Platinum

All 15 products

All 15 products

Why you should buy Platinum Bullion?

Unlike Gold and Silver, Platinum doesn’t have the same history of being traded in the markets. However, it is dearly valued due to its rarity and real world industrial use. This has made it a fantastic investment product. A neat fact – about 80% of the world’s Platinum supply comes from South Africa. It’s limited supply gives investors an edge for when there’s supply chain issues or majority of it has nearly been mined. At one point, the metal was trading for much higher than Gold, which makes it a great opportunity now. As it is relatively undervalued, it’s only a matter of time before the bubble bursts and prices skyrocket. In the current state of the market it’s a great opportunity to take for a potential generous return.

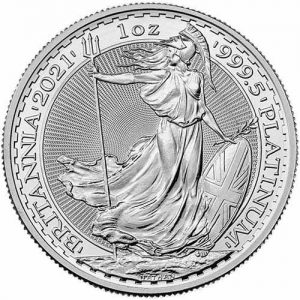

Platinum Coins

Similar to Gold Coins and Silver Coins, Platinum coins are all minted by government mints. Like any other bullion coin, they also have an assigned face value. If you are someone who likes government issued coins, then these are an excellent way to invest. Although coins tend to be a bit more expensive than bars, investors still opt for the intrinsic value. Due to the metals rarity, they tend to have a lower mintage as compared to Gold and Silver coins.

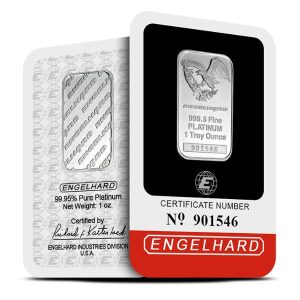

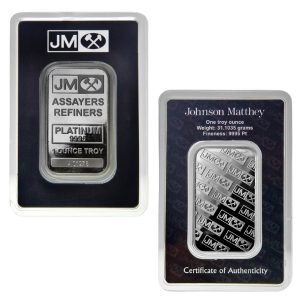

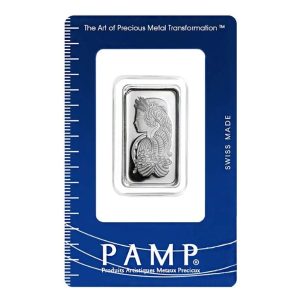

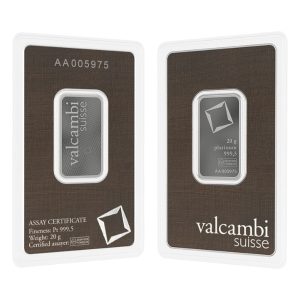

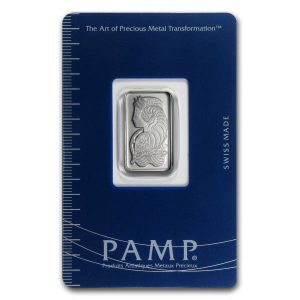

Platinum Bars

If you want a low premium investment, then you cannot go wrong with investing in bars. 1 Oz Bars are an excellent way of investing in the metal at lower cost than coins. Longterm, this may give you a slightly higher ROI depending on which coin it is compared to. Bars are made in various weights, they can be as small as 1 gram and can go up to 1 Kg.

Invest in Quality Platinum with AU Bullion

At Au Bullion, we offer a wide selection of platinum coins and platinum bars, providing you with secure and reliable ways to invest in this precious metal. Our platinum bullion collection offers high-quality products that adhere to industry standards. The platinum spot price is constantly fluctuating, and we provide up-to-date platinum price charts to help you track market movements and make well-informed investment decisions. We provide an extensive selection of platinum products, Like gram platinum bars, kilo platinum bars, ounce platinum bars and many more weights sourced from reputable and recognized mints. All our platinum items are LBMA (London Bullion Market Association) approved, ensuring the highest standards of quality and authenticity.

Something you will notice in both Platinum coins and bars is that they tend to have a purity of 99.95% Which is different from Gold and Silver which tend to be 99.99% pure. This is because it is significantly harder to refine the metal as it has a higher boiling point. Which is why the 99.95% purity is accepted worldwide.

Cash for gold is a great way to get the most out of your unwanted gold jewelry.

Why you should buy Platinum Bullion?

Unlike Gold and Silver, Platinum doesn’t have the same history of being traded in the markets. However, it is dearly valued due to its rarity and real world industrial use. This has made it a fantastic investment product. A neat fact – about 80% of the world’s Platinum supply comes from South Africa. It’s limited supply gives investors an edge for when there’s supply chain issues or majority of it has nearly been mined. At one point, the metal was trading for much higher than Gold, which makes it a great opportunity now. As it is relatively undervalued, it’s only a matter of time before the bubble bursts and prices skyrocket. In the current state of the market it’s a great opportunity to take for a potential generous return.

Platinum Coins

Similar to Gold Coins and Silver Coins, Platinum coins are all minted by government mints. Like any other bullion coin, they also have an assigned face value. If you are someone who likes government issued coins, then these are an excellent way to invest. Although coins tend to be a bit more expensive than bars, investors still opt for the intrinsic value. Due to the metals rarity, they tend to have a lower mintage as compared to Gold and Silver coins.

Platinum Bars

If you want a low premium investment, then you cannot go wrong with investing in bars. 1 Oz Bars are an excellent way of investing in the metal at lower cost than coins. Longterm, this may give you a slightly higher ROI depending on which coin it is compared to. Bars are made in various weights, they can be as small as 1 gram and can go up to 1 Kg.

Invest in Quality Platinum with AU Bullion

At Au Bullion, we offer a wide selection of platinum coins and platinum bars, providing you with secure and reliable ways to invest in this precious metal. Our platinum bullion collection offers high-quality products that adhere to industry standards. The platinum spot price is constantly fluctuating, and we provide up-to-date platinum price charts to help you track market movements and make well-informed investment decisions. We provide an extensive selection of platinum products, Like gram platinum bars, kilo platinum bars, ounce platinum bars and many more weights sourced from reputable and recognized mints. All our platinum items are LBMA (London Bullion Market Association) approved, ensuring the highest standards of quality and authenticity.

Something you will notice in both Platinum coins and bars is that they tend to have a purity of 99.95% Which is different from Gold and Silver which tend to be 99.99% pure. This is because it is significantly harder to refine the metal as it has a higher boiling point. Which is why the 99.95% purity is accepted worldwide.

Cash for gold is a great way to get the most out of your unwanted gold jewelry.

Hi,

Hi,