Imagine the ground beneath the global economy splintering like ice on a frozen lake. Cracks spiderweb out from central banks’ endless money printing, fiat currencies teeter on the brink, and the one asset class that’s anchored humanity for millennia – precious metals – erupts in chaos. We’re not talking mild tremors; we’re witnessing seismic shifts. Silver’s wild ride through early 2026 isn’t volatility – it is a siren blaring that the monetary system’s foundation is fracturing. Smart money hears it. Weak hands panic. You? This is your moment before the crossroads.

Precious Metals Volatility: The Warning

When one of the world’s most reliable safe haven swings 10% or more day after day, ignore it at your peril. Through the first 38 days of 2026, silver has been a battlefield: surging from just above $70 USD/oz to a peak of $121.64 USD/oz in late January, only to crater back to around $75 USD/oz as of this writing. That’s a staggering 60% round-trip swing – unprecedented for an asset long viewed as stable.

Gold, the steadier sibling, surged over 25% in January, climbing just shy of $5,600 USD/oz amid geopolitical tensions and dollar weakness. Yet the first week of February delivered a sharp 20% pullback, dropping it to roughly $4,890 USD/oz today. Gold’s relative resilience – still up significantly year-to-date – underpins the sector’s overall strength. These aren’t random fluctuations; they’re clear signals of systemic stress. Central banks continue hoarding gold at record levels, industrial demand for silver explodes in solar, EVs, and AI, while fiat inflation rages unchecked. The message is unmistakable: the old monetary order is cracking and the dawn of a new financial era lurks on the horizon.

Silver Draining RAPIDLY: The Physical Squeeze Intensifies

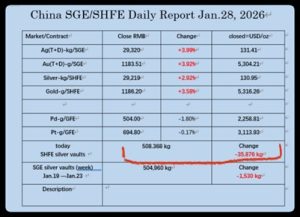

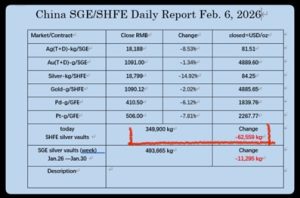

The frenzy is most visible in China – silver got as high as $140 USD/oz on the Shanghai Gold Exchange only to crater down to $84 USD/oz – still nearly $10 higher than western prices. The catch: physical silver has been withdrawn from the Shanghai Gold Exchange at a RAPID pace as prices drop.

On January 28th, the SGE held 508,368 kg of silver. By February 6th, that figure stands at 349,900 kg – a drain of over 30% in a single trading week. At that pace, the vaults could be emptied in a little over 3 weeks.

And as paper prices are pushed lower and weak hands price-watching sell their physical positions, the physical metal is being concentrated into smaller and smaller hands — factories, institutions, and determined long-term holders securing real supply amid relentless industrial demand and persistent global deficits. This isn’t a minor pullback; it’s a clear signal of tightening physical availability and accelerating concentration of the metal where it counts most.

With annual supply shortfalls persisting and demand unrelenting, this isn’t a temporary dip; it’s a fire sale on the world’s most critical undervalued asset.

David Bateman: The Tech Billionaire Whale Doubling Down

Leading the silver charge is David Bateman, founder of tech unicorn Entrata. Starting in October 2024, he amassed over $1 billion in precious metals, including 12.69 million ounces of physical silver – roughly 1.5% of global annual mine supply. But he didn’t flinch during the chaos. As prices plunged in early February 2026, Bateman doubled down aggressively: he rolled proceeds from partial miner sales into more silver, adding another 1.93 million ounces via 1,000-oz bars. That pushes his total stack to nearly 14.8 million ounces to-date.

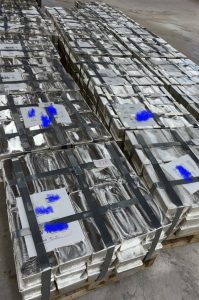

Bateman isn’t chasing hype; he’s a vocal fiat currency critic who demands physical delivery and has shared images of his discreet, vaulted silver hoard on X. He warns of monetary collapse, rejects paper proxies like ETFs, and sees silver as the ultimate hedge against a crumbling system. His actions mirror history’s great accumulators – quietly building while others panic. In an era of digital illusions, Bateman bets on hard assets. Follow the smart money: this engineered crash is designed to shake out the timid, handing whales, and prepared investors the opportunity of a lifetime.

(Actual Photo Posted by David Bateman)

The verdict is clear: this precious metals meltdown isn’t the end – it is one of the most compelling setups in generations. Prices are being driven lower while physical supply vanishes into stronger hands. Silver’s chronic deficit, dirven by explosive industrial demand and persistent mining shortfalls, sets the stage for powerful rebounds. Gold’s safe-haven status will only strengthen as global debt surges past $300 trillion. The foundation is shifting beneath us all. The weak sell in fear; the wise recognize opportunity when it appears.

What will you do at the crossroads?

Hi,

Hi,