Gold and Silver Bullion has historically proven to be a stable asset that hedges your money against inflation. It is quite easy to buy and even easier to sell. Although Gold and Silver Bullion is volatile in the short term, it has always maintained its value through the long term. In fact, it has appreciated in value over decades.

Investors may buy Gold and Silver Bullion because it helps beat inflation on their emergency funds which may not always happen in bank or liquid funds.

What is inflation?

Inflation is when fiat currencies lose value. Fiat currencies are currencies issued by governments like CAD and USD that are not backed by commodities such as gold. Therefore their value is harder to maintain. In times of high inflation, when your fiat currencies lose value, Gold will remain relatively stable or will increase in value. In general economics, Inflation is the rise in the price level of any economy over a certain period of time.

A clear example of inflation can be seen when looking at the price of a cup of coffee. Back in 1970 a cup of coffee used to cost $0.25. However, now a cup of coffee will cost you around $1.60.

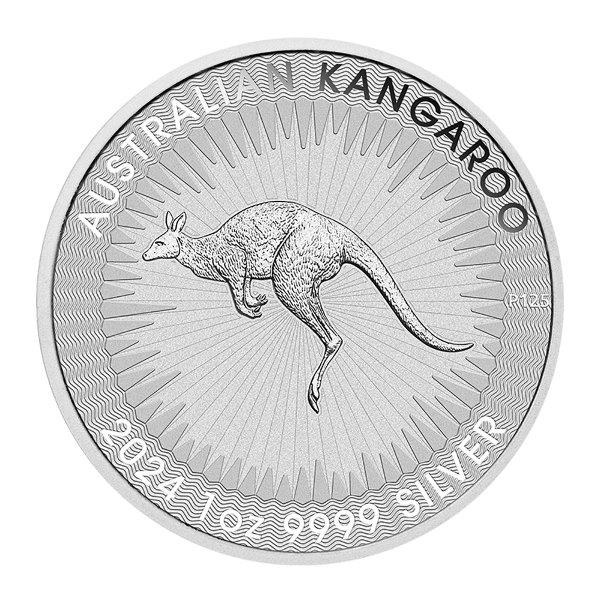

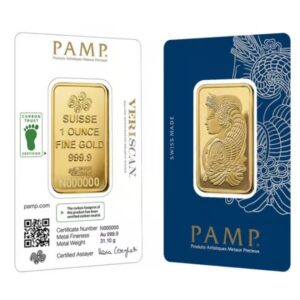

Gold prices go up when interest rates are down, which directly links to the overall strength in the economy. Hard assets such as Gold, Silver and land hold intrinsic value because of their limited supply. Gold and Silver is excavated from intense mine sites that take a lot of money to sustain. The difficulty of extracting Gold and Silver contributes to the hefty value the metals hold.

Gold and Silver are safe-haven metals that tend to appeal to economic weakness. It acts as a store of value, maintaining its purchasing power for thousands of years. If you have any inquiries about your next Gold and Silver investment, contact Au Bullion at +1-905-605-6757. We specialize in buying and selling Gold, Silver and platinum Bullion and strive to provide all our clients with the highest quality service and the lowest premiums.

Hi,

Hi,