Gold Quietly Eyes All-Time-High

While there were a few financial analysts that have been warning people of instability in the banking system ever since stimulus checks spurred unprecedented currency creation – most officials in government/finance have been reassuring the public that the banking system is strong. Even going back to this past Monday, President Joe Biden again stated the banking system was resilient, which was parroted by Federal Reserve Chair Jerome Powell during the Federal Reserve Press Conference yesterday. However, after another large-scale bank failure, referring to First Republic Bank, doubts are beginning to swirl, with people starting to question the official narrative. And for good reason, as the collapse of First Republic Bank came in as the second largest bank failure in U.S. history surpassing the size of the recent failures of Silvergate Bank and Silicon Valley Bank.

That being said, it is not only the public that is beginning to question if the banking system is secure, but also gold. Even as the Federal Reserve continues its aggressive rate hikes, which should be bad news for the price of the shiny yellow metal, gold continues to question whether inflation is sufficiently under control. In January, United States inflation sat at 6.4% with last reports for March coming in at 5%, showing progress on the side of the Federal Reserve. However, since January, gold has risen in value by 12.03% at time of writing, contradicting the progress that appears to be made by the Fed as gold continues to signal higher inflation is here to stay. When commenting on inflation, Jerome Powell did agree that higher inflation would be here longer than originally anticipated which highlights a tricky situation for those at the Federal Reserve. Not only is inflation staying elevated after the most historic pace of rate hikes since the 1980s, which signals more rate hikes will be needed to bring inflation down, but we are also beginning to see major bank failures unseen since 2008 due to those very same hikes. It is clear; Jerome Powell and the Fed are between a rock and a hard place. However, to this, Jerome Powell stated Wednesday (May 3rd, 2023) that the banking sector “has been broadly improving since March… [and] the United States banking system is strong and resilient.” Again, gold appears to disagree as after the May 3rd press conference by Jerome Powell, gold shot up and just barely missed setting a new all-time-high in price.

What is interesting about the statement about the banking system improving this past month is that it takes no accountability whatsoever when referring to how much larger the financial problem we have today is in comparison with 2008. First off, look at the chart below comparing the number of bank failures with the value of the assets those banks were holding at the time they failed:

The largest of the Great Financial Crisis bank failures happened in 2008, with around 25 banks failing with assets equating to nearly $400,000,000 USD. In 2009 and 2010, the panic spread as many of the small to mid size banks began to collapse during the aftermath. In the end, around 300 banks failed in 2009-10, adding roughly another $300,000,000 USD in assets that were held by failed banks. Between 2008-10, the final count landed at roughly 325 banks that failed, with assets equating to around $700,000,000 USD or on average just $2,153,846.15 USD held by each failed bank.

When comparing this to 2023, you can clearly see how much the problem has been exacerbated due to easy money policies being in place for over 10 years since the last collapse in 2008. In 2023, we have seen just 4 bank failures in comparison to 325 between 2008-10, yet, the banks that have failed in 2023 already equate to nearly $575,000,000 USD in assets held by these failed banks. While it is still below the overall damage of nearly $700,000,000 USD from 2008-10, when considering the average assets held by the four failed banks in 2023 is $143,750,00 USD, 66.74 times larger than the average bank failure from 2008-10 – you begin to see the problem at hand. Understanding that numbers do not always work out perfectly, the following calculation should be taken with a grain of salt, though it still emphasizes the sheer size of the problem we are facing today due to unprecedented rates of currency creation. If the average bank that failed in 2008-10 was 66.74 times smaller than in 2023, and we saw the same number of bank failures in 2023 as we did in 2008-10 (325 banks) – the total losses in 2023 given the size of banks today would be $46,718,750,00 USD – a far cry from the $800,000,000 needed to bail out banks in 2008.

What should also be noted, is that as Jerome Powell was speaking about the resiliency of the banking system, 8 more U.S. regional banks began seeing their stock fall off the table:

- PacWest ($PACW) was down 36%

- Western Alliance ($WAL) was down 31%

- Metropolitan Bank ($MCB) was down 27%

- HomeStreet ($HMST) was down 23%

- Zions Bank ($ZION) was down 15%

- Citizen’s Financial ($CFG) was down 12%

- HarborOne ($HONE) was down 10%

- KeyCorp ($KEY) was down 9%

It is becoming quite clear that as smaller to mid-size banks continue to fail due to the tightening of monetary policy, it will continue to consolidate power into smaller and smaller hands as they fail. What happened after the failure of First Republic Bank is a perfect example: JPMorgan swooped in to purchase the assets held, effectively putting them over the 10% cap for public deposits. This was a rule put in place to avoid a monopoly being formed in the banking sector regarding public deposits. However, this rule was waived to allow JPMorgan to acquire First Republic Bank even though there were other buyers on the table. The fear that comes from this is as banks control more and more public deposits, they no longer need to offer attractive savings interest rates to attract depositors as there is no fear of deposits going elsewhere due to the concern of the alternative banks collapsing being far higher than the worry of receiving low returns on your deposits.

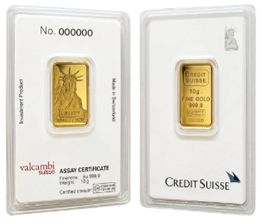

Alternatively, the public is beginning to realize that they do not need to stress about bank failures or low to negative interest rates on their deposits if they become their own bank with gold. Not only are you secure in the event of continued bank failures and/or a rapid loss in currency value during the chaos to follow, gold has shown as it fights for its’ all-time-high that regardless of the chatter – gold stays focused on securing value over a long period of time. Additionally, with gold’s all-time-high within view, any drop in price may mark an official bottom as when gold achieves a new all-time-high, that very well could trigger a rapid increase in value as it searches for price resistance at a higher level. If you do not want to miss the next buying opportunity, look toward our 10g Liberty Gold Bar coming out of Credit Suisse. These bars have also seen an increase in demand since Credit Suisse collapsed as precious metal investors question if more will be minted in the future.

Hi,

Hi,