In our newsletter last week we highlighted the dramatic difference in financial direction put forth by Western/European nations, and those that currently (and also hope to be) part of the BRICS economic coalition. It is becoming far clearer that the Western and European nations are going to continue to focus on illusionary wealth, while BRICS nations begin focussing on real, tangible wealth, specifically gold and silver.

As a reminder, these are the countries currently bidding to join BRICS: Algeria, Argentina, Bahrain, Bangladesh, Indonesia, Iran, Egypt, Mexico, Nigeria, Pakistan, Sudan, Syria, Türkiye, the United Arab Emirates, Venezuela, and Zimbabwe. All of which are rich in tangible commodities that the world NEEDS to function – giving each of these countries something of real value to offer the collation as a new member of BRICS if accepted into the alliance.

Today, we focus our attention on one of the countries looking to join BRICS due to the recent financial announcements that have been made by their government, as well as why this country’s desire to join BRICS is so high: that country being Zimbabwe. Going back to August of 2022, Zimbabwe was getting crushed by inflation running at 285%, a number that has only become worse in large part due to economic sanctions placed on Zimbabwe by the United States. At the time (Aug ’22), the Zimbabwe government announced the release of 1oz gold coins that were available to purchase by the public giving them a means of wealth security/storage due to their local currency devaluing so rapidly. The issue with this announcement was the fact that citizens of Zimbabwe had become so impoverished that 1oz gold coins were far too expensive to purchase for the average citizen. This highlighted why silver is gaining such popularity due to fiat currencies losing mass value across the world. Due to silver sitting below its 1980 price high, this means it is still affordable for the general public, while also providing the same protection of wealth as gold.

The main reason for Zimbabwe wanting to join BRICS as mentioned before, is due to economic sanctions that have been placed on them by the United States. These sanctions have caused Zimbabwe as a country to lose over $42 billion USD in revenue over the past two decades leading to increased poverty across the country. It should be noted, that similarly to other current and hopeful BRICS nations – Zimbabwe is rich in natural resources, with their largest yearly export being gold itself. Exporting gold at a rate more than double the next highest export of nickel, and 4x more than the next of raw tobacco. This alone shows that Zimbabwe is in a position to flourish if they were not under the financial authority of the United States due to the USD holding world reserve status.

However, the Zimbabwe government would not stop at 1 oz gold coins for public purchase, just this past week, Zimbabwe took another shot at pushing their citizens toward prosperity announcing a digital currency backed by gold that will be available for purchase at a fractional level, meaning citizens can store $1 at a time in gold if that is all they have, rather than needing to wait until they can secure a full ounce. While this is absolutely a step in the right direction, we would be remiss if we did not bring up all that was wrong with this announcement to help educate our readers in the event gold backed currencies come to the West or other countries, as well.

What is important to understand with the prospect of gold backed currencies is that in order to make them secure, they must be redeemable in gold or silver (whichever metal is backing the specific currency). The reason for this is simple: if these currencies cannot be traded in and redeemed by the public for the physical gold/silver that is backing them, the issuing government or central bank can simply create more digital tokens than they have gold/silver to back them. Essentially, creating the same problem we have now with fiat currencies. Yes, fiat currencies since August 15th, 1971 have not been backed by gold, but between 1944 and 1971 they were. During that time, the United States printed FAR MORE dollars than they had gold, which initially led to Charles de Gaulle (then President of France) to repatriate as many dollars as they could for gold, before President Nixon closed the convertibility window on the dollar, ending countries ability to get gold for their dollars. With digital currencies, this same scheme run by the United States government can be perpetuated again.

This is why, even as we cover exciting announcements of governments turning toward silver and gold, we continue to highlight the fact that physical silver and gold are what provide their holders with the ultimate financial protection. You never have to worry if your paper fiat currency or digital token can be converted to gold or silver in the event the currency begins to depreciate because you are already holding the physical metal itself.

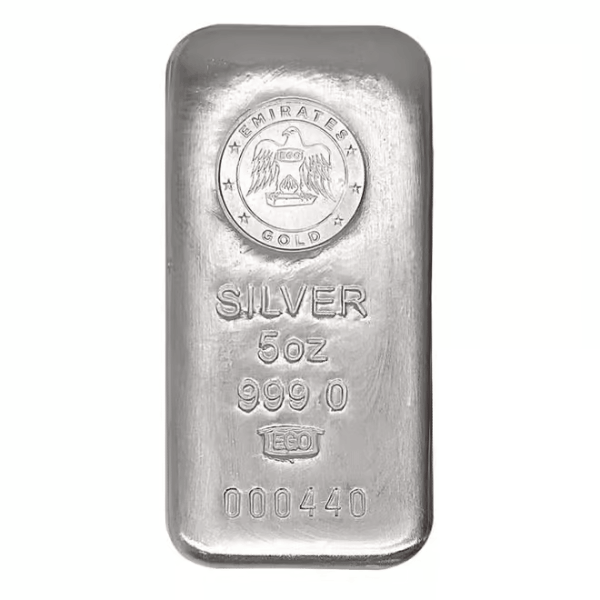

If you want to get ahead of the impending transition into an economy more focused on the real world value of commodities – check out our 5oz Silver Cast Bar out of Emirates Gold. This bar comes from a company with over 25 years of experience making investment-grade gold and silver bars, while also being sold at some of the lowest market premiums helping you secure more of your fiat dollars with each purchase.

Hi,

Hi,