When we were reporting on the gains made by silver and gold in our previous newsletters, we had always referred to their progress when measured in United States Dollars (USD). The reason for that is simple. With the USD being the world reserve currency, we have long pointed out that it would be the last domino to fall when it comes to the collapse of world fiat currencies. With both silver and gold sitting at a near 28% gain since January of this year in USDs, it clearly signals that all fiat currencies are in trouble; however, it does not emphasize just how quickly other fiat currencies are collapsing relative to silver and gold. In today’s newsletters we will focus on the currency most important to all Canadians, the Canadian Dollar (CAD). What we present will clearly outline why owning gold and silver is imperative for all Canadians if they wish to not only stem the tide of currency devaluation, but to thrive through the changes.

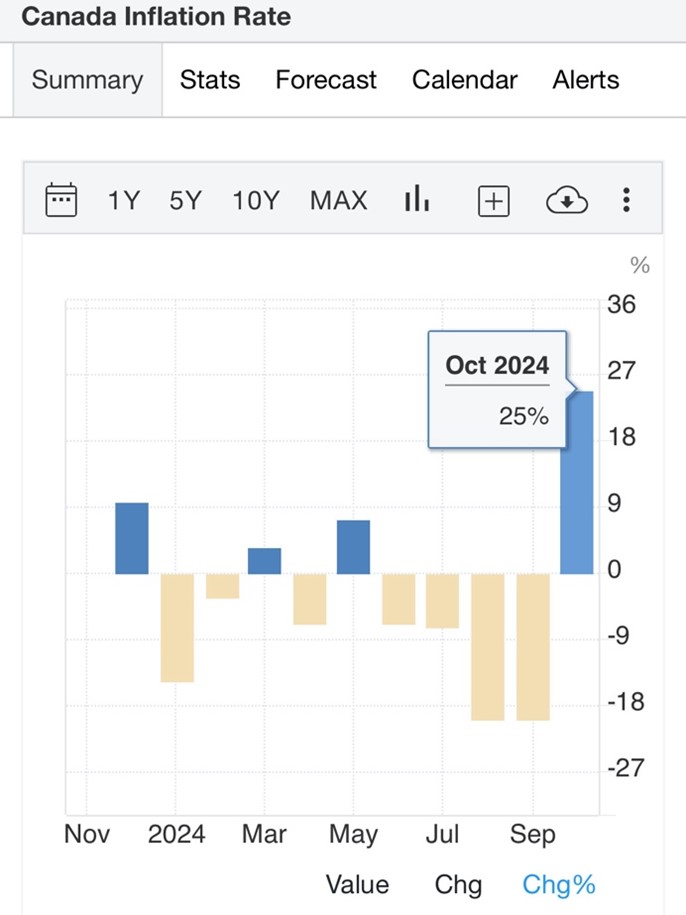

In September of 2024, the Bank of Canada celebrated as their reported inflation came down to 1.6%, below their 2% target. This prompted them to cut rates by an additional 50 bps bringing interest rates down to 3.25%, something we have long warned would cause a recoil with inflation forcing it to go much higher. In October of 2024, inflation began its journey higher posting at 2% on the month. While on the surface this may not seem like a large increase, when put into percentage terms this represents a 25% increase in inflation in just 30 days. With interest rates continuing to be lowered, resistance for higher inflation is lowered along with it. Diving into the 2% inflation report for October, when looking at the categories most important to Canadians you see a much higher level of inflation. Food inflation was reported to be up 2.8%, which all Canadians certainly felt at the grocery store. Rent or shelter inflation was up 7.3%. While services inflation was up 3.6%. Where most of Canadians are spending their money are the categories that are seeing the largest increases. We have long known the reported inflation is a number that can be easily manipulated lower (covered in a previous newsletter), and even still, the numbers being reported are cause for concern for all citizens.

When looking at how the CAD has fared in comparison to the world’s strongest currency, the USD, you see the picture becoming ever grimmer. The all-time low for the CAD’s exchange rate with the USD was 1.60 on January 31st, 2002, a couple years after the Dotcom Crash of 2000. Meaning, in short, that it took $1.60 CAD to get $1.00 USD. Many of you reading may even remember a time when the CAD was stronger than the USD, though, those days are over a decade behind us. Today, the CAD is rapidly approaching that all-time low of 1.60, currently sitting at 1.42. What is staggering about this increase is that it represents a 7.52% loss against the USD in just 12 months, which, is the equivalent to what was lost over the past 5 years.

Notice the last time the CAD was this weak against the USD was during the lockdowns of 2020. It is shocking to realize the CAD is as weak today as it was when economies essentially halted in place. What should also be considered in this equation is the trade war that is manifesting itself between Canada and the United States. Donald Trump has threatened Canada with tariffs if the shared border is not secured from the Canadian side, even going as far as calling Canada the 51st state of the United States with Justin Trudeau as its Governor. Doug Ford, the Ontario Premier fired back at Trump threatening to cut off millions of Americans that live on the border with Ontario from the energy Ontario produces. With Trump stating in response, “that’s okay if he [Doug Ford] does that, that’s fine. The United States is subsidizing Canada, it is truly a subsidy, and we shouldn’t have to do that.” Trump went on to claim that the United States subsidizes Canada to the tune of $100 billion USD per year. He made similar claims in 2018. One thing that is clear when looking at these incredibly murky waters is that if Canada engages in a trade war with the United States, the value of currency will only fall quicker as it is likely currency creation would increase to offset the impact of the trade war.

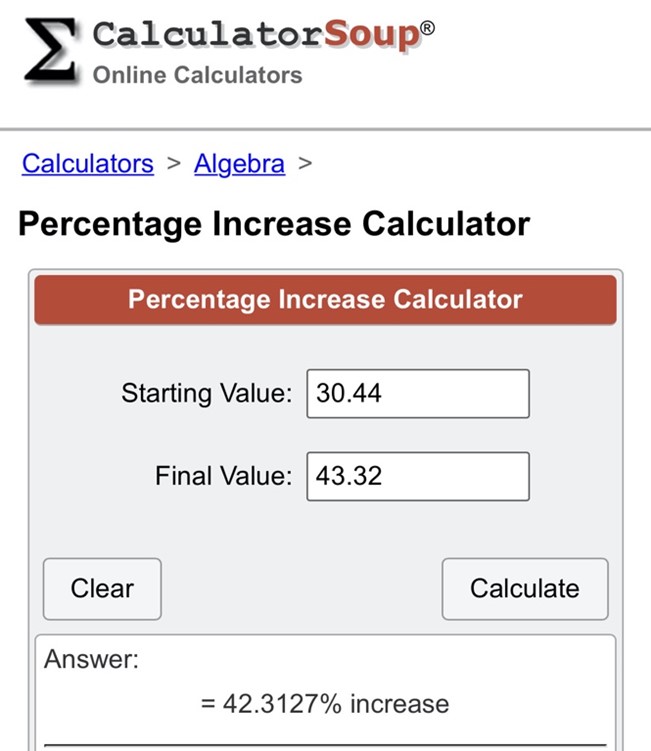

When looking at how this loss in value in the CAD relative to the USD impacts Canadians when it comes to silver and gold, it becomes obvious why owning silver and gold is essential for all Canadians to preserve their wealth. At time of writing, one ounce of silver in CAD is $43.32. At the beginning of the year, that same ounce was valued at $30.44. That represents a massive 42.31% increase in silver in CAD terms.

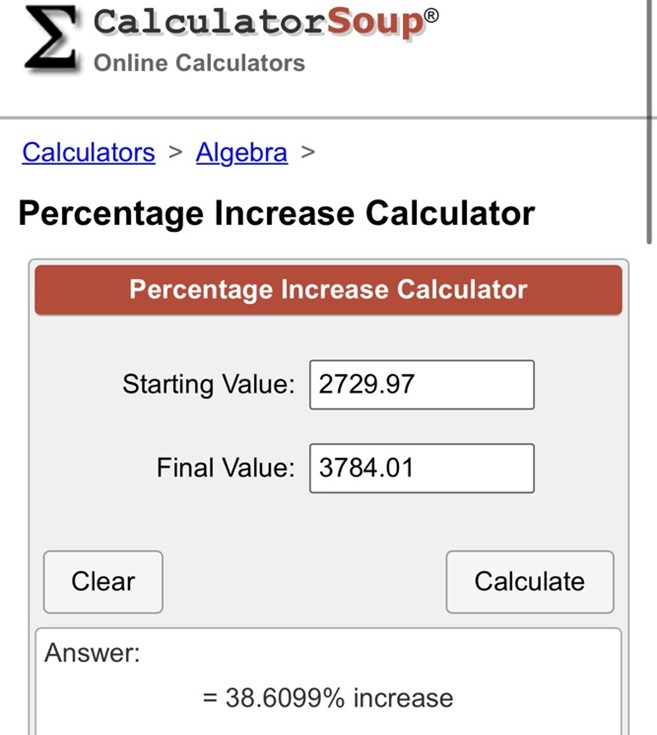

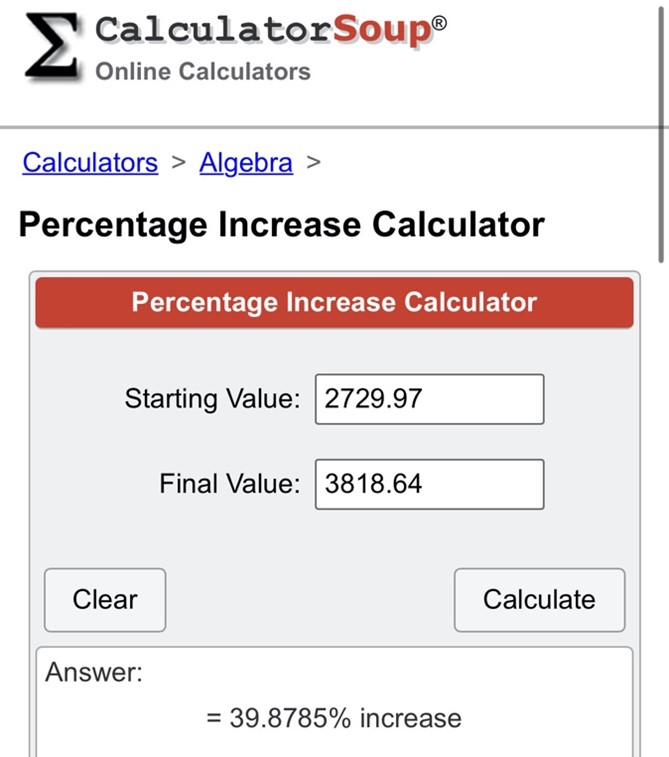

One ounce of gold at time of writing sits at $3784.01 CAD, which is up from its price at the beginning of the year: $2729.97 CAD. This represents an increase of 38.61%.

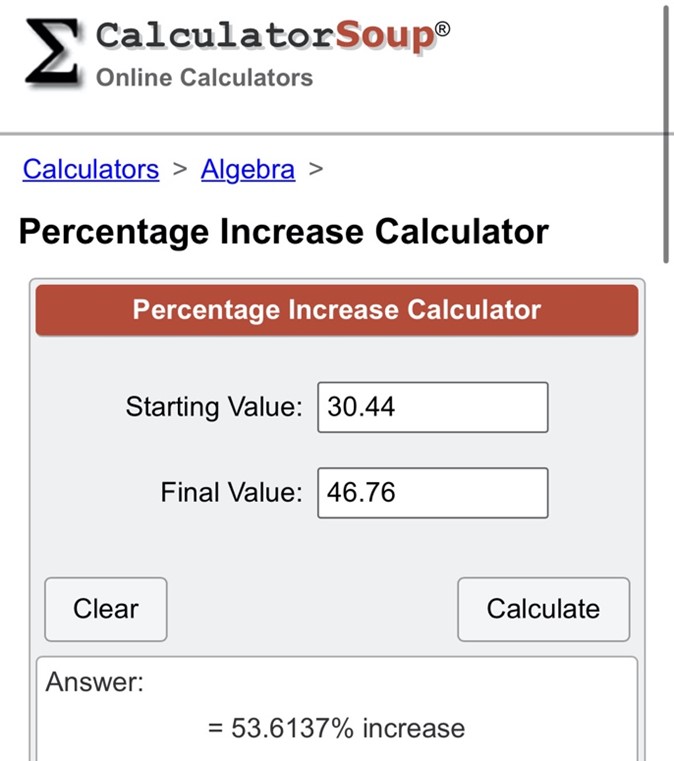

If we were to instead look at the price highs for both silver and gold recorded this year, rather than where their price is at present, the loss of value in the CAD becomes glaringly obvious. Silver’s low to high on the year represents an increase of 53.61% as it reached $46.76/oz. Gold on the other hand saw an increase of 39.88% seeing a high of $3818.64/oz.

After a year of all-time high after all-time high for gold, and with silver outpacing gold along the way in search of a new all-time high of its own, regardless of what we are told about the health of economies domestically and abroad, silver and gold are sending warning signals that trouble is on the horizon. With the CAD losing nearly half of its value relative to gold and silver in a single year it emphasizes the importance of owning these precious metals as any savings held in fiat CADs struggle to keep up with the rising cost of goods and services.

Hi,

Hi,