Gold has truly had a remarkable year in the face of high interest rates and what most government officials called “transitory inflation”. Earlier in the year, those in the precious metals sector were watching for gold all-time highs, which did come, but seemingly took a month or two to reach each new barrier. Then as we crossed the midway point in the year, these all-time highs became more common place appearing every week. As of recent, it seems as if gold has no end in sight as new all-time high prices are being reported daily with the most recent high eclipsing $2740 USD/oz or nearly $3800 CAD/oz.

Furthermore, it appears as if our thesis on silver is also playing out almost exactly as we have predicted to-date in our newsletters. In short, the theory is that gold will kick the door down and set the tone for all precious metals by continuously forcing its way to higher highs, which will ultimately lead to silver sprinting through the open door once gold has cleared the path of resistance allowing for silver to reach far higher percentage gains than seen in gold. With gold pushing another all-time high on Friday, silver responded with an absolute SURGE climbing $2.03 USD on the day or 6.40% as if it were shot out of a cannon. Gold had a solid day of its own rising over 1% as it claimed a new all-time high, but the incredible day for silver pushed the gap between their yearly gains wider. Silver is now up an incredible 41.47% since January 1st, 2024, while gold is up a respectable 31.98% in the same time frame. Silver has turned out to be the better buy of 2024, albeit there is still time left in the year for gold to close the gap. Although, if our theory continues to play out accurately, all gains seen in gold will be surpassed by silver.

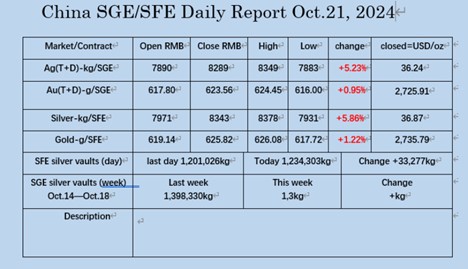

Chinese markets gave confidence to the move seen on Friday on the Western markets as today silver in China on the Shanghai Gold Exchange saw a surge of its own rising 5.87% nearly toppling the $37 USD/oz mark, closing the day at $36.87/oz. As we stand, silver prices in China are still 9.67% higher than prices in the West, continuously adding upward pressure to Western prices.

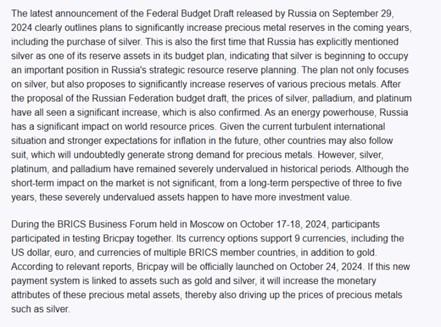

Looking deeper into reports coming out of China, we turn to the massive announcement that came out of Russia that stated silver would be added to official reserves for the first time. As this report came out on September 29th, 2024, we believe it has contributed to the over 8% gain silver has seen since that date. Below you can read an excerpt that came from a Chinese media company shared by Xiaojun Bai on twitter:

It appears China believes there is a link between the recent rise seen in precious metals and Russia’s monetary announcement. Even further, we point you to the final paragraph that speaks toward a mutual payment system for BRICS+ nations that is sure to be discussed at the long-awaited BRICS 2024 Summit taking place this week starting tomorrow.

Adding to the gasoline that was poured on precious metals prices last week was an article released by Bank of America where they touted gold as the “last remaining safe haven” as United States Treasuries begin to lose their luster with their national debt increasing over $1 trillion every 100 days. Truly, an astonishing rate of debt accumulation and as each country follows suit national currencies are being debased daily which lends to the trend of central banks buying gold and silver at an alarming pace.

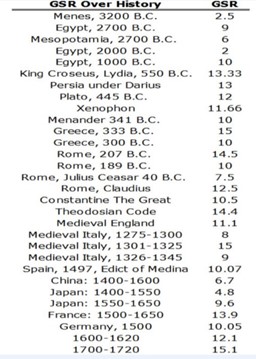

Flipping back to our original topic regarding the gains we expect to see in silver relative to gold in reference to the statement above from the Russian Federal Budget draft that outlined, “Silver, platinum, and palladium have remained severely undervalued in historical periods.” – we want to point you to an interesting list that highlights the historic gold/silver ratio that was seen during different periods throughout time. Please keep in mind as you read through the list below that the gold/silver ratio is 80.72 at time of writing, essentially indicating that it takes nearly 81 ounces of silver to purchase a single ounce of gold. At the start of the year the gold/silver ratio hovered closer to 90:1, decreasing as silver sees higher gains. Also note, silver comes out of the ground at a 7:1 ratio during mining which is why many in the precious metals sector believe that number is closer to where a fair ratio would live between the two metals.

Based on the above which spans 5000 years the average gold/silver ratio is 10.31. With gold being at $2720.22 USD/oz at time of writing, that would put a single ounce of silver at the historic price of $263.84 USD. Of course, it is hard to say where this ratio ends up once gold and silver are reintroduced to the masses as money as fiat currencies face their ultimate end, however, one thing we believe will continue to be true and can be accurately predicted is that silver has far higher to climb that gold. At the end of the day, we believe based on economic factors, geopolitical tensions, technological advancement, and many more variables, owners of both silver and gold will be well protected by either asset. Our intention is to add insights to our clients to ensure at the end of the day you are each making the most well-informed purchase decisions.

Hi,

Hi,