Central Bank Digital Currencies (CBDCs) have long been discussed in our newsletters as well as throughout social media and mainstream media channels. Without rehashing the entire argument for and against CBDCs (as these can be found through our blog page on our website), in short, our belief is that the arguments against far outweigh the arguments for a form of currency that removes all privacy from its holder. While we do concede that most of the currency in circulation today is in digital form and therefore a majority of transactions in the world are also already digital; we must emphasize the importance of a more private option being available for citizens. This being where silver and gold become superior, and to a lesser extent the ability to still hold and transact in physical cash. Something that would be eliminated in a fully digital financial environment dominated by CBDCs issued by various countries in the same way cash is today. Again, for a deeper dive into the dangers behind CBDCs we urge you to read our previous newsletters on the subject.

Keeping on the topic of CBDCs, the state of Missouri has proposed a bill in opposition of the issuance of a United States CBDC. While Missouri’s proposed bill is far and away one of the strictest against CBDCs, they become the 15th state to raise concern with proposed legal legislation. Missouri is not only openly stating that CBDCs are NOT money, but that they will block any state participation in a CBDC trial. They took it one step further, stating that if a CBDC is issued by the Federal Reserve, the state will not accept CBDCs as a form of payment, essentially outlawing a digital dollar in the state if this bill is passed. New Hampshire, Indiana, Wisconsin, and Alabama join Missouri, as they too seek to outlaw participation in trials for CBDCs, as well as their overall acceptance during transactions within the state. South Dakota, Nebraska, Oklahoma, Florida, Utah, Wisconsin, Tennessee, South Carolina, North Carolina, Louisiana, and Indiana have also proposed bills stating that CBDCs are not money. Hawaii has joined the fight against CBDCs as well, although their proposed bill is less clear on the reasoning.

While CBDCs were one of the main topics within the bill proposed by Missouri, there was another major portion of this bill that sheds further light on the state’s thoughts of where the financial system is heading. Missouri, if this bill is passed would also renew legal tender status to both gold and silver bullion, allowing for state citizens to use bullion for payments. If Missouri’s state senate passes the bill, they would become the 12th state to make gold and silver legal tender, marking a real shift back toward societies roots with gold and silver as the foundation of money underpinning its value.

There has been a clear change of direction when it comes to the global economy away from fiat currencies, specifically the United States Dollar as the world reserve currency, shifting toward more secure assets such as silver and gold. This has been reported more so as a shift taking place from countries on the eastern hemisphere, however, the shift toward silver and gold close to home as gone more unnoticed by the public. The proposing of legal tender status in Missouri going mostly unreported being a perfect example.

Adding more truth to this claim is a statement from the CEO of the world’s largest publicly traded oil company, Igor Sechin of Rosneft, who said, “Using the dollar as an instrument of sanctions is a big mistake, because trade will never stop. Both energy security and life in general depend on it. Alternatives will always be found. Gold will be the dollar’s main competitor, which mankind has been using for thousands of years for settlements.” And he is right, after sanctions were placed by the United States, BRICS+ nations increased the pace at which they accumulated precious metals as well as increased the speed at which they moved away from the United States Dollar to settle trades amongst themselves. The threat by Donald Trump to place 100% tariffs on BRICS+ countries that abandon the dollar is merely an empty threat as BRICS nations accounted for $578B of United States imports. If BRICS+ turns away from the United States it would be the American economy that suffers far worse than the ever-expanding BRICS+ bloc.

For good reason gold gets much of the attention when speaking about precious metals, however, silver has rapidly gained importance, Russia going as far as announcing silver as a part of their strategic reserve plans for the first time, recognizing silver as a financial asset. And it isn’t just Russia, BRICS+ as an entity has a strangle hold on the silver market which, if a trade war were to break out, would cripple the Western world as every electronic device and a large percentage of military artillery are reliant on silver. With the world running at an over 200-million-ounce deficit, having silver close to home will be vital to a country’s advancement.

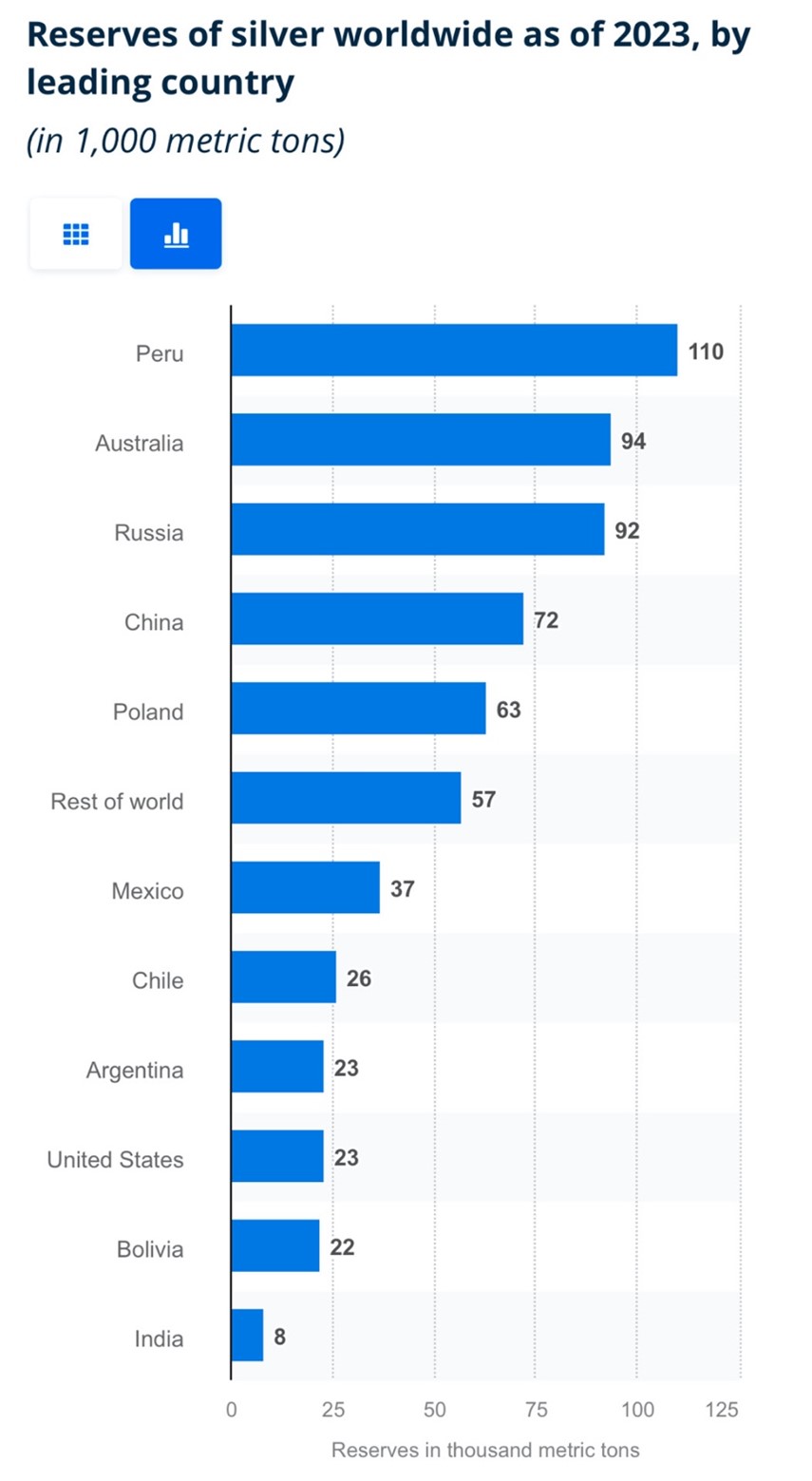

Out of the top ten individual countries in terms of silver reserve size, four countries are currently members of BRICS+, Russia, China, Argentina, and India, and another three, Chile, Peru, and Bolivia, have expressed interested in joining. The above is a good indication of the current health of silver reserves within BRICS+, but what about future production?

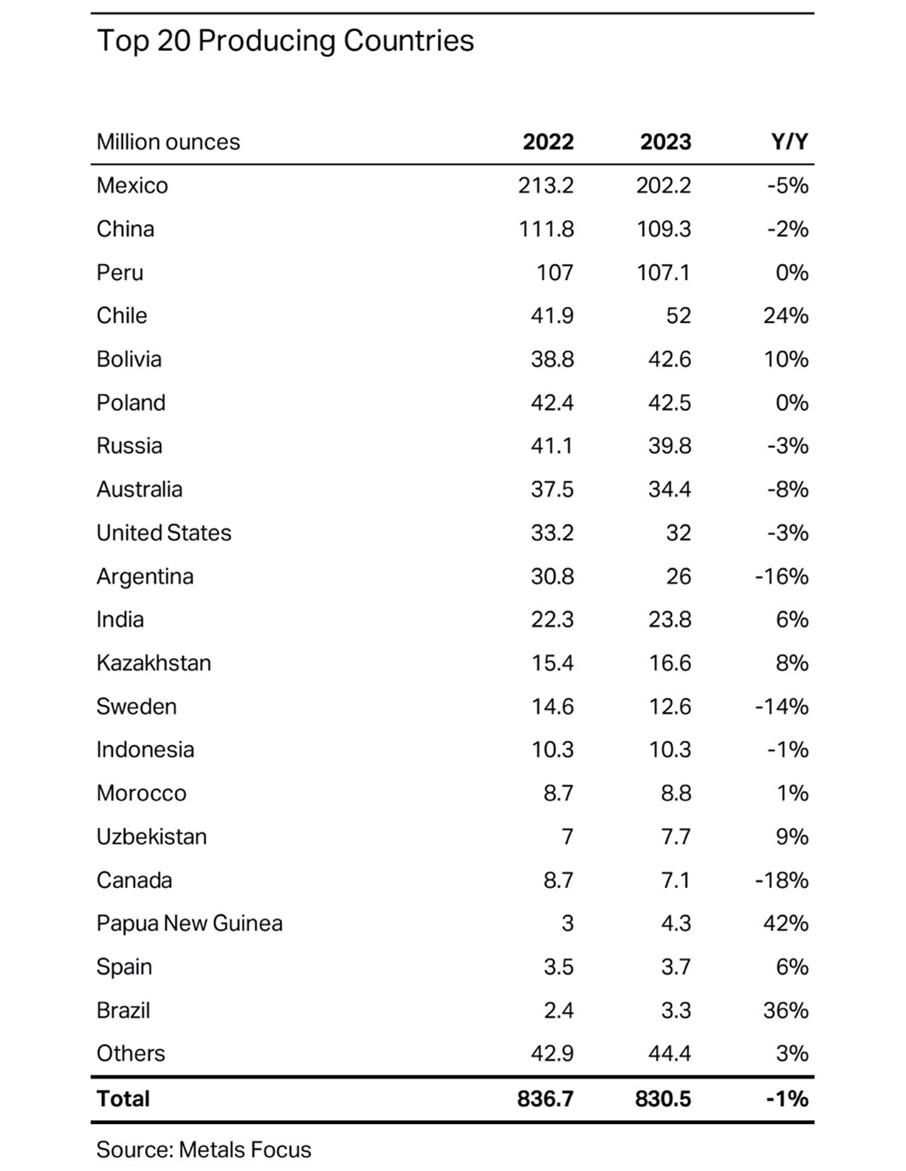

Of the top 20 silver producing countries, BRICS+ accounts for five of the top producers, with another four countries in the top 20 expressing interest in joining BRICS+ including Peru, Chile, Bolivia, and Indonesia. It is important to note that if Peru, Chile, and Bolivia are granted membership to the bloc, BRICS+ would represent 7 of the top 11 silver producers in the world.

It is becoming more and more clear that there is a financial divide in the world. There are those that are focused on permeating debt and financial control via Central Bank Digital Currencies, and those that understand the importance of physical assets that we as a collective are reliant on for survival and advancement alike. The choice you make today will determine if your wealth succumbs to ever-increasing currency debasement or an appreciation due to the same fact, although alternatively, you are holding gold and silver bullion rather than digital dollars.

Hi,

Hi,