It is no secret that silver and gold as assets have been one of the strongest performing on the year. Silver has increased in value 32.59% year-to-date, while gold has shown gains to the tune of 28.89% over the same time frame. When looking at stocks, the S&P 500 has led the way for those indexes increasing 22.43%, the Dow Jones sits at 13.76%, Russell 2000 is up 10.51%, and even the volatile NASDAQ still pales in comparison to silver and gold posting gains of 21.69%. Precious metals have silently been dominating as an asset class and yet still receive little to no coverage. On the other hand, while stocks have shown gains of their own, they have been all the rave with economic shows on prime-time TV pounding the table that stocks are a “BUY!”. But are they really?

What we are seeing in the global financial landscape is that if leaders of countries and central banks are watching those prime-time TV stock suggestion shows, they are not heeding their advice. Rather, there continues to be an incredible shift toward both silver and gold from countries across the world, but of course, most of the heavy purchases of both metals are coming from countries out East, those interested in getting involved with BRICS+ or at the very least those looking to become more independent and less reliant on outside foreign aid that leave them riddled with unpayable debt.

Turning to the latter, countries in Africa have been implementing massive changes to their gold mining policies to ensure they get to keep more of the bullion that is being pulled out of their soil. It started with Zimbabwe introducing their gold-backed currency in which we have covered in previous newsletters. Their action has since spurred others to follow with Tanzania’s mining regulator announcing that any mines exporting gold must put 20% up for sale to the Central Bank to allow for them to boost their currency reserves; a trend that has become far more common, banks shedding United States Dollars while simultaneously purchasing any gold they can afford. Carlos Lopes, a professor at the Nelson Mandela School of Public Governance in South Africa stated, “In the last few years, because of inflation and all these movements for stimulus packages, the returns are extremely low. On the other hand, gold is going up in terms of price because these big banks are also going after gold as protection [against the devaluation of their local currencies]. So, it is a very good investment to go to gold.” His sentiment should be more well understood by those in the West who previously had not seen high inflation in nearly 50 years up until the 2020 lockdowns which shot prices of everyday goods way up, the value of our fiat currency way down, neither of which will ever reverse itself. All fiat currencies are debt instruments that will only ever lose value relative to real goods. It is only a matter of time before Western countries see inflation like African countries have been dealing with for decades. And because of that inflation African countries understand that gold and silver are the only ways to protect themselves and have rightly turned to keeping domestically mined gold in-house as much as possible. Ghana and Uganda are two other African countries that have implemented similar policies as Tanzania, adding to the list of countries prioritizing gold reserves in preparation for the precious metal perfect storm.

Turning our attention to silver, the Silver Institute released an updated projection based on data received through the year which stated:

- Global silver mine production in 2024 is projected to reach 824 million ounces, which sounds like a lot, but is a 1% decline from last year.

- The silver deficit will grow to 215 million ounces.

Silver is necessary for the future and there simply is not enough of it to go around. The only way deficits are historically rebalanced is by a large mining production increase or an increase in price to help slow demand. Given that silver production has continued to drop over the last few years and considering how valuable an asset silver is to the world, being arguably the most important commodity in the world outside of oil, it is no surprise countries are also beginning to prioritize their silver reserves with India leading the way. As a side note, outside of oil and food as a general, silver is the most widely used commodity in the world with over 10,000 applications. That is a fun research topic for you to do at home.

Another country that is looking to return silver back to its original origin as a monetary metal rather than solely an industrial metal, following in BRICS+ alliance member India’s footsteps, is Russia. It has been proposed to government that Russia will spend north of the equivalent of $500 million USD on precious metals and gemstones, with silver being included for the first time. The statement read, “the plan is to acquire refined gold, silver, platinum and palladium to increase the share of highly liquid assets in the State Fund.” The important note is where it states, ‘highly liquid’ and the reason for that is because it is a recognition that countries around the world all place the same high value on owning bullion making it incredibly easy to sell or to trade for other commodities such as oil which is something African countries have also began to explore.

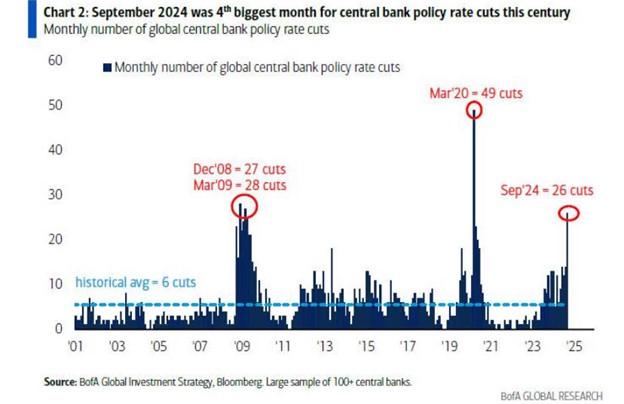

When looking at the perfect economic storm that is brewing, we want to turn our attention to interest rates once again. This past September saw the 4th most rate cuts this century by Central Banks around the world. The three higher months were March 2020 which saw the stock market drop 13% in that month alone, gold that same month was up 6.29%. The other two were December of 2008 and March of 2009, between those two dates the stock market dropped 17.63%, gold between December of 2008 and March of 2009 was up 8.24%. The chart below highlights the significance of the rate cuts and what should alarm people who own no gold and silver is that they are likely not done with their cutting cycle as it really has just begun.

Lastly, we finish with China. We have long been reporting that China has been releasing data that indicates a staggering increase in their gold reserves purchasing the yellow bullion for 18-straight months before buying no gold this May and ending their streak. The reason was similar the reason African countries have begun prioritizing their gold reserves, with economic unsteadiness growing along with geopolitical tensions, gold was a way to protect themselves from financial shifts. A shift that most recently sent Hong Kong’s Hang Seng Index plunging downward by 9.41% in a single day earlier this week marking the largest loss since 2008 and the 2nd largest this century. The citizens in China that purchased gold beans in the most recent frenzy earlier this year must be thanking themselves for not only having the foresight to see this coming but for having the courage to act on that knowledge.

The same will be said for citizens of all countries as this economic shift takes place. As we have mentioned, in no way do we mean to come off as alarmist, we are simply stating facts when we say the world has seen a new financial system implemented every 30-50 years going back over 150 years and we are now in year 53 of our current system that began on August 15th, 1971, when Richard Nixon ended the gold standard and began the USD Standard or the Fiat Standard as we like to call it. Those who hold silver and gold will be protected as they have been during every financial collapse through time – there is no reason this one will be any different and as we have shown through our newsletters, silver and gold have already silently performed admirably in the face of high interest rates that would usually spell their demise. The best for these assets is truly to come as we see more all-time highs for both metals in their near future.

Hi,

Hi,