Gold futures may be a lucrative investment opportunity for those who have an interest in the gold market. Learn how to take advantage of this opportunity. Have a look at the gold price chart for more clearance of the price.

There is a wide range of options for newcomers to the gold market who are looking to invest in the precious metal. Gold futures investing is a common and well-liked strategy. Futures may be seen as a kind of financial agreement between a buyer and a seller. The buyer agrees to purchase the asset from the seller at a predetermined price and on a future date mutually agreed upon by both parties.

Futures trading in seven different currencies was introduced in 1972 at the Chicago Mercantile Exchange. However, the COMEX in New York did not see its first gold futures contract traded until 1974. Since then, trading gold futures contracts has been a common investing tool on several stock markets.

Learn the Basics of Trading Gold Futures

Gold futures allow investors to trade the commodity without paying the full price. The gold spot price, quantity, and delivery month are agreed upon. Gold futures are a contract in which a person commits to take gold at a specified date by making an initial payment and agreeing to fulfill the payment.

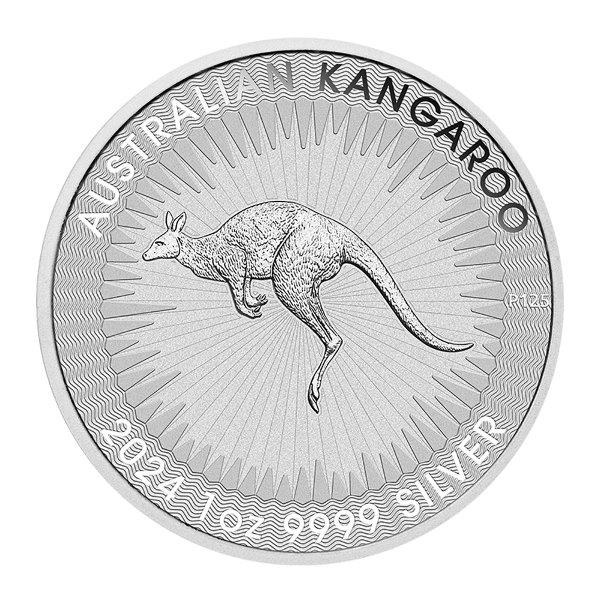

Gold futures are an alternative to bullion coins and mining equities and come in 100, 33.2, and 10 ounces. Many prefer gold futures over gold ETFs (ETFs). Gold ETFs work like stocks, so investing in one is like trading on an exchange. There are primarily two categories of gold exchange-traded funds (ETFs): those that follow the price movements of the metal itself, and those that deal with investments in gold-based businesses.

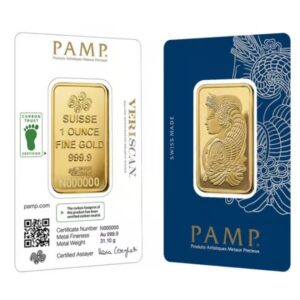

Investors may get exposure to gold via exchange-traded funds (ETFs) that track the price of the precious metal by holding either actual gold bullion or gold futures contracts. It is essential to keep in mind that investing in these gold ETF platforms does not enable investors to own any actual gold; even a gold ETF that tracks physical gold cannot, in most cases, be redeemed for actual gold. This is one of the most important things to keep in mind when investing in gold ETFs.

Alternately, exchange-traded funds (ETFs) that invest in gold firms provide investors exposure to the equities of gold mining, development, and exploration companies, as addition to gold streaming companies. Aubullion.ca offers gold bullions with the highest purity level and is a trusted and authorised dealer of Royal Canadian Mint goods. It provides a variety of investment choices for gold and promises its clients excellent service.

Where you can trade gold future?

Gold future contracts are available for trading on the New York Mercantile Exchange (NYMEX) in the United States. These contracts are denominated in US dollars per ounce and are based on the price of 100 troy ounces of gold. An example price change of 10 cents would be $10 per contract, thus $1 would be worth $100.

Trade on the New York Mercantile Exchange (NYMEX) is scheduled to end on the third to last trading day of the delivery month in February, April, June, August, October, and December.

Gold futures are also traded on the Tokyo Commodity Exchange, with a contract size of 1 kilogram, or around 32.15 troy ounces.

Here are a few tips for investors to remember as they evaluate this possibility:

Benefits of investing in gold futures

- Trading gold futures gives investors the option to make a partial payment when a contract is made and the remaining payment at a later date.

- This implies that if investors are able to sell soon, there is a good chance that they will never pay back the full amount of gold that they bought. Instead, customers will most likely pay a modest fraction of the whole price up front, but any loss will be adjusted on a down payment and paid back in net.

- Futures contract value may be monitored simply by watching the underlying asset’s exchange price.

- Investors are not required to store their gold futures anywhere.

Investing in gold futures carries some risk

- Volatility in the gold futures market indicates the market might potentially fall.

- The value of gold, on the other hand, seems to be in a constant state of fluctuation. This implies that if the price drops significantly between the time of the agreement and the period of delivery, the investor might incur a loss.

- The “built-in” price difference in gold futures is analogous and can affect the genuine value of the metal.

- Default risk is the possibility that someone will be due a profit but be unable to cash it in.

A Concluding Remark on Gold Futures

Investing in gold futures has both great potential gains and significant potential losses, making it clear that this strategy is not suitable for everyone. In light of this, Aubullion.ca that they “offer worldwide gold price discovery and potential for portfolio diversification.”

Aubullion.ca provides continual trading possibilities linked with gold futures, and that they represent a different kind of investment opportunity compared to equities, coins, and gold bullion.

Hi,

Hi,