As we navigate through 2025, the global economic landscape is undergoing seismic shifts, underscored by warnings from financial giants and unprecedented movements in commodity markets. Moody’s, one of the world’s leading ratings agencies, has sounded the alarm on the United States’ fiscal health, while copper, gold, and silver prices surge in price, with both gold and now copper setting record highs, signaling deeper economic undercurrents. Meanwhile, China’s strategic stockpiling of industrial metals adds another layer of complexity to this evolving narrative making it far more difficult for the average citizen to navigate. With this newsletter, we hope to shine further light into the murky swamp that is our collective financial system.

Moody’s latest report paints a grim picture of the United States’ fiscal future. Despite retaining its coveted triple-A rating—the last of the major agencies to do so after Fitch’s downgrade to AA+ in 2023 and S&P’s similar move in 2011 after the Great Financial Crisis of 2008, a time we still haven’t fully recovered from—Moody’s warns of a “continued multi-year decline” in fiscal strength. The agency, which lowered its outlook on the U.S. in November 2023, projects that the debt-to-GDP ratio will climb from nearly 100% in 2025 to a staggering 130% by 2035, which we believe is being kind in their projections. If current financial cracks turn to craters, the debt-to-GDP ratio will skyrocket past 130% in the United States before we see 2030. Even more concerning, interest payments are expected to balloon, consuming 30% of federal revenue by 2035, up from just 9% in 2021. Again, a predication we believe is being far too lenient.

Nonetheless, this trajectory highlights a stark reality: the U.S. is losing ground faster than other top-rated sovereigns. The dollar’s central role in global finance and the dominance of the Treasury market have long been pillars supporting its rating, but Moody’s cautions that these strengths may no longer be enough to counterbalance widening deficits and declining debt affordability. For investors, this is a critical signal. Credit ratings influence borrowing costs—lower ratings mean higher interest rates, which could ripple through markets, increasing the cost of everything from food to mortgages to corporate bonds.

The backdrop to this fiscal erosion includes political gridlock and policy uncertainty. With Fitch and S&P already downgrading the U.S. due to repeated debt ceiling standoffs and fiscal deterioration, Moody’s warning underscores a broader trend of diminishing confidence in America’s economic stewardship. As President Trump’s tariffs disrupt global trade and unfunded tax cuts loom, the path to fiscal stability looks increasingly narrow.

Copper’s Record Run: A Recessionary Red Flag?

While fiscal concerns mount, the commodities market is sending its own set of signals. Copper, often dubbed “Dr. Copper” for its ability to diagnose economic health, has soared to an all-time high of $5.27 USD per pound ($11,618.36 USD per ton on the London Metal Exchange), marking a 30% increase in 2025 alone. This unprecedented surge, while impressive and bullish for precious metals investors given copper is often an early signal that metals such as silver and gold are about run higher, it is also a double-edged sword. Copper’s critical role in industries like construction, electronics, and renewable energy makes it a bellwether for global demand. Historically, sharp spikes in copper prices have preceded severe economic downturns, as they often reflect supply constraints or speculative fervor as investors and countries alike dash to own real things rather than signalling toward robust overall growth.

The current rally is fueled in part by supply disruptions and heightened demand from the energy transition. However, it also coincides with deteriorating economic conditions, including fears of a U.S. recession exacerbated by trade tensions. If copper’s climb is a harbinger of trouble, it could foreshadow tighter monetary conditions and reduced industrial activity ahead. Reminder, silver is also one of the most coveted industrial metals in the world – if a supply disruption occurs given the world is already facing an over 200-million-ounce deficit in the shiny white metal per year, silver will see a squeeze in price greater than what has happened in copper to start 2025.

Precious Metals Surge: Gold and Silver Take Flight

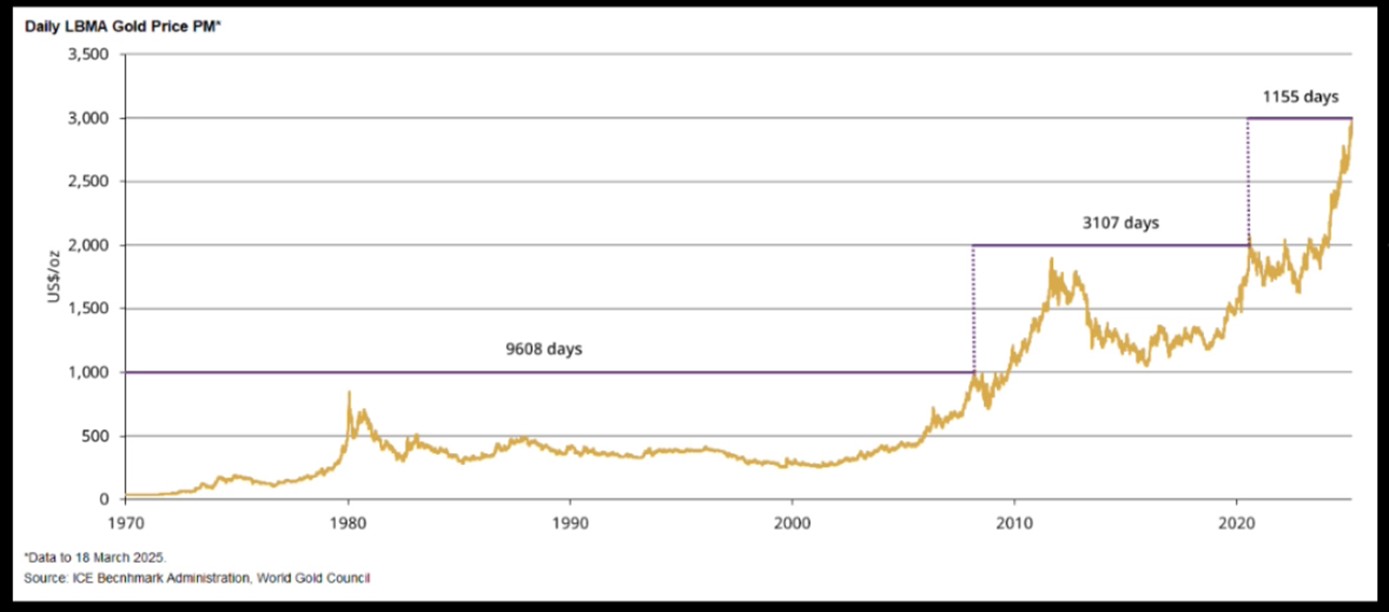

Copper’s rise isn’t happening in isolation. Precious metals are also hitting milestones, with gold crossing $3,000 USD/oz on the LBMA for the first time in history and silver climbing above $35 USD/oz on the Shanghai Gold Exchange, crossing the $33 USD/oz mark in the United States. Gold’s ascent is particularly striking: starting in 1970, it took 9,608 trading days to reach $1,000 USD/oz, 3,107 days from then to hit $2,000 USD/oz, and just 1,155 days from then to break $3,000 USD/oz—a 60+% faster pace per milestone. This acceleration reflects rampant inflation, geopolitical uncertainty, and a flight to safe-haven assets amid fiscal woes, while also suggesting $4000 USD/oz by summer of 2026, if not sooner, is achievable. Think about this, the current pace of gold appreciation would continue continue if nothing were to change in the world financially and it is clear our current financial situation is deteriorating quicker than it is being repaired. This could only lead one to believe unimaginable gold, and subsequently silver prices are on the near horizon.

Silver, too, is riding this wave, bolstered by industrial demand (notably in solar energy) and investment flows, up 16.55% in 2025 already. The arbitrage between Western and Eastern markets—once as high as 12% in 2024—has narrowed to 5.81%, mirroring gold’s trend where Eastern buying (especially from China and India) appears to be driving global prices higher. As evidence, gold also carried an arbitrage moving West to East of nearly 6% in 2024, gold prices are now higher in China than they are in the United States as China pulled Western prices above $3000 USD/oz and beyond.

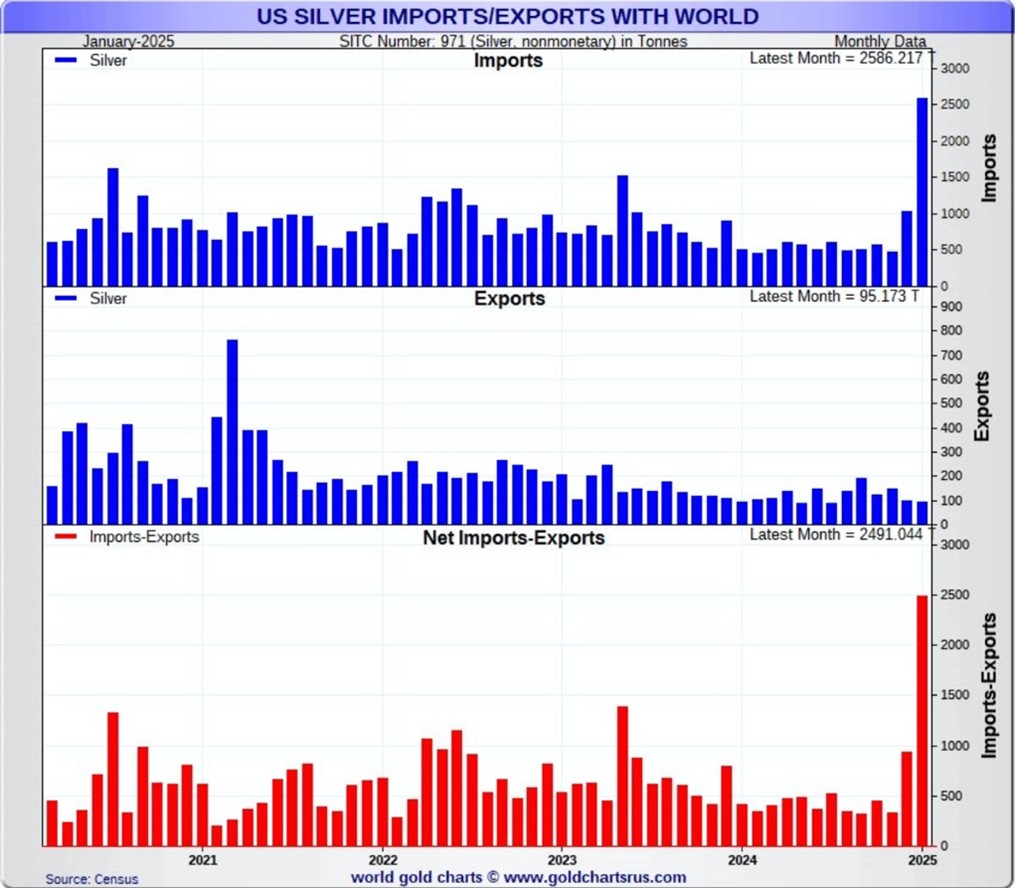

U.S. silver imports underscore this frenzy. In January 2025 alone, the U.S. imported 2,586 tonnes of silver—dwarfing every monthly total over the past five years. Kazakhstan led with 482 tonnes exported to the United States, followed by Canada (461 tonnes), then by Mexico (421 tonnes), finally Germany (350 tonnes) and other smaller exports. This unprecedented influx hints at stockpiling or speculative buying, potentially tied to inflation fears, industrial needs, or both.

China’s Strategic Play: Stockpiling for Stability

Amid these market gyrations, China is making calculated moves. The National Development & Reform Commission (NDRC) has signaled plans to bolster strategic reserves of cobalt, copper, nickel, and lithium in 2025.

Though, China’s stockpiling isn’t new; it has been increasing metal reserves and rotating inventories for years almost in anticipation for this very moment, which, wouldn’t be surprising as we have long covered that economic transitions take place in cycles and this financial system overhaul is long overdue… China certainly knows this. To that, the scale of this push, alongside plans to expand storage for grain, oil, and other essentials, reflects a broader strategy to shield against volatility, diversify supply chains, or even an impending crisis brought on by financial collapse or war. As the world’s largest consumer of copper (over 50% of global supply), China’s actions could stabilize prices—or, conversely, tighten supply further, pushing costs for everyone higher.

What It All Means

The convergence of these trends—U.S. fiscal decline, copper’s recessionary signal, precious metals’ surge, and China’s stockpiling—paints a picture of a world in transition. For the U.S., mounting debt and political paralysis threaten its economic dominance, potentially raising borrowing costs and weakening the dollar’s allure. Copper’s rally, while a boon for miners, may herald tougher times ahead, while gold and silver’s ascent reflect a flight to safety amid uncertainty.

China’s proactive stance, meanwhile, positions it as a counterweight, leveraging its industrial might to secure resources and influence markets. Investors should take note: diversification into hard assets like gold and silver certainly offer a hedge, while copper’s trajectory warrants close monitoring. The interplay of fiscal policy, trade dynamics, and commodity prices in 2025 will shape the global economy for years to come. The more evidence that is compiled would lead most to agree the music isn’t just slowing, it has already stopped, and behind the scenes those that hear clearly are rushing for their chairs.

Hi,

Hi,