In previous newsletters we have been sounding the alarm on the steady transition taking place out East from illusionary intangible wealth to real tangible wealth. This transition is taking eastern countries from debt based financial assets over to physical commodities in all forms – silver and gold being a large part of that transition. One of the biggest players in this transition is China who once again at the beginning of this month announced they have increased the country’s gold reserves for a ninth straight month, continuing their rapid accumulation. This coming at the same time they have decreased their holdings of United States Treasuries by 11% over this year, and they are showing no signs of slowing down this trend.

If you have been following the market, the above would come as no surprise given the fact that one of the largest Credit Rating Agencies in the United States (Fitch) made a move to downgrade U.S. debt from the highest rating of AAA down to AA+. While the move to do so may not seem too impactful only being bumped down one grade, when you look into what is happening in the economy deeper, you begin to see a much different picture. First off, the last time the United States had their debt downgraded was in 2011, and this came after a major collapse in the housing market in 2008, which was still being felt when this move was ultimately made 3 years later. This time around, experts across the world have been warning of impeding economic disaster, which is leading people to speculate that the U.S. debt downgrade is foreshadowing greater danger to come. While this is just speculation at this point, when you take into consideration that countries have been rapidly shedding U.S. based Treasuries from their books before this move happened, it appears fair to speculate that countries are becoming fearful that the United States is not going to pay out, or at least if they are paid, the United States dollars they would receive will carry far less value due to incredibly high rates of currency creation.

Another thing that experts have been pointing to is what is happening in Japan. Due to their debt being poorly viewed around the world, the Japanese Central Bank has been buying all of its own debt to finance the government; this is causing a rapid debasement and loss of purchasing power of the Japanese Yen. The reason for this, is because if you have foreign buyers of your debt, you are shipping currency out of the county and therefore, there is not as much of it chasing goods within your own country which keeps inflation lower and helps to steady the purchasing power of the currency within your borders. However, if you (being a central bank) need to purchase your own debt, all that currency floods your local markets, drastically impacting the value of each currency note. Today, you are seeing that exact situation begin to manifest itself in the United States. With countries selling their current holdings and in large part refusing to buy more, the Federal Reserve will be forced to purchase United States Treasuries as the buyer of last resort, which will have a severe impact on the United States Dollar. It was also just announced that the U.S. Treasury will need to be loaned a whopping one trillion dollars per quarter, meaning over four trillion dollars will need to be printed and injected into the economy in one year. There is really no way to view that as a positive for those holding savings in dollars and not in gold and silver.

All that said it is not just the government that is struggling to pay its bills with a national debt quickly approaching $33 trillion and interest rates pushing payments toward one trillion dollars per year. United States consumer credit card debt has hit a record one trillion dollars for the first time in the countries history, showing that it is also citizens that simply do not have the funds to survive on a day-to-day basis. Remember what we wrote at the start of this newsletter, there is a financial shift happening out east away from illusionary wealth over to real wealth. This is glaringly obvious when you realize that all credit card debt is, is paying for goods with money consumers simply do not have. If this illusionary wealth economy did not exist, consumers would not have been trained to spend way above their means, and would need to accumulate real wealth in order to purchase real goods. However, due to the system being set up the way it is, consumers continue to struggle with illusionary wealth while central banks around the world RAPIDLY accumulate real wealth in the form of gold and silver.

The last thing we will look at today is also coming out of China who is set to hit a record level of investments in metals and mining, continuing the shift toward real assets. In 2018, China invested $17 billion in metals and mining, today they are on track to blow past that mark looking at over $20 billion being shifted toward mining physical assets for their country. In addition to that, China’s Belt and Road Initiative, which was launched in 2013 to give countries an alternative to western-led infrastructure projects has now attracted investments from over 148 countries for a combine total that has now surpassed one trillion dollars.

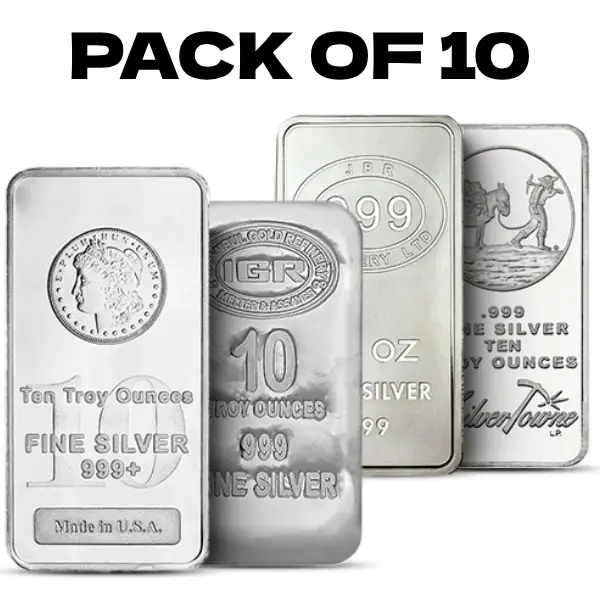

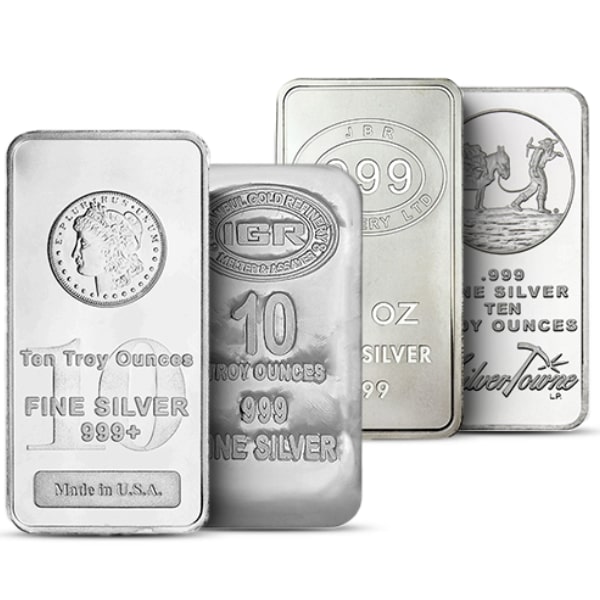

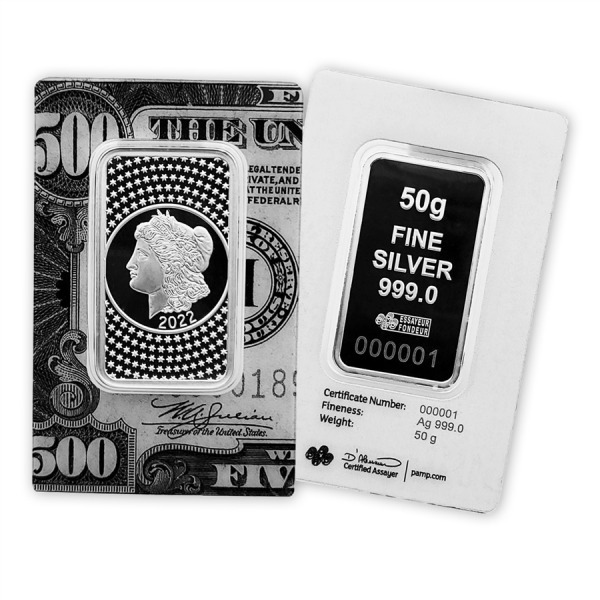

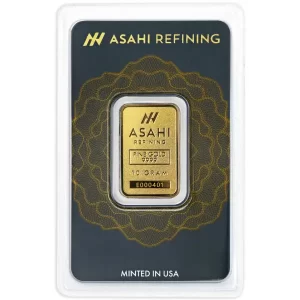

As western and European countries continue to drown themselves in debt, China is leading nations toward real tangible wealth, and the truth is, we as individual citizens can do exactly the same. Remember, it was announced at the beginning of this year that the world was facing a 200 million ounce deficit in physical silver, and the world’s largest producer of silver has now been shutdown for approaching 8 weeks. Gold is incredibly scarce and viewed as money in every country of the world, which is why central banks have not stopped piling it into their reserves. If you want to get out ahead of the impending credit crisis that is fast approaching, stocking up your silver and gold before all citizens are rushing toward them to try to secure ANY wealth they may still have would be a wise option. Below you will find the stunning PAMP Suisse ‘Morgan Dollar’ Silver Bar, which can be used to store value, but also is sure to act as a talking piece to begin to spread the word to others on the importance of holding physical silver and gold.

PAMP Suisse ‘Morgan Dollar’ Silver Bar

Hi,

Hi,