In the ever-shifting landscape of global finance, where digital assets flicker and fade, one timeless commodity is commanding unprecedented attention: silver. As we step into 2026, the precious metals market is not just buzzing — it’s roaring. Record-breaking demand is straining supplies at the world’s top mints, while savvy nations and investors scoop up physical bars and coins during every dip. This isn’t just market noise; it’s a seismic shift that’s reshaping portfolios and redefining value in an uncertain world. Let’s dive into the developments that are turning heads and sparking urgency among those in the know.

Mints Under Pressure: Sold Out and Scaling Back

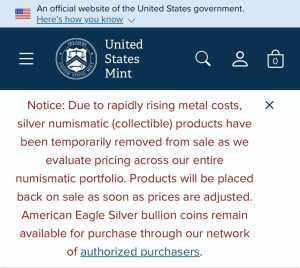

Imagine logging onto the United States Mint’s website, eager to secure a piece of investment-grade silver, only to find sales halted. That’s the reality hitting investors right now. The US Mint, one of the globe’s premier producers of bullion, has suspended online sales of silver products, citing an overwhelming surge in demand that’s outpacing their ability to keep up with rapidly rising prices. This isn’t a minor hiccup p— it’s a full-stop on operations that signals something profound in the market.

North of the border, the Royal Canadian Mint is facing a similar crunch. Their flagship 1 oz Silver Canadian Maple Leaf coin, a staple for collectors and investors alike, is completely sold out on their website. Officials point to “increased demand” as the culprit, with production lines struggling to meet the influx of orders. When two of the world’s largest mints — responsible for minting millions of ounces in precious metals annually — start running dry on investment-grade silver, it’s a wake-up call. These institutions aren’t just suppliers; they’re barometers of global appetite. The public, from seasoned traders to everyday savers, should sit up and take notice. This scarcity isn’t temporary — it’s a harbinger of tighter supplies ahead, as industrial needs for silver in solar panels, electronics, and EVs continue to escalate.

Dips Turn to Goldmines: India’s Massive Silver Hauls

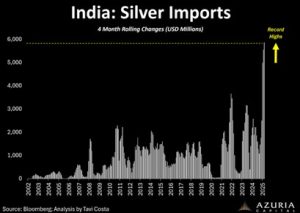

Silver’s price chart tells a story of resilience and opportunity that’s impossible to ignore. Every time the “paper” price—the futures market value—takes a dip, major players don’t hesitate; they pounce. Take India, the world’s largest silver importer, as a prime example. Recent data shows a staggering spike in imports, with the country’s 4-month rolling changes hitting record highs nearing $6 billion USD in value. As illustrated in the accompanying chart from Bloomberg, analyzed by Tavi Costa of Azuria Capital, India’s silver inflows have surged dramatically over the past two decades, with the latest peaks dwarfing historical norms.

Correlate this with silver’s price action, as seen in the 4-hour CFD chart from TradingView. Just days ago, on January 15, 2026, silver experienced sharp pullbacks — drops of -15.95%, -10.94%, and -7.78% in quick succession — yet it’s rebounding with vigor, trading around $88 USD per ounce. These dips aren’t weaknesses; they’re launchpads. India, sensing the value, floods the physical market, buying up tons of the metal. This pattern repeats: a price surge, a brief retreat, and then new floors are established, providing foundational strength for the next upward leg.

What does this mean? While paper prices fluctuate on speculation, physical demand from nations like India — driven by jewellery, industrial use, and investment — creates a safety net. Silver isn’t just recovering; it’s building momentum, turning temporary setbacks into strategic entry points for those attuned to the market’s rhythm.

Silver’s Meteoric Rise: From Third Place to Trillion-Dollar Dominance

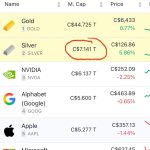

Rewind just a week, and the asset rankings painted a different picture. In our previous newsletter, silver had slipped to the third spot among top assets by market cap, trailing behind tech giant NVIDIA. Fast forward to today, and silver has vaulted ahead with authority, boasting a commanding C$7.141 trillion market cap in Canadian dollars. As captured in the latest snapshot from asset trackers, silver now sits proudly at number two, well behind gold’s C$44.725 trillion but also leagues ahead of NVIDIA’s C$6.137 trillion.

This isn’t a fluke — it’s the result of silver’s explosive performance, up over 25% year-to-date. The shift underscores a broader trend: investors are pivoting from volatile stocks to tangible assets that hold intrinsic value. Silver’s market cap surge reflects not only price appreciation but also its growing role in green technologies and as a hedge against inflation. In a world where tech valuations can evaporate overnight, silver’s steady climb offers a compelling narrative of stability and growth.

Historic Milestones: Gold and Silver Shatter Records

January 14, 2026, will go down in history as a banner day for precious metals. Gold smashed through its all-time high, closing at C$6442.69 per ounce — a robust 8% gain year-to-date. But silver stole the spotlight, soaring to its own record of C$129.82 per ounce, marking an astonishing 25% rise since the start of the year.

These peaks aren’t isolated events; they’re the culmination of geopolitical tensions, supply chain disruptions, and a flight to safety amid economic headwinds. Gold’s steady ascent reaffirms its status as the ultimate store of value, while silver’s outsized gains highlight its dual appeal as both an industrial powerhouse and an investment darling. Together, they signal a market that’s not just heating up — they signal a market on fire.

Painting a Picture

As we wrap up this edition, the threads weave a clear tapestry: from mint shortages and national buying sprees to record highs and market cap dominance, silver is emerging as a force that’s impossible to overlook. In an era of uncertainty, where fiat currencies waver and digital dreams falter, the allure of physical assets shines brighter than ever. Whether you’re watching from the sidelines or already in the game, these developments invite reflection on where true value lies. Stay tuned — the precious metals story is just beginning to unfold.

Hi,

Hi,