Overview of Zimbabwe’s Financial Crisis

Southern Africa’s landlocked nation of Zimbabwe is a sovereign state. Harare is the nation’s capital and largest metropolis. a nation with about 16 million inhabitants. Due to a confluence of causes including hyperinflation, currency devaluation, political unrest, and economic mismanagement, Zimbabwe has endured a severe financial crisis for many years. From 2003 until April 2009, when the government halted its currency, hyperinflation was a major issue. By the end of 2015, Zimbabwe declared ambitions to adopt the US dollar entirely. The US dollar, South African rand, and euro were all used concurrently under the multi-currency system that the government approved.

Need for a New Digital Currency

Zimbabwe has been looking at the prospect of introducing a new digital currency to supplement its current monetary system to solve difficulties with a lack of readily available hard currency, limited access to foreign currencies, and expensive transaction fees. By facilitating faster access to financial services and lowering transaction costs, a digital currency could aid in boosting financial inclusion. Additionally, it might provide a more reliable currency choice, allowing for more safe and open transactions.

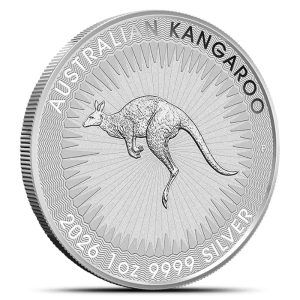

According to governors, the Reserve Bank of Zimbabwe needs $100 million in gold to launch its digital currency that is backed by gold. According to a state-owned Zimbabwean newspaper, Zimbabwe’s central bank would issue “digital gold tokens” to lower the demand for foreign cash. Additionally, the central bank will increase the output of its own gold coins.

The idea of a digital currency backed by gold was approved by the monetary policy committee last month. In order to serve as a store of value and support the local currency, Zimbabwe started issuing gold coins in June of last year.

Hi,

Hi,