All we have heard about recently is more and more about the Federal Reserve and the Bank of Canada achieving their soft landings they began to speak about when inflation skyrocketed last year to 40-year highs. But is that actually true?

When taking what they are showing us at face value, it may appear so, as what we are shown in that the United States’ Consumer Price Index (CPI), which measures inflation, has gone from 9% at its peak around October 2022 down to 3%, while Canada’s Consumer Price Index has gone from just over 8% down to 3.6%. However, what is not explained to the public is that in order to actually quench inflation and stop it in its tracks, we would need to see consistent deflation (reduction in prices) to return us to pre-pandemic levels, but that has simply not happened, and in reality, has not even come close to happening.

By using year-over-year CPI readings, it is easy to portray to the public that inflation is in fact coming down, when in reality, prices are still rapidly increasing, just at a slower rate than what we saw previously. Which is still bad news for citizens of the western world as it is proving that the impact created by such a rapid increase in inflation due to record currency creation between 2020 and 2022 will be here to stay. The reason year-over-year inflation numbers can be so easily used to deceive those who do not look under the hood of the economy is simple: if I gain 10 pounds one year, and then only 4 pounds the following year, it would appear as if year-over-year I have stopped gaining wait, when in reality, I still gained 4 pounds this year and am heavier than I was at the start of the year. The same thing is happening with the United States and Canada’s CPI numbers.

Where this becomes obvious is if you look at the price of gasoline throughout Canada. The price per litre during 2022 surged above $2.00 for the first time in the country’s history, and then began to retract once the Bank of Canada started hiking interest rates. This knocked gas prices down about 60 cents to around $1.40 in many places in the country. However, it never retracted so much that we saw the prices we were paying pre-pandemic. And what has happened since that decline? Prices have been ever so slightly climbing again to where we see gas prices now hovering between $1.60 – $1.70 per litre, creeping back toward the record high of $2.00 per litre we saw during the initial inflation wave. The same can be said for other essentials that cannot be cut from citizen’s budgets such as housing payments and food purchases. It is important to remember what we wrote about a couple weeks ago that inflation likes to move in waves of three. Last year we saw the first wave, and the second wave very well may be starting to pick up speed again.

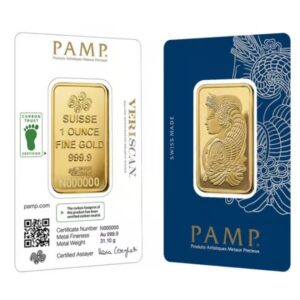

Using the Bank of Canada’s CPI numbers that were released yesterday, inflation rose 0.6% month-over-month, which at face value does not seem like a large increase. However, if you calculate that over a 12-month span, we are looking at an inflation rate of 7.2% this time next year, which is awfully close to the 8% high we saw last year, and this is if we see no significant increase from now until August of 2024. David Rubenstein, co-founder of the Carlyle Group a private equity company that currently has nearly $400 billion dollars of assets under management summed it up when he stated earlier this week “we aren’t going to cut expenses in the government. We aren’t going to increase taxes that much. We aren’t going to go to a bailout with the IMF, that’s not realistic. And we’re not going to default, the only other alternative is to inflate your way out.” Which is what we have been suggesting for quite some time, and why we have been pounding the table here at Au Bullion about the importance of silver and gold being held in physical form to become your own bank. The only way to inflate your way out of a $32 trillion dollar debt situation is to print currency rapidly so that you can more easily pay off such a massive debt.

When looking at this from a broader perspective, it is clear that central banks agree with Rubenstein or they would not be buying the best inflation hedge in the world at such a rapid pace, that being gold. Last year in 2022, central banks set a record with a cumulative purchase of 1,136 tonnes of gold entering central bank control; that is 36,523,195.2 troy ounces of gold. When looking at if they have continued on the same path in 2023, not only have they continued, central banks have been increasing their rate of purchases from 2022, which again saw a record number of ounces being purchased by these entities. In Q1 of 2022, central banks around the world purchased 82.7 tonnes of gold, only to pick up speed every quarter after that. In Q1 of 2023, central banks have already secured 228.4 tonnes of gold, increasing their pace year-over-year by 176.18%, and showing no signs of slowing down.

Again, it is imperative that citizens of the world take note of what central banks are doing – rapidly increasing the amount of gold they hold during a time when the shiny yellow metal is cheap, as they understand once it begins to move rapidly higher, they do not want to be chasing the metal in hopes they get some, but rather enjoying the increased purchasing power of the gold they already hold. If you also want to get ahead of any rapid price jump in gold, there is no better choice than the 1 oz Gold Maple out of the Royal Canadian Mint due to the fact it comes with the highest amount of security built in to each coin to ensure you know exactly what you are buying.

Hi,

Hi,