In current economic conditions where everything is uncertain, one thing that is constantly making it to the headlines is Global Debt. Governments, businesses, and consumers have been borrowing to their record thresholds, causing overall global debt to surpass over $300 trillion according to a latest report by the Institute of International Finance. Moreover, this ever-increasing mountain of debt is causing more than just headline anxiety for experts–it’s sending investors back to one of history’s most respected havens of value–Gold.

The Debt Spiral and Currency Weakness

When countries have a higher rate of debt compared to economic growth, governments will often have no option but to print more cash or maintain low interest rates in order to service this debt.

Weakening fiat currencies means that investors will eventually start looking for alternative currencies that preserve value, and gold is at the top of the list. Unlike paper currency, gold is not printed or devalued by a central bank. This is a currency that has actually been around as a protection against inflation for hundreds of years.

Gold as a Hedge Against Fiscal Uncertainty

A high-debt situation is often fraught with political and economic challenges. This is because countries have three dilemmas to choose between when faced with a high-debt situation. These include increasing taxes, reducing expenditure, or printing their currencies. Each of these is likely to act as a trigger in terms of market uncertainty. This is where a gold investment is seen as a haven.

Investors, ranging from individual investors to central banks, have been answering this call. Central banks have been net buyers of gold in recent years and have increased their holdings as a prudent measure against the threats of high debts and exchange rate fluctuations.

Global Trends in Hard Asset Investments

With countries such as the US, China, Japan, and a large part of Europe all laden with enormous debts, investors around the world are diversifying their investment portfolios by investing in hard assets such as gold and silver. Hard assets represent a real tangible form of security that cannot be wiped out by an economic policy or a digital figure entered in a balance statement.

In fact, retail investors in Canada and the USA have become increasingly interested in buying physical bullion in order to safeguard their wealth from economic imbalances and public debts that continue to escalate.

Why Now May Be a Good Time to Consider Gold

In a world where everything points to increasing debt, one thing is clear—the viability of fiat currencies is becoming less predictable in the long term. On the opposite side of this equation is gold, an element that has been a steady hand and a valuable asset down through the ages.

If you are looking to build your resilient finances, owning physical gold is one of the best decisions you will ever make.

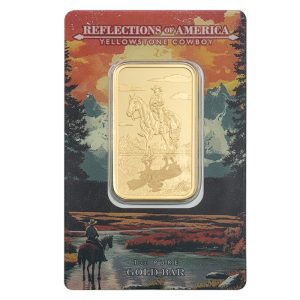

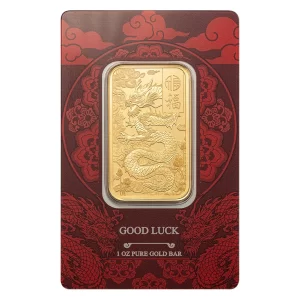

Invest in Gold with AU Bullion

AU Bullion is proud to offer a large selection of gold coins and bars produced by respected mints around the world, such as the Royal Canadian Mint, Perth Mint, and Asahi Refining. Whether it’s your first purchase or an investment of experience, AU Bullion provides you with attractive investment terms, convenient delivery, and unbeatable service in Canada and the US. Browse our entire collection online or visit us in our Vancouver or Brampton stores to begin building your gold investment portfolio today!

Hi,

Hi,