In an era of unprecedented economic uncertainty, the global financial landscape is riddled with warning signs that echo the precursors to past crises. From soaring debt levels to corporate distress reaching all-time highs and shifting liquidity dynamics, the world is grappling with chaos that threatens investors and economies alike. Amid this turmoil, precious metals like gold and silver stand out as timeless safeguards with central banks continuously adding to reserves each month, offering protection against inflation, market volatility, and systemic risks. As we delve into key indicators of instability, it becomes clear why diversifying into precious metals seems pretty well essential.

Record-High Margin Debt: A Financial Time Bomb

One of the most alarming developments is the surge in U.S. margin debt, which has reached a staggering all-time high of over $1 trillion as of July 2025. This figure represents money borrowed by investors to amplify their stock purchases, using their portfolios as collateral. While margin lending can boost returns in bull markets, it magnifies losses during downturns, potentially leading to forced selling and cascading market declines.

The risks are profound. High margin debt levels often signal excessive speculation and overleveraged positions. In historical contexts, such as before the 2000 dot-com bust or the 2008 financial crisis, elevated margin debt preceded sharp corrections. Today, with debt climbing 9.45% month-over-month and 24.6% year-over-year, investors face heightened vulnerability. A market dip could trigger widespread margin calls, where brokers demand additional funds or liquidate assets, exacerbating sell-offs causing a massive drop in stock prices. For the broader economy, this could spill over into reduced consumer spending, tighter credit, and even recessionary pressures. In this environment, gold and silver serve as non-correlated assets, preserving value when equities falter.

Surging Corporate Bankruptcies and Collapsing Lumber Prices: Echoes of Past Crises

Compounding the concern, U.S. corporate bankruptcy filings have hit their highest levels since the 2020 pandemic. Through July 2025, 446 large companies have filed for bankruptcy—a 12% increase over the same period in 2020 and the most for any seven-month stretch since 2010. July alone saw 71 filings, the highest monthly total in five years with no signs of slowing down. This wave reflects persistent challenges like high interest rates, supply chain disruptions, and weakening demand, signaling deep-seated corporate stress.

Adding to the red flags, lumber prices are experiencing a sharp decline, dropping 10.78% in the past month to around $596 per thousand board feet as of August 20, 2025. This volatility mirrors patterns unseen since 2006-2007, when prices collapsed from about $350 to $250 per thousand board feet amid a housing slowdown that foreshadowed the Great Financial Crisis and mass foreclosures. Lumber, a key indicator of construction activity and economic health, suggests softening housing demand and broader slowdowns. Combined with bankruptcies, these trends point to fragility in sectors like real estate and manufacturing, potentially leading to job losses and reduced growth. Precious metals, historically resilient during such periods, provide a hedge by maintaining purchasing power as fiat currencies weaken and risk on assets begin to drop like rocks.

Reverse Repo at Historic Lows: Liquidity Signals Tightening

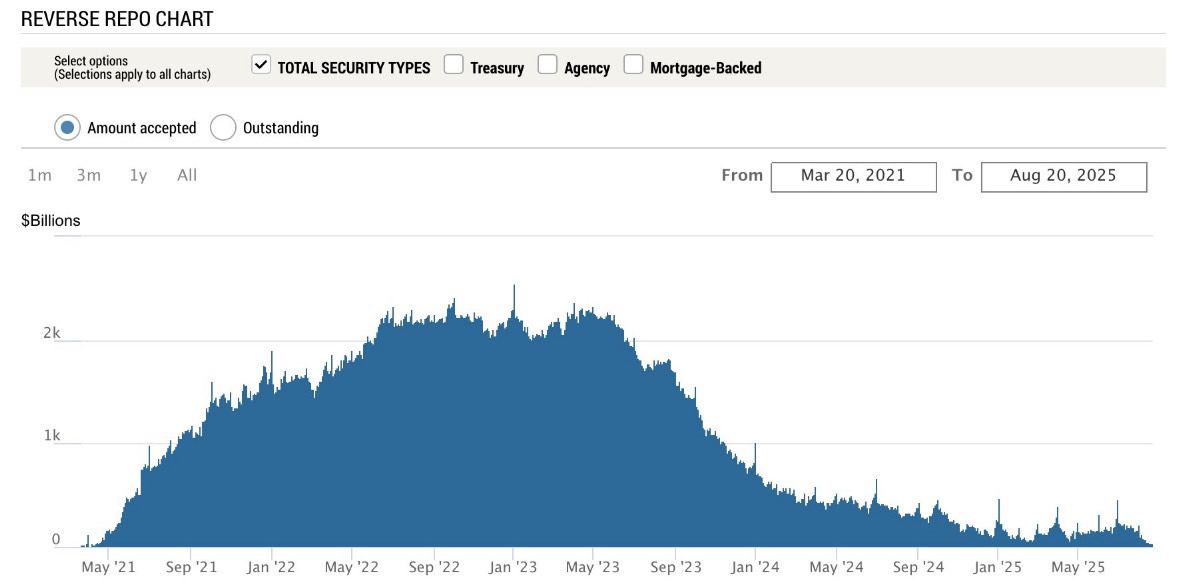

Briefly, the Federal Reserve’s Overnight Reverse Repurchase Agreement facility allows institutions to lend cash to the Fed overnight in exchange for Treasury securities, helping manage excess liquidity and support interest rate targets. High usage indicates abundant cash in the system; lows suggest normalization or potential strains.

Currently, the Overnight Reverse Repurchase Agreement balance has plummeted to recent all-time lows, standing at approximately $25.4 billion as of August 21, 2025. This drop from well over $2 trillion in prior years signals a draining of excess reserves, possibly due to the Fed’s balance sheet reduction or shifting market dynamics. While it may reflect policy normalization, it could also herald tighter liquidity, higher borrowing costs, and increased volatility—reminiscent of pre-crisis liquidity crunches. In such scenarios, investors flock to safe-haven assets like gold and silver, which thrive amid uncertainty and the likely Fed response of massive currency creation.

Why Gold and Silver Now?

These interconnected risks—record margin debt, bankruptcy surges, lumber price drops, and liquidity evaporation—paint a picture of mounting financial chaos. History shows that during crises, traditional investments suffer while precious metals shine. Gold, often called “crisis insurance,” has risen over 25% in value this year alone, outpacing many assets. Silver on its end has risen nearly 28% this year outpacing gold for the second straight year.

Owning physical gold and silver diversifies portfolios, protects against inflation (which remains well elevated), and guards wealth during downturns. Whether through coins or bars incorporating these metals have the potential to mitigate risks in turbulent times. As global debts swell and geopolitical tensions rise, the case for precious metals has never been stronger.

Hi,

Hi,