The Great Wealth Shift Accelerates

The precious metals arena is exploding into chaos, and it’s handing savvy holders the keys to generational wealth. Imagine silver skyrocketing 60% in a month, only to get hammered 20% overnight, while gold demand shatters records and shadowy forces scramble for cheap metal. This isn’t just market noise; it’s the rumble of a massive wealth transfer from paper-pushers to physical stackers. Dive in as we unpack the volatility, the widening arbitrage goldmine, and why crypto giants are hoarding bullion like it’s the new Bitcoin.

Volatility Erupts: Silver’s Wild Ride and the East-West Divide

The precious metals market is a powder keg, and January just lit the fuse. Silver, our underdog hero, surged over 60% through the month, making history as it ripped through triple digits (USD) fueling dreams of a breakout. Then, whack! Overnight on January 30th, Western markets slammed silver below $100 USD/oz, cratering $20 in a flash (a brutal 17% drop). Gold wasn’t spared, plunging nearly 9%, while platinum took a 17% nosedive as well. Chaos? An understatement. Opportunity? Absolutely.

But here’s the plot twist: While the West wallows in sub-$100 illusions, China’s spot silver price, while it did dip Friday, holds firm above $125 USD/oz, a jaw-dropping 28% premium at time of writing. That’s not a glitch; it’s an arbitrage bonanza. At this spread, physical silver will rocket Eastward at warp speed, draining Western vaults faster than you can say “supply squeeze.”

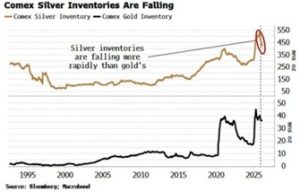

Exhibit A: COMEX silver inventories are plummeting, falling more rapidly than their gold supply in recent months. Look at the chart below – stockpiles have nosedived since 2020, accelerating into 2026, while gold, still falling, is holding a steadier outflow. This isn’t random; it’s a signal of real-world demand for physical silver outpacing manipulated paper prices that sell a single ounce hundreds of times over.

Adding intrigue, the London Metal Exchange (LME) announced a trading delay last night due to a “technical issue”, hours before the seismic drop in prices. Coincidence? In this high-stakes game, timing like that raises eyebrows. Are we witnessing desperate attempts to cap prices amid a buying frenzy? Time will give us the evidence we need.

Record Gold Demand Fuels the Fire

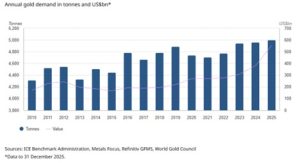

Zoom out, and the fundamentals scream “bullish” louder than ever. Total gold demand shattered records in 2025, surging past 5,000 tonnes for the first time in history. A staggering milestone driven by a relentless investment appetite for ETFs, bars, and coins alike from central banks, corporations, and retail buyers. The chart lays it bare: Demand lingered around 4,000-4,500 tonnes through the 2010s, then exploded higher, crossing the 5,000-tonne threshold posting an annual value of beyond $550 billion amid all-time high prices.

And here’s the kicker: This historic consumption frenzy unfolded while gold prices were already on a tear – up massively in 2025, and then roaring another 25% higher in January 2026 alone, marking one of the strongest monthly gains in over 40 years. We’re talking fresh all-time highs repeatedly, with the yellow metal climbing relentlessly before the latest dip.

Yet right on cue, aggressive price smashes hit the tape. This isn’t weakness, it is a gift. With demand hotter than ever and structural buyers (Eastern powerhouses, institutions, you name it) clearly carrying an insatiable appetite, these engineered pullbacks look like engineered opportunities: a fire sale engineered to let desperate accumulators load up on as much physical gold (and silver, platinum) as possible before the rocket fuel ignites again.

The slams feel timed to shake weak holders while the smart money scoops basement bargains. There is no other logical way to view the situation unfolding in precious metal markets. Record demand during record prices in 2025, yet, when prices drop erasing trillions USD in value, we are to conclude demand will simply cease to exist? It’s textbook accumulation ahead of the next leg up – shake the tree, harvest the fruit, then watch prices soar skyward. The wealth transfer accelerates from the fearful to the fearless.

Crypto Meets Gold: Tether’s Massive Hoard Signals the Future

Enter the digital twist. Tether, the behemoth behind USDT – the world’s largest stablecoin – now holds around 140 tonnes of gold, making it one of the largest known private holders outside governments and major ETFs. That’s a staggering $24 billion USD stash, built by snapping up 1-2 tonnes weekly. You may wonder, why is a crypto leader, peddling digital dollars, going all-in on ancient bullion?

Simple: Trust. In a world of fiat fragility, physical gold evokes unbreakable confidence. Tether appears to be backing some of its tokens with real metal, and with gold prices up 65% last year, their holdings have ballooned in value. Could they be piling in during these Western dips, while Eastern premiums hold strong? Why wouldn’t they? It’s as if they see the writing on the wall: digital assets need physical anchors to thrive.

This isn’t industry hype – it is convergence. Crypto innovators hoarding gold underscores the shift: precious metals aren’t relics; they’re the backbone of tomorrow’s wealth.

The storm in precious metals isn’t ending – it is intensifying. Volatility like this forges fortunes, transferring trillions from the oblivious to the prepared. Whether it’s silver’s arbitrage warp, gold’s demand explosion, or Tether’s golden pivot, the message is clear: hold physical, stay vigilant, and ride the wave. The East is winning; the West is waking up. Don’t get left without a train ticket – this is your cue to do your research, be smart and secure your slice of the transfer. The real bull run? It’s just beginning.

Hi,

Hi,