Prices of gold

When inflation is high, currencies are weak (particularly the U.S. dollar), or something catastrophic happens around the globe, gold prices tend to climb. As a result, the correlation between price and volatility in the gold market is more complex than in the stock market. It is not uncommon for both price and volatility to increase at the same time. One notable instance of this is the global financial crisis of 2008-2009. The U.S. dollar fell in value and inflation fears grew as the economy showed signs of weakening. This led to an increase in both the price of gold and its volatility. An unexpected outcome occurred during the severe European financial crisis that hit in the summer and autumn of 2011. As Europe’s economy worsened, the U.S. dollar strengthened and gold prices declined, despite increased volatility. Unlike stock volatility trading, gold volatility trading need not be tied to prevailing market prices.

Price of silver

Speculation, supply, and demand affect silver’s price, just as they do with most other commodities. Silver’s price is more variable than gold’s due to the metal’s smaller market, lower market liquidity, and demand variations between industrial and store of value applications. Sometimes, this may lead to very different estimates in the market, which in turn increases the inherent instability of the market.

As a safe-haven investment, silver’s price tends to follow gold’s. However, the ratio between the two is not constant. The silver to gold abundance in the crust is 17.5 to 1. Traders, investors, and purchasers often examine the relationship between gold and silver prices. The price-to-value ratio in ancient Rome was 12 (or 12.5) to 1. One troy ounce of gold was valued at 15 troy ounces of silver under a statute issued in the United States in 1792; similar legislation established a ratio of 15.5:1 in France in 1803. However, throughout the 20th century, the average ratio of gold to silver prices was 47 to 1.

Since September 2005, the price of silver has increased significantly, from roughly $7 per troy ounce to $14 per troy ounce for the first time by late April 2006, with an average price of $12.61 for the month. By March of 2008, it had stabilized at about $20 per troy ounce. However, in October 2008, the price of silver, along with other metals and commodities, plunged 58 percent as a result of the credit crisis. On April 29, 2011, silver reached a 31-year high, trading at $49.21 per ounce, on the back of worries about monetary inflation and the viability of governments in the developed world, especially in the Eurozone.

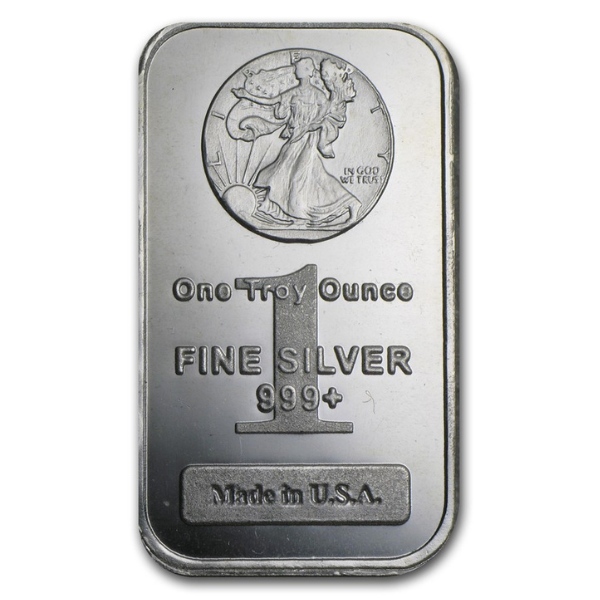

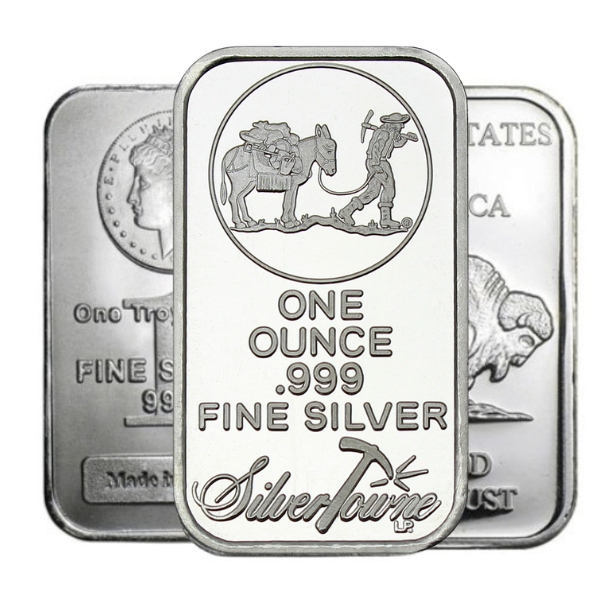

Investment in silver

In addition to its value as an investment, silver finds widespread application in decorative and ornamental contexts, such as coins, bars, and jewelry. However, silver’s many technological, industrial, and medicinal applications make it more than just a commodity. Because of its special characteristics, silver has more industrial applications than gold does. More than half of all mined silver will be employed in industry, compared to less than ten percent of all produced gold. This is due in part to the fact that silver is a powerful thermal and electrical conductor and has other unusual chemical characteristics. Silver is one of the few metals to have anti-bacterial properties, hence it also has medicinal applications. Because of its deep ties to manufacturing, silver’s popularity tends to track that of the manufacturing sector. As a result, we may draw a correlation between the cost of silver and GDP growth.

However, even though silver is a highly desired metal and has many characteristics in common with gold, the pricing of these two metals couldn’t be more different. Many people use a metric called the “gold-silver ratio” to assess how the two metals’ prices are doing about one another; this metric reveals that silver’s price has never been more than a tenth as high as gold’s, despite silver’s widespread applications. Investors in precious metals often choose silver over gold because of its lower entry price.

Willing to buy some silver , check for Silver price & make your purchase now from trusted bullion dealers – Au Bullion.

Hi,

Hi,