Precious Metals

1–30 of 253 products

1–30 of 253 products

Precious Metals

Gold

Gold has been the most popular precious metal in the world ever since its discovery. Throughout the years, gold has been used for countless purposes, such as jewellery, clothing, art, and much more. Although gold is remarkably popular for many different purposes, gold is also the most popular precious metal to invest in. Investors invest in physical gold through bullion coins and bars. Gold continues to fulfill investors’ wishes as a reliable and efficient asset.

Silver

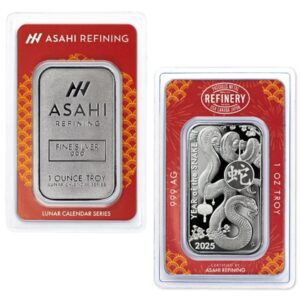

Silver has a long and rich history and has been one of the most popular precious metals for centuries. The precious metal was super popular and used for countless different purposes, especially in jewellery, artwork, and much more. Eventually, silver was used as currency which caused it to be popular across the world through trading. Today silver is one of the most popular precious metals to invest in, only second to gold. Investors can invest in silver through high-quality silver coins and bars.

Platinum

Just like the other precious metals, platinum has been incredibly popular ever since its discovery. Since ancient civilizations, platinum has been used for many purposes, especially in jewellery. As an investment, platinum holds additional value due to its rarity. Due to the fact that there is an incredibly small amount of platinum available to invest in, the precious metal holds additional value. Canada is among the top-five platinum-producing countries in the world.

Why you should Invest in Precious Metals

Precious metals such as gold, silver and platinum make incredible investments. Precious metals are unique investments and interact with trends in the market in a unique way. Precious metals possess preservation qualities which makes them such a reliable and safe asset. Essentially, investing in physical bullion allows investors to protect their wealth from market crashes and inflation. Throughout history, precious metals have performed remarkably throughout difficult times such as market crashes and inflation. Renowned mints, refineries, and bullion dealers all around the world provide investors with the highest quality of gold bullion products.

Want to buy Gold and Silver contact us now & grab your metal in easy steps.

Tags: Silver and Gold

Precious Metals

Gold

Gold has been the most popular precious metal in the world ever since its discovery. Throughout the years, gold has been used for countless purposes, such as jewellery, clothing, art, and much more. Although gold is remarkably popular for many different purposes, gold is also the most popular precious metal to invest in. Investors invest in physical gold through bullion coins and bars. Gold continues to fulfill investors’ wishes as a reliable and efficient asset.

Silver

Silver has a long and rich history and has been one of the most popular precious metals for centuries. The precious metal was super popular and used for countless different purposes, especially in jewellery, artwork, and much more. Eventually, silver was used as currency which caused it to be popular across the world through trading. Today silver is one of the most popular precious metals to invest in, only second to gold. Investors can invest in silver through high-quality silver coins and bars.

Platinum

Just like the other precious metals, platinum has been incredibly popular ever since its discovery. Since ancient civilizations, platinum has been used for many purposes, especially in jewellery. As an investment, platinum holds additional value due to its rarity. Due to the fact that there is an incredibly small amount of platinum available to invest in, the precious metal holds additional value. Canada is among the top-five platinum-producing countries in the world.

Why you should Invest in Precious Metals

Precious metals such as gold, silver and platinum make incredible investments. Precious metals are unique investments and interact with trends in the market in a unique way. Precious metals possess preservation qualities which makes them such a reliable and safe asset. Essentially, investing in physical bullion allows investors to protect their wealth from market crashes and inflation. Throughout history, precious metals have performed remarkably throughout difficult times such as market crashes and inflation. Renowned mints, refineries, and bullion dealers all around the world provide investors with the highest quality of gold bullion products.

Want to buy Gold and Silver contact us now & grab your metal in easy steps.

Tags: Silver and Gold

Hi,

Hi,