On the surface it is being reported that central bank demand for gold has started to decline through 2024, which, would not be unsurprising given the previous 3 years set records for central bank gold accumulation. It is only natural that there would be a tapering of demand. However, using financial reports from the World Gold Council, the London Bullion Market Association (LBMA) and the International Monetary Fund (IMF), the reality of central bank gold demand becomes less certain regarding the reported slowing of demand.

As it turns out, which is also unsurprising, central banks in many instances allow their true gold reserve count to go understated, which in turn allows for a percentage of their gold purchases to go unreported. The reason this should come to no surprise is that gold has long been seen as the bedrock of the financial system. Therefore, in times of uncertainty, if central banks are seen fleeing toward gold, the public will begin to question why that is, potentially instilling fear that our currency is not safe. This in turn would not only put upward pressure on demand allowing central banks to accumulate less due to the competition over gold with the public intensifying, but it would also let the cat out of the bag that they no longer trust the current world reserve currency to support their countries, the United States Dollar. In our opinion the latter is what central banks would be more worrisome of as they have far larger pools of precious metals to purchase from than the public, however, upsetting the United States and its allies could spell trouble making a more covert swap from United States Dollars to gold an ideal option for these countries.

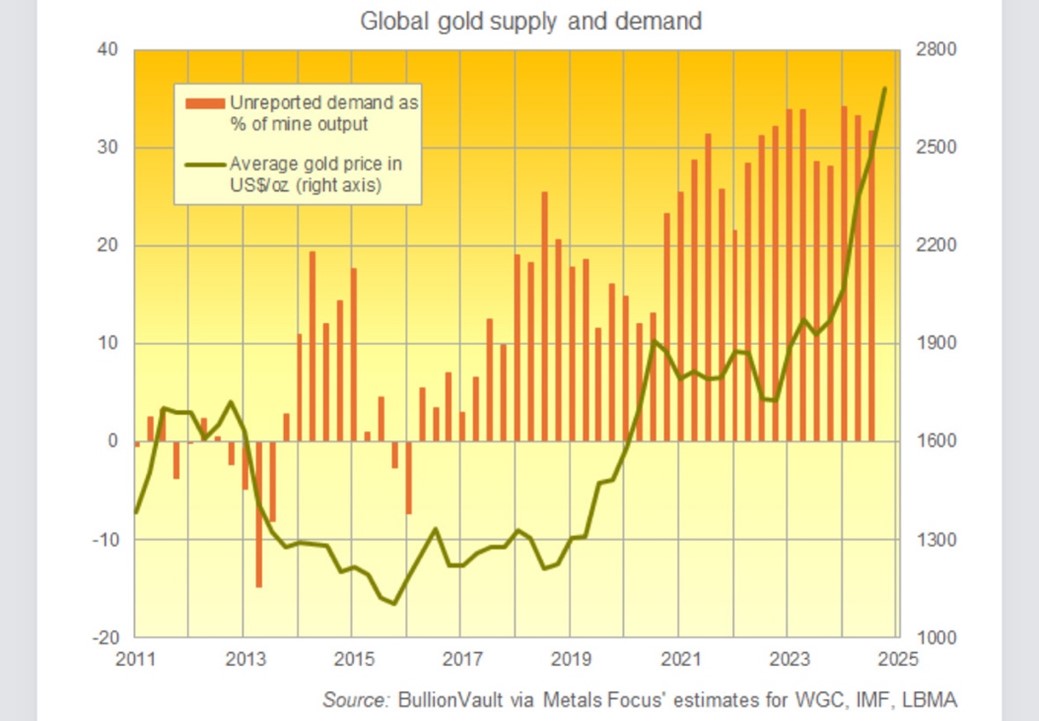

As proof to the above statement that central banks are in fact purchasing gold without reporting it to the public, we point you to the below chart:

What you are looking at is the unreported demand as a percentage of global mining output. This is shown in orange. As you can see, even when central banks were reporting record gold accumulation, unreported purchases soared past 30% for the first time, meaning the records for gold accumulation set should realistically be far higher. Unreported gold demand pushed up near 35% through 2022, and again in 2024, currently sitting at around 31.5%. The World Gold Council reported, “that across the past 12 months… visible demand, [or in other words, reported demand,] matched only 68.5% of new-mine output.”

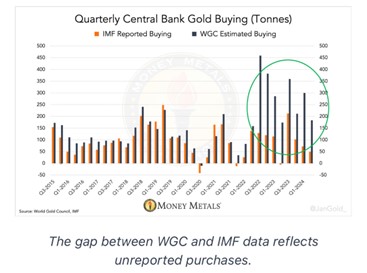

As a final point of consideration for the above claim, we point you to the chart below that compares reported gold purchases from the IMF to World Gold Council estimated purchases. It should be noted that a discrepancy this large has not been seen in many years.

To switch gears from global to individual, we want to cover two of the largest buyers of unreported gold, and we must remind you of the reason we stated this would happen. That being, a fear of sanctioned retribution in retaliation to visibly shifting the financial tide away from American/Western dominance. Hence, covert gold purchases have seen an uptick as confidence in the United States Dollar and other fiat currencies take a strong downtick.

The first of such countries we want to highlight is Saudi Arabia. Which, in a turn of irony, was crucial in paving the path for the current financial system we find ourselves in due to the original Petrodollar Deal struck with the United States.

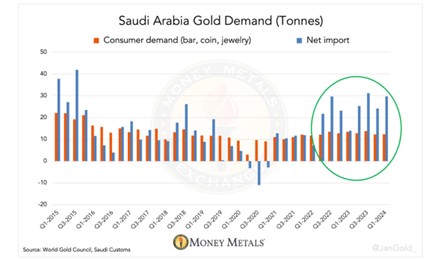

Saudi Arabia, for a good part of the last decade has long had gold imports see a strong correlation with overall consumer demand within their country. However, since 2022 when record central bank purchases began, Saudi Arabia saw a massive divergence.

It is clear that Saudi Arabia has been hoarding gold for a later date at an increased pace over the last couple years. This change in imports of gold aligning with a “change of teams” from the Petrodollar System to a member of BRICS+, essentially moving from West to East is an incredibly important note to make.

To figure out where this extra gold may be coming from, Jan Nieuwenhuijs, a gold columnist compared Saudi Arabia’s net gold imports minus their consumer demand and compared the unreported gold totals with Swiss exports of gold to Saudi Arabia. The correlation is clear leading Jan, and others, to come to the conclusion that Saudi Arabia secretly purchased approximately 160 tonnes of gold from the Swiss Alps. With Switzerland long being a financial haven due to their neutrality and loose banking regulations, it again shouldn’t be surprising to learn they too facilitate covert bullion trading with countries that wish to keep portions of their purchases under wraps.

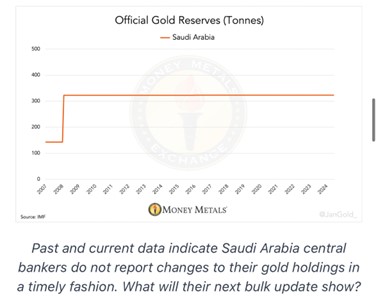

What makes this situation with Saudi Arabia even more interesting is that fact that they only began announcing their gold trades in 2015, meaning no one truly knows how much gold Saudi Arabia has. Diving a little deeper, you will find that Saudi Arabia has not announced official gold reserves since February of 2008, nearly two decades ago, and when they did, they reported reserves at 332 tonnes, 180 tonnes higher than they reported a month earlier.

Regardless of the reported total, one thing we can be certain of is that Saudi Arabia is keen on keeping the real gold reserve total hidden from prying eyes.

Country number two on our list of secret gold buyers is none other than China. We and others have written in the past that due to China being the largest importer of gold, the largest producer of gold, as well as having strict laws restricting the exporting of gold, the true tonnage of China’s gold reserve could very well be over 20,000 tonnes, more than double what the United States is reported to have, which currently stands as the largest reported reserve in world at 8134 tonnes.

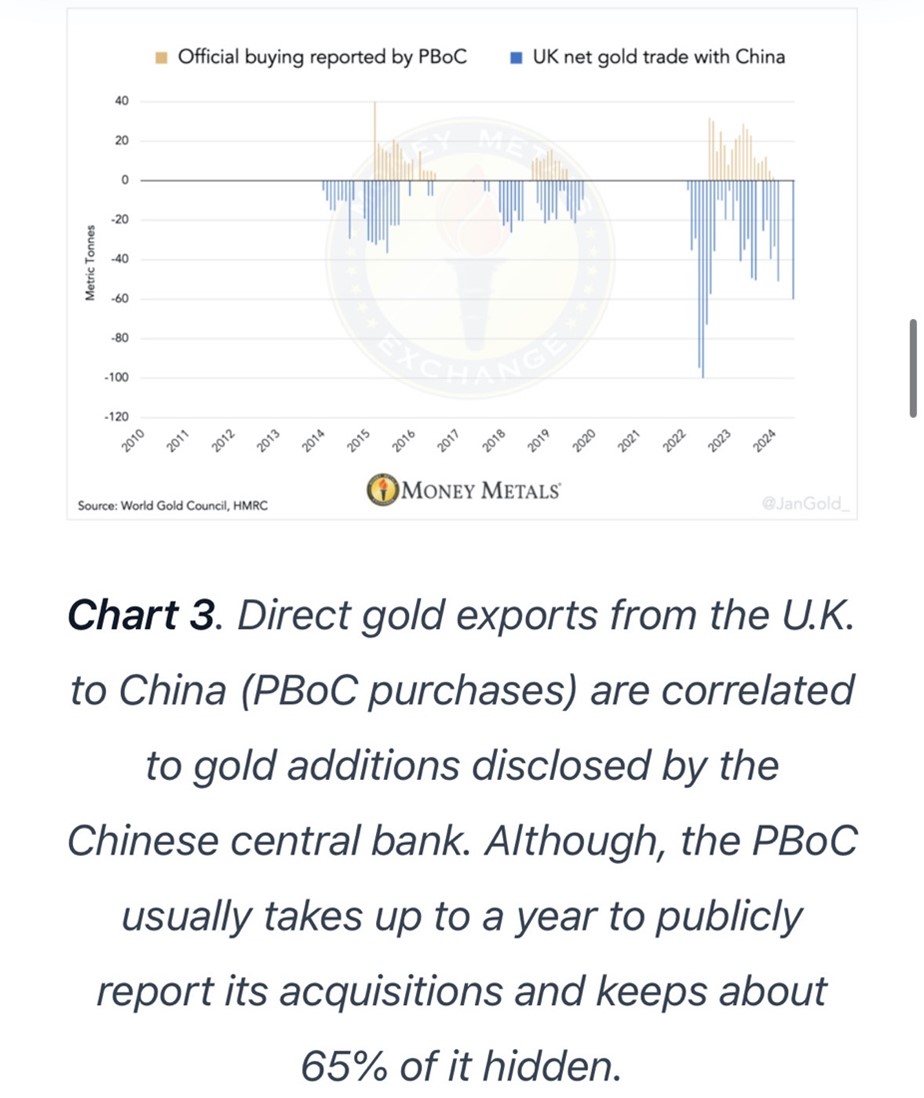

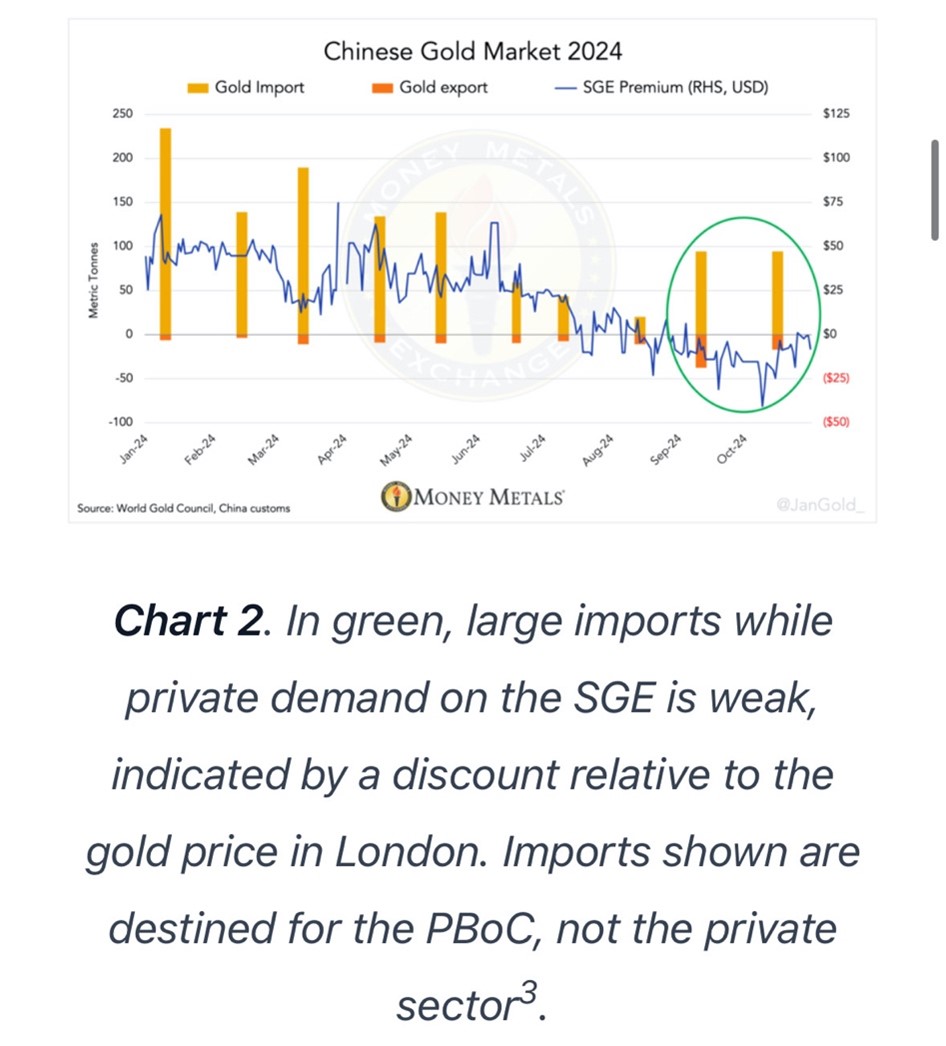

On the surface, we were told that after an 18-month buying spree by the People’s Bank of China (PBOC) that ended in May of 2024, no further purchase by the PBOC had taken place. However, when looking at the Chart #1 below, and understanding China has always been secretive regarding their gold purchases, you can clearly see that China imported 60 tonnes of gold from the UK. However, the PBOC hasn’t officially reported any purchases on their end allowing this news to slide under the radar through all of September and October. Further adding to the case that this unreported gold was purchased by the PBOC and not the Shanghai Gold Exchange (SGE) where private trading of gold takes place, is the fact that premiums have taken a severe dip on the SGE indicating private purchases of gold have certainly seen a pullback in demand. Seen in Chart #2.

(Chart #1)

(Chart #2)

Of course, when it comes to a personal stack of gold and/or silver held by a citizen, the best security is for people not to know you own the precious metals at all. Governments and Central Banks are held to a different regulatory standard and are therefore in a position where their imports and exports, along with official reserves, are called upon to be more transparent, even if this isn’t always reflected in real reports. With the financial system teetering on a knifes edge and geopolitical tensions rising at an accelerated pace, do you find it surprising to learn that a percentage of purchases of gold bullion have gone unreported? For us, the answer is clear.

Hi,

Hi,