The Shanghai Silver Heist

Precious metals are in absolute breakout mode – and the story isn’t just rising prices; it’s a global power shift unfolding in real time. Silver, the volatile star of the show, is exploding higher in the East while the West scrambles to catch up. This isn’t normal market action – it is a historic arbitrage black hole that’s draining physical supply from the west and moving it east, tightening inventories, and setting the stage for explosive gains. Buckle up: the forces at play are rewriting the rules of the game.

Shanghai Silver’s Parabolic Surge: The Arbitrage Vacuum Sucking Ounces East

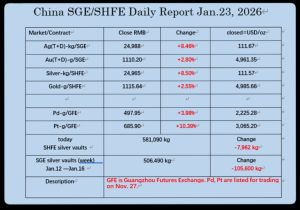

Today alone, silver spiked 8.5% in Shanghai benchmarks, hitting equivalents around $111.57 USD/oz (and a stunning $153.96 CAD/oz equivalent). That’s miles above Western spot prices, which are just shy of the historic $100 milestone at ~$99/oz. Flash back to January 12th’s 14.42% spike in Shanghai, combined with today’s move, and the East-West arbitrage has ballooned to around 12.70% (with premiums in physical trades often even wider).

China and India aren’t dipping toes – they are diving in headfirst, snapping up every available physical ounce. China’s export restrictions (tightened on January 1st) lock in supply for their solar, EV, and tech dominance, while Indian dealers pay massive premiums to secure silver bars. Traders are air-freighting metal to capture the arbitrage gap, but the flow is one-way: West to East. This relentless demand is squeezing global physical availability, forcing Western prices higher in a desperate bid to catch-up. Silver isn’t just rallying – it is becoming the decade’s most explosive play.

Goldman’s Baffling “Mistake” Warning

In the midst of this frenzy, Goldman Sachs floated a head-scratcher: investors rushing to gold as a safe haven are supposedly making a “big mistake.” Yet, almost in the same breath, major banks (including Goldman) keep hiking bullish forecasts – Goldman itself just bumped its end-2026 gold target to $5,400 USD/oz – and central banks remain aggressive net buyers at record levels.

The irony couldn’t be thicker. Why publicly downplay the gold rush when the facts scream otherwise? It feels like narrative steering: discourage retail crowds from piling in, preserve more supply for institutions, governments, and central banks to accumulate quietly at “better” levels. The public misses the rocket ride and future gains; the insiders lock in positions ahead of the squeeze. When words clash with actions – record buying, higher targets – trust the facts. Precious metals are tightening fast, and the smart money is already deep in the game.

Trump’s Greenland Gambit

Donald Trump’s aggressive push to acquire Greenland – framed around national security, rare-earth minerals (including silver), and Arctic control – has ignited global ripples. Protests erupt in Nuuk and Copenhagen, tariff threats fly, and uncertainty spikes over critical resources dominated by China.

Markets price in chaos immediately. This week: gold surged 6.5%, silver moved 9% higher, palladium climbed 10%, and platinum exploded 16% to fresh records. These aren’t random pops – they are classic safe-haven and supply-hedge reactions to escalating geopolitical risks. Trump’s Greenland play exposes Western vulnerabilities in strategic minerals, pushing investors toward timeless stores of value that no single power can fully control or seize. Precious metals.

The Big Picture: Positioning Before the Next Surge

Precious metals aren’t whispering warnings anymore – they are sounding the alarm. Silver’s East-West arbitrage is reshaping global supply dynamics in real-time, institutional forecasts point toward relentlessly higher prices, and fresh flashpoints like Greenland are pouring rocket fuel on the safe-haven hedge case. Physical reality is overtaking paper promises, and the momentum is accelerating.

The window isn’t going to stay open forever, always narrowing as ounces vanish eastward and chaos mounts. Those paying close attention are positioning now, before the next surge locks in even higher baseline prices. This is the macro shift that defines winning eras. Stay sharp – history is being made, and the smart move is becoming clear.

Hi,

Hi,