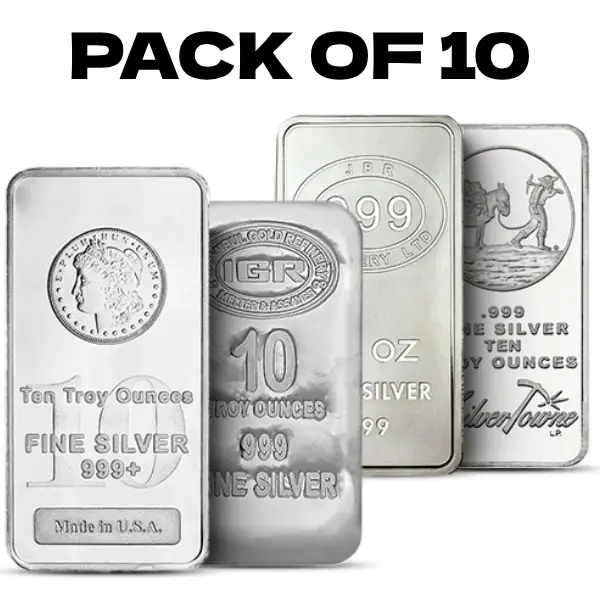

10 Oz Silver Coins

1 product

1 product

About 10 oz Silver coins

A 10 oz silver coin typically refers to a silver bullion coin that contains 10 troy ounces of silver, which is equal to approx 311.1 grams. 10 oz silver coins are an excellent option to build your investment portfolio. Silver performs better in economic uncertainty, as well as it acts as a tangible hedge against inflation. These coins are highly demandable commodities in silver investment due to their liquidity. The historical significance and potential collectible value of silver coins provide an added dimension to their worth and demand.

Why invest in 10 oz Silver coins

Investing in silver coins offers a way to diversify and build an investment portfolio. These coins always act as reliable assets independent of currency fluctuations, which means silver is an excellent inflationary hedge. Their liquidity and easy availability make silver an attractive choice of investment among investors of different levels. Due to the rise in industrial demand for silver, these coins present an opportunity for investors to get maximum returns.

Precious Metal’s Investment

Investing in precious metals like gold, silver, platinum, or palladium is a great option because these metals tend to hold their value well, even when there is bad economic time. You can stabilize your investment portfolio with Precious Metal’s investments. Bullion is easy to buy and sell, due to its high demand, which keeps its value pretty steady. But just remember, their prices can go up and down as these are highly volatile in nature.

Want to buy Gold and Silver contact us now & grab your metal in easy steps.

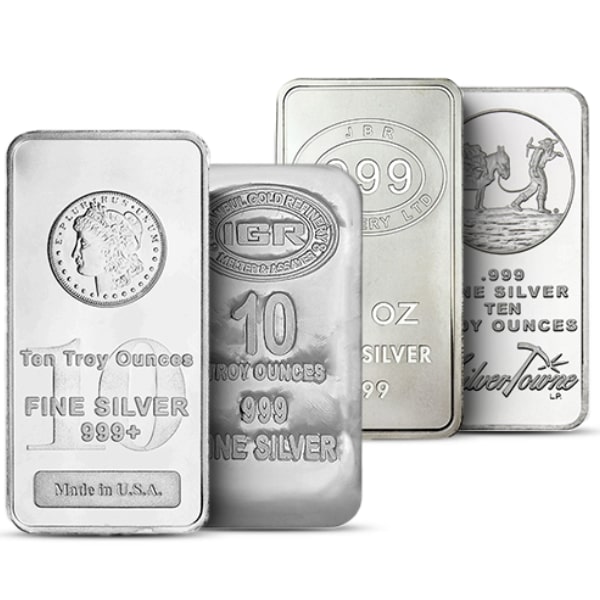

About 10 oz Silver coins

A 10 oz silver coin typically refers to a silver bullion coin that contains 10 troy ounces of silver, which is equal to approx 311.1 grams. 10 oz silver coins are an excellent option to build your investment portfolio. Silver performs better in economic uncertainty, as well as it acts as a tangible hedge against inflation. These coins are highly demandable commodities in silver investment due to their liquidity. The historical significance and potential collectible value of silver coins provide an added dimension to their worth and demand.

Why invest in 10 oz Silver coins

Investing in silver coins offers a way to diversify and build an investment portfolio. These coins always act as reliable assets independent of currency fluctuations, which means silver is an excellent inflationary hedge. Their liquidity and easy availability make silver an attractive choice of investment among investors of different levels. Due to the rise in industrial demand for silver, these coins present an opportunity for investors to get maximum returns.

Precious Metal’s Investment

Investing in precious metals like gold, silver, platinum, or palladium is a great option because these metals tend to hold their value well, even when there is bad economic time. You can stabilize your investment portfolio with Precious Metal’s investments. Bullion is easy to buy and sell, due to its high demand, which keeps its value pretty steady. But just remember, their prices can go up and down as these are highly volatile in nature.

Want to buy Gold and Silver contact us now & grab your metal in easy steps.

Hi,

Hi,