

🔍 Market Insights

Understanding what drives the silver market is critical for successful investing. At Au Bullion, we provide daily insights into the key trends and macroeconomic factors shaping the price of silver. These include:- Global economic indicators such as inflation, interest rates, and GDP reports.

- Geopolitical events like wars, sanctions, and elections that may affect market stability.

- Industrial demand and supply constraints, particularly from sectors like electronics, solar energy, and medicine.

- Currency strength, especially the USD/CAD exchange rate, which can influence local pricing for Canadian investors.

💡 Investment Tips

- ✅ 1. Track Price Trends Regularly Monitor live silver prices and historical charts to identify optimal entry and exit points. Buying during price dips and selling during peaks can improve your ROI over time.

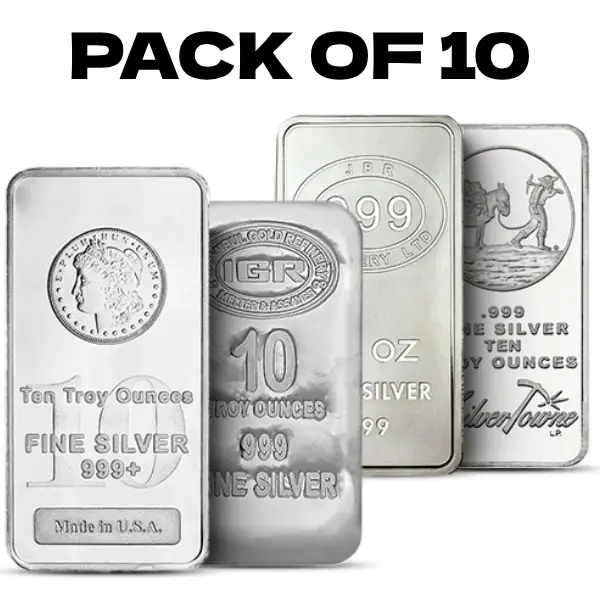

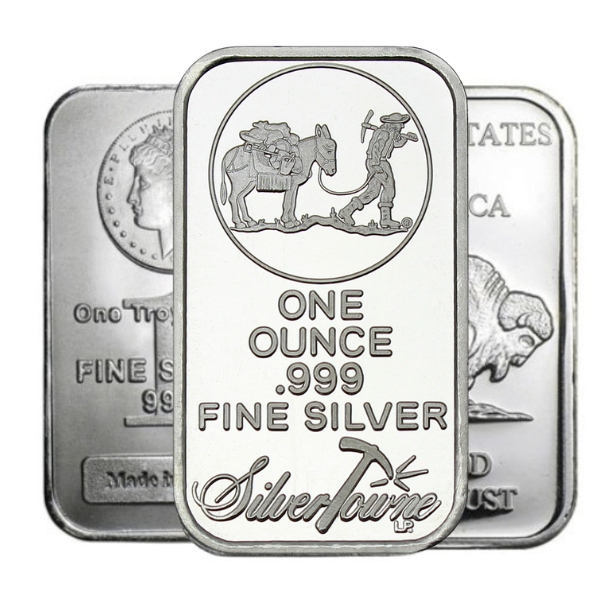

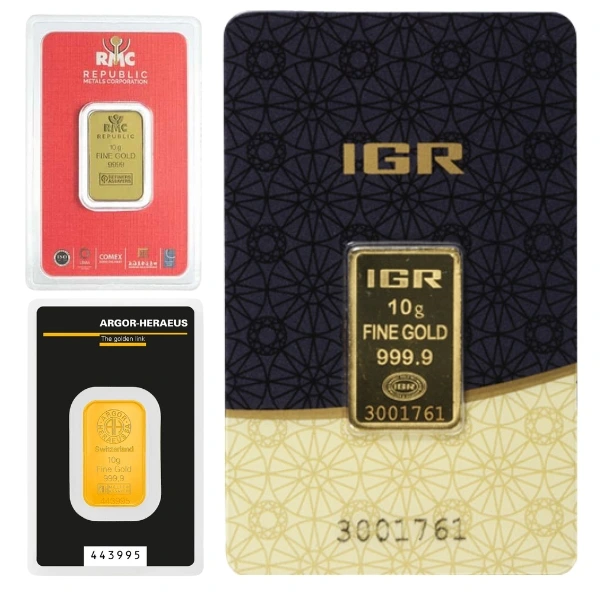

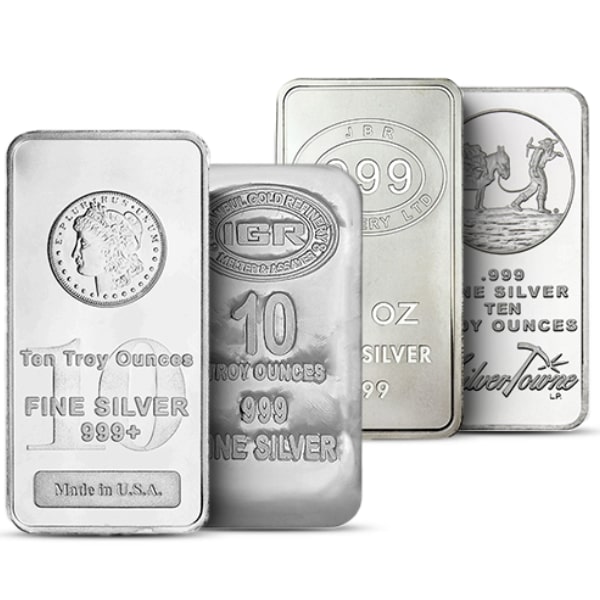

- ✅ 2. Diversify Your Precious Metals Portfolio Don’t limit yourself to just silver coins. Consider investing in a mix of silver bars, rounds, collectible pieces, and monster boxes for better liquidity and value growth potential.

- ✅ 3. Consider Physical vs. Paper Silver While ETFs and silver stocks are popular, physical silver bullion offers the benefit of tangible ownership. In times of economic uncertainty, physical assets are often viewed as more secure.

- ✅ 4. Stay Informed About the Global Economy Silver prices are influenced by inflation, interest rates, industrial demand, and geopolitical events. Keeping up with these developments will help you make more informed and confident investment decisions.

- ✅ 5. Set Price Alerts Use Au Bullion's price alert tool to get notified when silver reaches your preferred buy or sell price. This feature helps automate your investment strategy and ensures you don’t miss key market opportunities.

Ready to Invest in Silver?

Explore our wide selection of silver bullion products and start your investment journey today with trusted, secure service from AU Bullion Canada.

Shop Silver NowNew to Buying Silver? Check our Product Recommendation Tool

Shop Silver Bullion Products

Live Silver Prices

Silver Throughout History

Like most precious metals, silver has a rich history, linked to many cultures and traditions around the world. Silver was originally discovered in Ancient Egypt and has been incredibly popular ever since. Throughout history, silver was used for many purposes, especially jewellery. Back then, silver was thought to be rarer than gold, making its price higher than gold. As silver became more popular in the market, it was clear that silver isn’t rarer than gold. Eventually, the Egyptians used silver as a form of currency for thousands of years while still being popular in jewellery, artwork, and much more. Get live silver prices from the chart and make your decision to buy or sell silver bullion. During the Roman empire, silver became popular all around the world. It was used as standard coinage giving it equal value across the trading world. This event turned precious metals into popular currency. Silver became remarkably important in the global investment market and still continues to be one of the top precious metals in the world.Silver as an Investment

World's most popular precious metals to invest in is silver, only second to gold. Silver coins and silver bars are great ways to invest in silver bullion. As an investment, silver is comparatively more affordable and has a reliable ROI. Precious metals have a unique relationship with the market. They are safe from inflation and crashes in the market, making them a safe and reliable asset. Throughout history, trends show that silver prices tend to rise as the market drops.The price of Silver today and Silver Price Charts

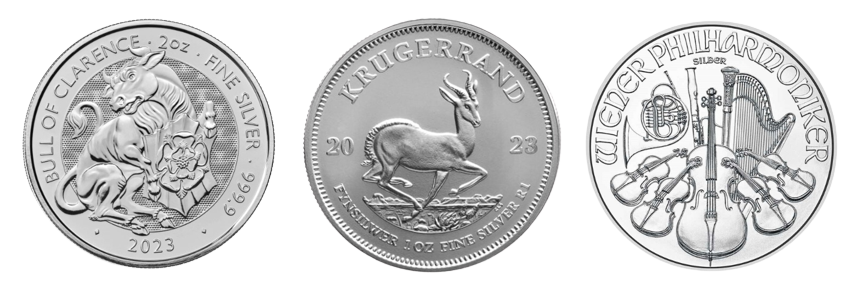

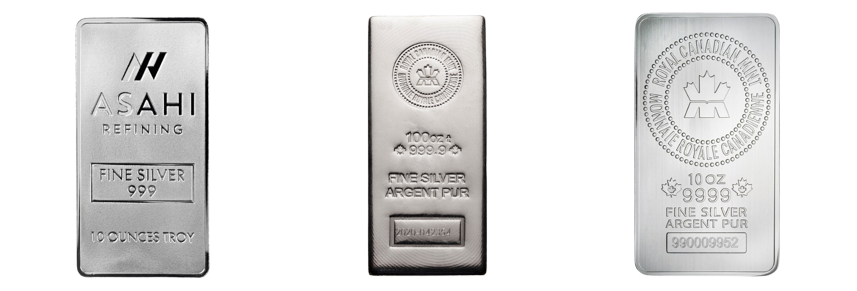

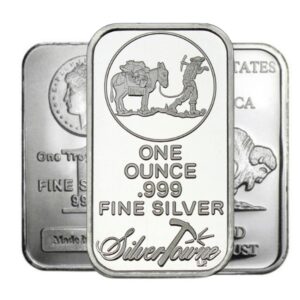

Like all assets and precious metals, the price of silver varies each day. Many factors cause silver’s spot price to change, such as real-world events, supply and demand, and more. You can stay up to date on silver prices by using our silver price charts. You can observe the fluctuations and changes in silver prices throughout the years while keeping up with silver’s spot price. They allow you to keep up with silver trends throughout the years, making it easier for you to make an accurate and effective investment decision. Silver price charts are accurate tools and are easy to use. Want to sell gold check for Gold prices. Au Bullion Offers: Silver Coins , Silver Bars, Silver Tubes, Silver Rounds, Silver Monster Boxes, Silver Collectibles, Silver Buyers Near Me, Silver Canada price, Silver spot price, Silver price cadSHOP OUR SILVER PRODUCTS

Silver Spot Price Chart

Gold

Silver

Platinum

More Questions about Silver

What factors influence the price of silver?

The price of silver is influenced by various factors including supply and demand, inflation, currency fluctuations, geopolitical risks, and economic indicators. Silver, like gold, is considered a "safe haven" asset, meaning its price may increase during times of economic uncertainty or instability. However, silver also has significant industrial uses, which can affect its price as well.

Why does silver price fluctuate?

The price of silver fluctuates due to changes in supply and demand, market speculation, and economic or political events. Increased industrial demand or decreased supply (due to mining issues, for example) can cause prices to rise, while decreased demand or increased supply can cause prices to fall.

How is the price of silver determined?

The price of silver is determined in the commodities market, where future contracts are bought and sold. The "spot price" of silver is the current price in the marketplace at which a given asset—like a security, commodity, or currency—can be bought or sold for immediate delivery.

Is silver a good investment?

The value of silver can fluctuate, so while it can be a profitable investment, it also carries risk. Silver is often viewed as a safe haven in times of economic uncertainty, and it can also provide a hedge against inflation. However, as with any investment, potential investors should do their due diligence and consider consulting with a financial advisor.

Does silver price rise during inflation?

Similar to gold, the price of silver often rises during inflation. This is because as the value of paper currency falls, the relative purchasing power of silver tends to increase.

Can I predict the silver price?

Some traders use economic indicators, market trends, and technical analysis to try to predict the price of silver. However, predicting price movements in any market, including silver, is inherently uncertain and involves a significant degree of risk.

Why Choose AU Bullion Canada?

Secure Payments

Fast Shipping Across Canada

24/7 Customer Support

Certified and Trusted Dealer

Hi,

Hi,