The global financial landscape is shifting beneath our feet, and the tremors are reverberating through the markets for gold and silver. Far from being mere commodities, these metals are reasserting their timeless role as anchors of value in an age of uncertainty. Three seismic events this week illuminate this transformation: China’s Shengda Resources amassing a colossal silver reserve, raw silver prices in China smashing records, and the U.S. gold stockpile crossing a historic mark. These developments aren’t random – they’re interconnected signals of a world pivoting toward a precious metals-backed future; a future long covered in these newsletters. When you look at each newsletter as an individual piece, it may seem like nothing major is happening. However, when you look at them in totality you begin to see the nails in the coffin of our current financial system growing in number at rapid succession.

China’s Silver Fortress: Shengda’s 10,000-Tonne Gambit and the Looming Supply Crunch

Let’s start in the heart of the world’s manufacturing powerhouse: China. Shengda Resources, a Shenzhen-listed heavyweight in mining and commodities, has quietly amassed a staggering 10,000-tonne reserve of physical silver. That’s equivalent to over 321 million ounces – enough to supply global industrial demand for months. Whispers of this hoard leaked last week, catapulting Shengda’s stock to its daily limit on the Shenzhen exchange, with shares surging 10% in a single session. Investors aren’t betting on folklore; they’re pricing in reality that those companies that own real things will survive long into the future.

Why now? Silver isn’t just shiny – it’s the unsung hero of green tech. Solar panels, electric vehicles, 5G infrastructure, and AI hardware guzzle the stuff like never before in history. Regardless of what you personally think about the green energy movement, it is happening, and physical silver supplies are getting crushed as a result. The Silver Institute reports annual deficits averaging 200 million ounces for the past five years, a chasm widening with every EV battery produced. Shengda’s move isn’t eccentric; it’s existential to their survival. As one analyst quipped on X, “This is China playing 4D chess while the West fiddles with derivatives.” Companies hooked on silver – from Tesla to TSMC – face a stark choice: build reserves or risk obsolescence when supplies inevitably run dry. Foxconn, Apple’s assembler, reportedly inked a secret deal last month for 50 tonnes, hedging against disruptions.

This hoarding frenzy echoes the 1970s silver squeeze but is amplified by modern scarcity. With mine output flatlining at 800 million ounces annually against 1.2 billion in demand, physical allocation is the new king. Central banks, too, are circling, India’s central bank the RBI added 25 tonnes of silver to its forex kitty in Q3 alone. Shengda’s fortress isn’t just a corporate flex – it’s a blueprint for survival in a metals-backed future, where paper promises yield to tangible troy ounces. As deficits compound (projected at 250 million ounces by 2026), expect a cascade: manufacturers front-loading purchases, ETFs hemorrhaging paper claims, and spot premiums exploding. The message? In the race to remonetize, silver’s scarcity is the ultimate moat.

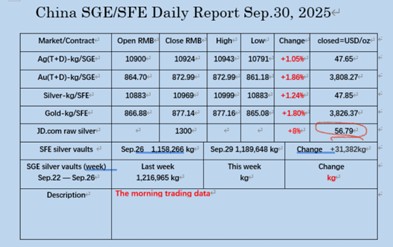

Raw Silver Record Shatter: $56.79/oz in China Signals Global Repricing

If Shengda’s stockpile was the warning shot, China’s raw silver market just fired the cannon. Spot prices for unrefined .999 silver bars not cast into bullion hit $56.79 USD per ounce last Friday on the Shanghai Metals Market – a blistering 13.69% above the all-time high of $49.95 USD per ounce set in January 1980 during the Hunt brothers’ legendary corner. Adjusted for inflation, that’s a nominal peak that dwarfs even gold’s recent frenzy.

This isn’t hyperbole; it’s market math. China’s premium – often 5-10% over London fixes – reflects hyper-local demand from its solar juggernaut, which consumed 180 million ounces last year. With U.S. tariffs biting imports and domestic mines strained, refiners are paying up. “We’re seeing bids at levels that make 2011 look like a dip,” notes a Beijing trader. The ripple? Global repricing.

What does this mean for global finance? A seismic revaluation. Silver’s industrial tether (estimated at 60% of total demand) makes it a hyper-sensitive barometer for economic pivots. As fiat debasement accelerates – U.S M2 up 40% since 2020 – investors are fleeing dollars for bars. This price spike validates the thesis: precious metals as inflation’s antidote and growth’s enabler. Corporations like Siemens and Panasonic are now budgeting 20% premiums for Q4 deliveries, per Bloomberg data. In a metals-resurgent world, this isn’t volatility; it’s validation. Expect algorithmic trading desks to recalibrate, with silver ETFs like SLV eyeing $60 by year-end. The 1980 all-time high wasn’t a fluke – it was foreshadowing.

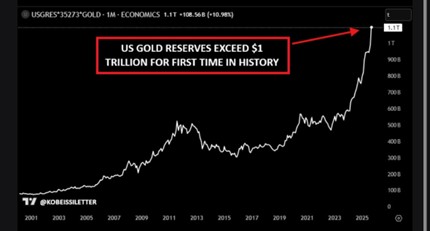

Uncle Sam’s Golden Milestone: $1 Trillion Hoard Ushers in Revaluation Whispers

Across the Pacific, the U.S. Treasury’s gold reserves have quietly crested a psychological Rubicon: $1 trillion in market value, the first time ever. At 8,133 tonnes (unchanged since 1971 and also unaudited), the Fort Knox stash – booked at a quaint $42.22 USD per ounce or $11 billion – now commands this bounty thanks to spot gold’s 46% year-to-date rally to $3,857 USD per ounce.

This trillion-dollar threshold isn’t mere arithmetic – it’s a catalyst. Lawmakers from Rand Paul to Elizabeth Warren are renewing calls for a full Fort Knox audit, dormant since 1953. “If it’s worth a trillion, why value it at Depression-era prices?” thundered a Senate hearing last Tuesday. Whispers of revaluation – last floated by Nixon in ’71 – grow louder. A 60x markup could plug deficits, fund infrastructure, or back a stable dollar.

Globally, it’s a beacon. Russia’s 2,300 tonnes and China’s 2,200 (plus unannounced buys) pale against Uncle Sam’s arsenal, but the value surge amplifies U.S. leverage. BRICS nations, eyeing de-dollarization, now covet gold swaps over Treasuries. JPMorgan estimates central bank purchases hit 1,200 tonnes in 2025, rivaling 2022’s record. This milestone cements gold as the ultimate reserve asset, nudging finance toward a hybrid standard where precious metals anchor volatility. As one Fed watcher put it, “We’re not returning to Bretton Woods – we’re evolving it.”

Push Toward a Precious Metals Dominion

Thread these threads, and the pattern emerges: a deliberate march to remetalize global finance. Shengda’s silver bunker fortifies supply chains against deficits; China’s price surge enforces fiat currency instability; and America’s trillion-dollar gleam reignites monetary debates. Together, they herald an era where balance sheets crave bullion, not sovereign bonds – where digital dollars are gold-pegged, trade settles in troy, and value is not lost by the second.

Skeptics decry volatility, but history favors the hoarders: from Rome’s aurei to FDR’s $35 fix. Today’s deficits (gold: 300-500t/year; silver: 200Moz+/year) and debasement (global debt: $300T) are the accelerants. Institutions like BlackRock are launching precious metal-backed ETFs; sovereigns like Hungary mandate 10% gold reserves. The tipping point? When corporates like Apple disclose vault audits.

Readers, this isn’t hype – it’s horizon. As the fiat facade frays, precious metals won’t just preserve – they’ll propel.

Hi,

Hi,