In a previous newsletter we covered the difference between a gold and/or silver backed currency that is redeemable in those metals and one that is non-redeemable. We clearly highlighted the dangers of backing a paper or digital currency with precious metals or a variety of commodities and then subsequently NOT allowing the paper/digital currency to be turned in for the gold and/or silver backing it. The main danger being that if citizens or countries as a whole are not allowed to turn in paper currency for gold and/or silver the government or issuing central bank remains unchecked as they can continuously print more paper currency into circulation without first adding to their gold/silver reserves; similar to what happened prior to Richard Nixon “suspending” the convertibility window of the U.S. Dollar into gold on August 15th, 1971. Suspending being in quotations as when it was spoken, Richard Nixon phrased this as being a temporary policy, however, approaching 52 years later to the day – the convertibility window remains closed.

Coming back to present day – three congressmen led by Representative Alex Mooney of West Virginia introduced Bill H.R. 2435 the “Gold Standard Restoration Act” on March 30th, 2023, that calls for the pegging of the volatile Federal Reserve Note (what is known more commonly as the U.S. Dollar) to a fixed weight of gold bullion. The reason the term Federal Reserve Note is used, is that is actually what is in circulation as the world reserve currency today. Based on the Constitution of the United States – a United States Dollar MUST be backed and convertible into a fixed weight of gold and/or silver OR at the very least have those metals circulating as money themselves. The currency used today is in direct violation of the Constitution and the introduced bill intends to put the United States monetary system back in line with the Constitution’s definition of money.

What is interesting about the proposed bill, is it is not meant to cover up the past atrocities caused by the devaluation of money, but rather expose them to the public to ensure this same scheme pulled with fiat currencies today cannot happen again in the near future. Bill H.R. 2435 explicitly states:

The Federal Reserve Note has lost more than 40% of its purchasing power since 2000, and 97% since the passage of the Federal Reserve Act in 1913… At times, including 2021 and 2022, Federal Reserve actions helped create inflation rates of 8% or higher, increasing the cost of living for many Americans to untenable levels… enriching the owners of financial assets while endangering the jobs, wages, and savings of blue-collar workers.

And while the above is true and successfully highlights the issue with rapid and reckless currency creation, a large supporter of the Gold Standard Restoration Act, Lawrence W. Reed, president of the Foundation for Economic Education took it a step further stating, “Governments cannot continue to spend and print on a massive scale without producing existential threats to the currency and our economy… The gold standard never failed America… If we do nothing, disaster awaits us just as it drowned earlier civilizations that spend and inflated their way to ruin.” Taking a quick look back at civilizations that held control over the world, Rome being a glaring example, you would see Lawrence Reed is correct. Under sound and stable money these empires flourished, as soon as they began to debase their currency with base metals of lesser value to pay for war, public works, social programs, and more – their empire slowly at first, then very quickly collapsed into rubble. Below highlights the dramatic drop off in silver within each Roman Denarius, once it got near zero, Rome fell soon after:

Bringing us back to the Gold Standard Restoration Act, a very important question that gets asked of people proposing a return to sound money, is due to the immense volume of dollars printed and no audit being done of the gold held in Fort Knox since the 1950s, how many dollars would be tied to what amount of gold? If we do not get the number right, the problem of unstable currency would not be solved. If you peg too much gold to each dollar, you will see heavy deflation, if you do not peg enough gold to each dollar, inflation will run out of control – if we get that number right, stability will be found.

To ensure this bill creates the stability it was meant to, Representative Alex Mooney included a couple important measures within…

First, the bill will force the disclosure of all central bank and U.S. government gold holdings, and any gold-related financial transactions over the last 6 decades. More specifically the bill states, “to enable the market and market participants to arrive at the fixed Federal Reserve note dollar-gold parity in an orderly fashion… the Secretary of the Treasury and Federal Reserve shall each make publically available all holdings of gold, with a report of any purchase, sales, swaps, leases, and any other financial transaction involving gold since the temporary suspension in August 15th, 1971, of gold redeemability obligations under the Bretton Woods Agreement of 1944.”

Second, Bill H.R. 2435 also requires the Federal Reserve and the U.S. Treasury to disclose “all records pertaining to the redemptions and transfers of United States gold in the 10 years preceding the temporary suspension in August 15th, 1971, of gold obligations.”

So, not only will the American people and the world finally find out just how much gold the United States actually holds today, they will find out just how much gold was lost to other countries in the past – likely highlighting that the United States holds far less gold than we are told, while other countries hold far more. Due to having so much paper fiat currency circulating around the economy and what is likely far less gold than we are told, the price per ounce of gold would need to move astronomically higher to successfully back all U.S. Dollars in circulation.

While nothing has been made official up until now, Bill H.R. 2435 the “Gold Standard Restoration Act” has at this point, successfully thrust sound money back into the consciousness of the public, and as financial chaos continues across the world – more and more people will begin pushing for the passing of this bill. As currently stands, there are 12 states in the USA that recognize silver and gold as legal tender and at this pace, it is not a matter of ‘if’, but rather ‘when’ the other states will get on board.

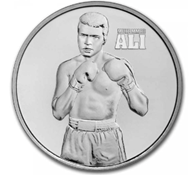

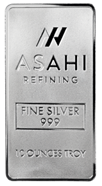

If you understand the principles of sound money, and wish to continue to build your wealth ahead of any major global financial transition – look toward a few great options we have available in-store or online today. If interested in gold, check out our 1oz Gold Bars coming out of BMO, or if silver is what you desire, check out our 1oz Silver Mohammad Ali Coins out of Niue, or a stacker favourite, our 10oz Silver Bars coming from Asahi.

Hi,

Hi,