The alarms are going off, and this time they’re not subtle. Two events in the past two weeks reveal the same truth: the global financial system is running on fumes and is buckling under the weight of silver and gold’s strength leaving precious metals as one of the only escape hatches available on the market today.

Let’s walk through what’s happening – clearly, without the jargon – and then we will connect the dots to the larger shift already long underway.

The Silver Squeeze: London’s Running Out of Metal

The London Bullion Market Association (LBMA) is the world’s largest silver warehouse. It’s where banks, refiners, and traders go to borrow, lend, or deliver physical silver. For decades, it’s operated on a simple promise: We’ve got the metal.

But right now? That promise is cracking under silver bullion’s weight.

India – the world’s hungriest silver buyer – has been walking in and saying, “I want all the silver. NOW.” In September alone, India imported 821 tonnes of silver (nearly 40% of global mining output for a single month), over double August’s imports of 410.8 tonnes of silver, despite near record-high prices. That’s driven by weddings, festivals, solar panel demand, and a growing middle class that trusts metal as money over paper fiat currencies.

The LBMA doesn’t have enough on hand. So, what did they do?

They borrowed 150 tonnes of silver bullion from Chinese banks at sky-high interest rates – some as high as 35% per year, when 1-3% is considered normal. That’s not a loan. That’s a desperation move for physical silver.

Here’s the problem:

They either pay crushing interest to carry and hold the borrowed physical silver…

Or they pay it back later – when prices are even higher. Either way, the math only works if silver keeps rising. If they try to suppress the price? India keeps buying hand over fist in an attempt to corner the silver market in its entirety. If the vaults empty, the system breaks. This isn’t speculation. This is physical reality.

The Bank Bailout: Pawning the Wedding Ring

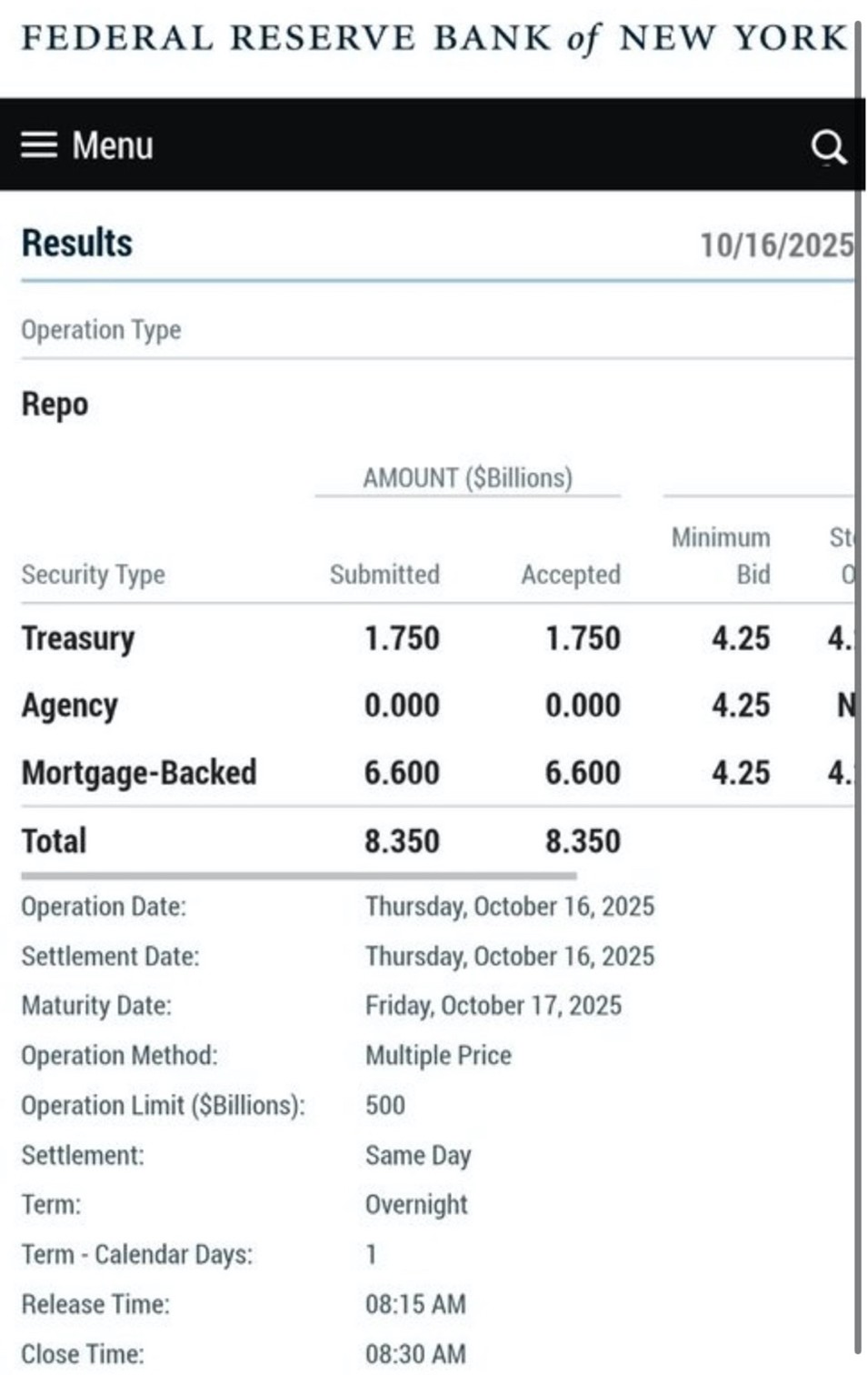

Now shift to the U.S. On October 16th, 2025, the Federal Reserve quietly injected $8.35 billion USD into the banking system through its overnight repo window. That might sound routine — but look closer.

Nearly 80% of the collateral wasn’t U.S. Treasuries the safest asset to use in an overnight repo agreement. This being when banks provide assets to the Federal Reserve in exchange for cash for operations and agree to buyback the assets the next day. Instead, they used mortgage-backed securities – bundles of home and commercial loans; the very same asset that caused the Great Financial Crisis in 2008.

Think of it like this: When banks are healthy, they borrow against gold watches (Treasuries). When they’re desperate, they bring in old TVs and broken stereos (risky mortgage paper).

This wasn’t a one-off. The same day, the Fed opened a $491 billion USD emergency liquidity line – nearly half a trillion dollars on standby just in case banks need it. Why? Because regional banks are drowning in bad loans. Office buildings sit half-empty. Malls are ghost towns. Car loans are defaulting. These banks lent trillions of USD into commercial real estate (CRE) – and now the bills are coming due. When borrowers stop paying, banks run out of cash. They rush to the Fed. The Fed prints more currency. And the cycle repeats. But each rescue further weakens the United States Dollar. Each silent bailout pushes capital into real assets and builds the strength of precious metals. The scary part, this is happening in every major economy across the world which is why a new system is being ushered in via gold and silver foundations because the evidence is there for all to see:

You cannot continuously print your way out of a debt-based system, it inevitably collapses, and in its place, trust is restored with real tangible assets.

The Bigger Picture: A Global Transition in Motion

These aren’t isolated events. They’re symptoms of the same disease: loss of faith in paper money. For 50 years, the world ran on U.S. dollar dominance. Central banks held U.S. Treasuries. Trade was priced in USD. Trust was infinite.

That era is ending.

- India and China are hoarding physical metal, not paper promises.

- Central banks bought over 1,000 tons of gold in 2023 and 2024 – and they’re on pace to do it again in 2025.

- Russia, Brazil, and the BRICS are building gold-backed trade systems.

- De-dollarization isn’t a theory. It’s happening in real time in countries across the world.

Meanwhile, in the West:

- The Fed’s balance sheet sits at $6.5 trillion – and will be forced to grow.

- $1.5 trillion in Commercial Real Estate loans come due by 2027.

- Repo fires keep flaring because of bad debt coming due.

The system can’t print its way out forever. Eventually, trust collapses. And when it does, gold and silver – the only true money with no counterparty risk – become the ultimate safe havens.

What This Means for You

This isn’t about fear. It’s about clarity. The LBMA’s silver scramble and the Fed’s quiet bailouts are early warning sirens. They tell us the old system is fragile, over-leveraged, and running out of tricks. But they also tell us something powerful: The transition has begun. And those who own real money – gold and silver in hand – will come out on the other side stronger.

The system isn’t “broken”. It has worked as anticipated for over 50 years only now it is held together by hope, duct tape, and overnight loans. Silver is the canary.

The banks are the coal mine. When one bank collapses, the others follow. And when they do? Gold and silver won’t just rise. They’ll redefine wealth.

Hi,

Hi,