Yesterday, on Tuesday, February 13th, we saw some curious price action in the precious metals sector that likely has many holders of these assets confused, as the price movement we saw in both silver and gold was truly a dance with irony like no other. Without going into an exhaustive list of the reasons citizens, governments, and banks alike store up reserves of physical silver and gold, the reason most generally agreed upon is to safeguard against the devaluation of global fiat currencies most notably through rapid inflation due to currency creation (money printing).

After we saw inflation spike to 3.4% year-over-year in December to finish off 2023, the Federal Reserve assured the globe inflation was still trending downward at a rate within their expectation. It was then predicted we would see tangible evidence of that in January with markets expecting inflation year-over-year to come in at 2.9% to start off 2024. Instead, early yesterday morning we got a reading of 3.1% year-over-year inflation in January and early signs of panic began to show. The most obvious was that before this inflation reading, markets were pricing in the first interest rate cut would be in March 2024, with 100% certainty. Afterward, that certainty vanished, and now markets are expecting interest rate cuts to come at a 38% likelihood, completely flipping back to an expectation that rates will be held higher for longer.

And this is where the precious metal price irony enters the picture. As stated above, high inflation is one of, if not the primary reason silver and gold bullion are viewed as valuable assets; in short, due to their store of value over time. However, after we got news of a hotter inflation reading than expected showing the Federal Reserve has failed to contain inflation (something precious metal advocates have been screaming from the rooftops as a major reason to own these assets), we saw gold drop from $2020.75 USD/Oz to $1992.99 USD/Oz, a 1.37% drop and it happened in a flash. Similar with silver, the price dropped from $22.84 USD/Oz to $22.03 USD/Oz, a 3.53% drop, again with a majority of that shift coming right after inflation news was announced. Also worth noting, this was the first time gold closed below $2000 USD/Oz since November of 2023, a span of over 2 months, and what is odd is it was fuelled by higher inflation.

What is important to realize is even though it appears gold and silver have flipped and are now reacting poorly to higher inflation readings – this is in fact far from the truth. Silver and gold initially have reacted to the fact that interest rates are now being priced in higher for longer, which we have spoken about work as headwinds to silver and gold prices, and not the fact inflation is heading higher again. However, this scenario in reality could not be more bullish for silver and gold investors because as we have touched on before, the Federal Reserve is in between a rock and a hard place, with nowhere to go, and this signals the Federal Reserve failed to raise interest rates enough to stop inflation. Previously, this was just a theory. After what happened yesterday, we can consider their sticky situation a fact.

German banks are warning of the largest real estate driven economic collapse since 2008. Janet Yellen has on record stated that commercial real estate is causing major issues for smaller banks in the United States, which as we have seen, once collapsed, simply get absorbed by a larger bank, which likely ends up collapsing itself. This is exactly what happened to New York Community Bancorp just recently. Signature Bank fails in March of 2023; New York Community Bancorp who is now itself on the verge of collapse was the bank that previously absorbed the bad debt held at Signature. It is a poison debt cycle, and only those holding physical gold and silver escape as no debts or obligations are attached to real, sound money.

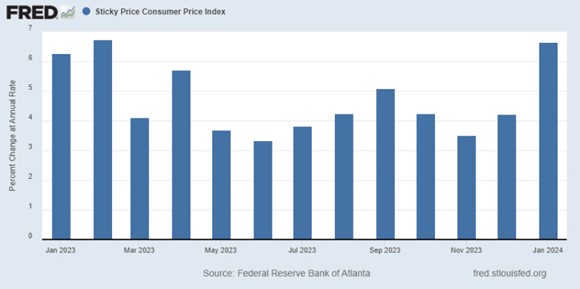

Another pair of charts that point directly toward an environment of heating inflation, are that which comes out of the Atlanta Fed Office that reflects what is called ‘Sticky Price Consumer Price Index’ which measures a basket of goods that is historically known to inflate in price at a much slower pace than overall goods. When this chart begins to spike, it is usually a sign that inflation has become widespread and more engrained. As of January, it reads 6.77% – over double the 3.1% CPI reading we just got.

The above chart is a more zoomed in version of the one below it. The top chart shows how drastically this basket of goods has inflated in price since December 2023 when we first started seeing inflation pick up again. While the second chart shows clearly that inflation has returned with a vengeance, and has not been this elevated since January of 2023 when the Federal Reserve still had a long battle ahead of it. All the Federal Reserve’s progress has vanished into thin air. Only now the global economy is on the brink of collapse due to record interest rate hikes, and on top of that is now once again struggling with pesky inflation that looks to be spiking again. This is the perfect storm of stagflation, an environment in which gold and silver have historically performed admirably.

It should also be mentioned that as predicted, China added another 10 tonnes of gold to its reserves in January – a 15th straight month. With it also being reported that in 2023, individuals buying the most gold in China were between the ages 25 to 34 who increased their share of buying from 16% in 2022 to 59% in 2023.

Then out of Zimbabwe we were told that their government has accumulated 1 tonne of gold bullion since passing a law that forces national mining companies to pay partial royalties in gold. It was then announced that Zimbabwe hopes to not only join the BRICS Development Bank, but also wishes to back their currency with gold to stifle instability in their currency value; a sentiment growing stronger and stronger amongst BRICS+ nations.

Times are changing right before our very eyes.

Although yesterday was a rough day for both silver and gold, as we have seen over the past couple years through incredibly strong interest rate headwinds gold and silver have stayed resilient, holding value and preparing for the cracks in our world economy to break wide open. As noted around the world, central banks, which are in the know more than your average citizen, have been rapidly accumulating gold and silver at what they perceive to be a cheap price for both metals. And with chaos only growing, we will continue to offer the best premiums we can, to ensure our clients can protect themselves for as low a cost as possible.

1 Oz Random Year Silver Canadian Maple Tube | Royal Canadian Mint

1 Gram Gold Lady Fortuna Bar | PAMP Suisse

Hi,

Hi,