After Richard Nixon had removed the United States and so the world off the gold standard on August 15th, 1971, the American economy was thrown into a whirlwind, unsurprisingly, as currency was now untethered from real value. The result, deep recessions between 1973-75 and another in 1979-80 that caused serious financial pain to your average citizen. This naturally caused those who were against Nixon’s actions and in favour of gold as money to stir. The mumbles and grumbles about the need for gold became so loud in 1981 that then President Ronald Reagan decided to create a Gold Commission in Congress. With its main objective being to decide if the United States should return to the gold standard, and if so, how.

After a year of research and debate, the Gold Commission released its Majority Report, which stated, “The majority of us at this time favour essentially no change in the present role of gold. Yet, we are not prepared to rule out that an enlarged role for gold may emerge at some future date. If reasonable price stability and confidence in our currency are not restored in the years ahead, we believe that those who advocate an immediate return to gold will grow in numbers and political influence.”

Notice, the terms used: ‘some future date’ and ‘in the years ahead’. At no time was a specific time frame mentioned of when this enlarged role for gold may appear. Looking at the current landscape of the global financial system, we would say that role is quickly approaching, and the way world central banks are buying gold and silver, we would bet they too believe the same.

What was interesting about the report that was released was that there was two parts. The Majority Report prepared by those in favour of staying removed from the gold standard and the Minority Report: The Case for Gold written by those in favour of gold being the bedrock of the financial system, with the head of this group being then Congressman Ron Paul. A reflection of the Gold Commission Report by American Economist, Anna J. Schwartz stated the following about Ron Paul and the Minority Report, “He [Ron Paul] proposed a delay in the implementation of the program outlined therein [the minority report plan for returning to gold] until the Reagan Administration’s fiscal and monetary programs and the recommendations of the Gold Commission Majority Report were given an opportunity to prove themselves.” In other words, the suggestion of the Minority Report was the allow the Federal Reserve and the United States Government to print and print and print more currency under the recommendations of the Gold Commission until faith was lost in fiat currency and the people finally demand the return of gold.

While, what we laid out above may seem as if it is a stretch, our interpretation of Ron Paul and the Minority Report’s comments become more understandably accurate when you begin to analyze what exactly happened financially around 1981. And rather than ramble on about the changes that occurred at that time, we will just show you a few charts because as they say, a picture is worth a thousand words.

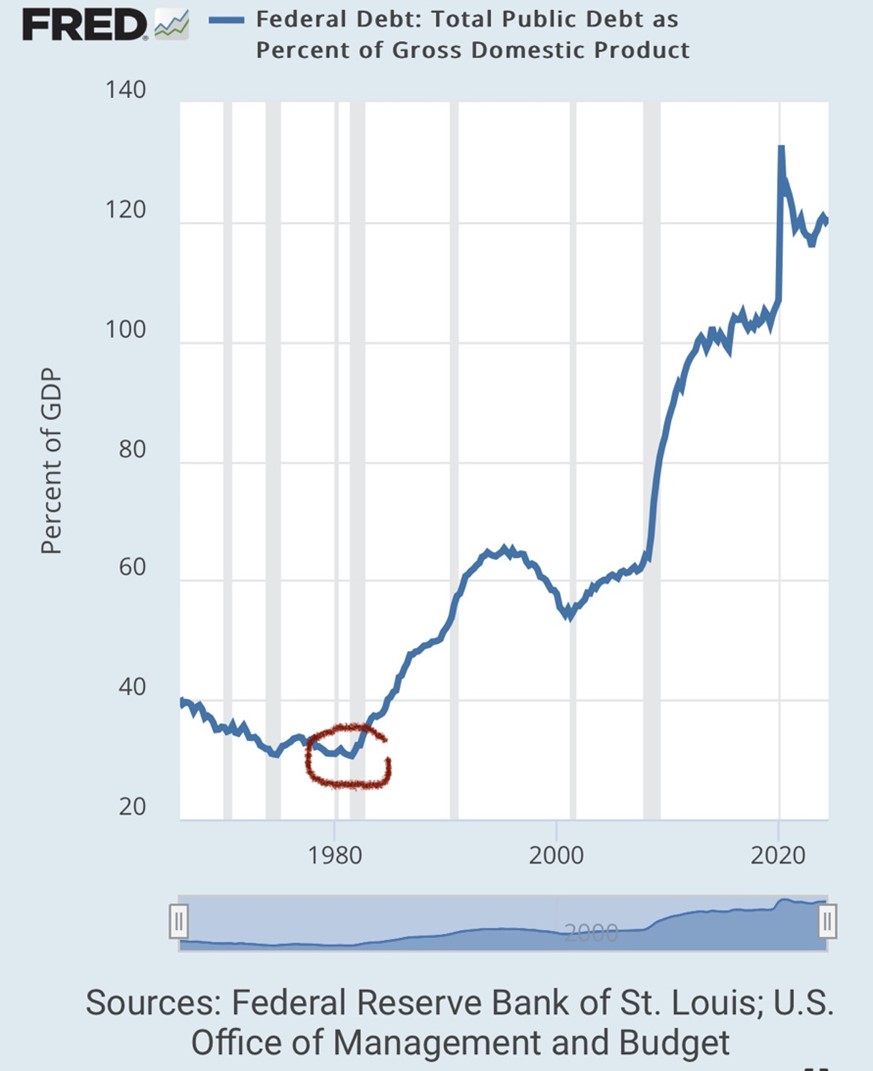

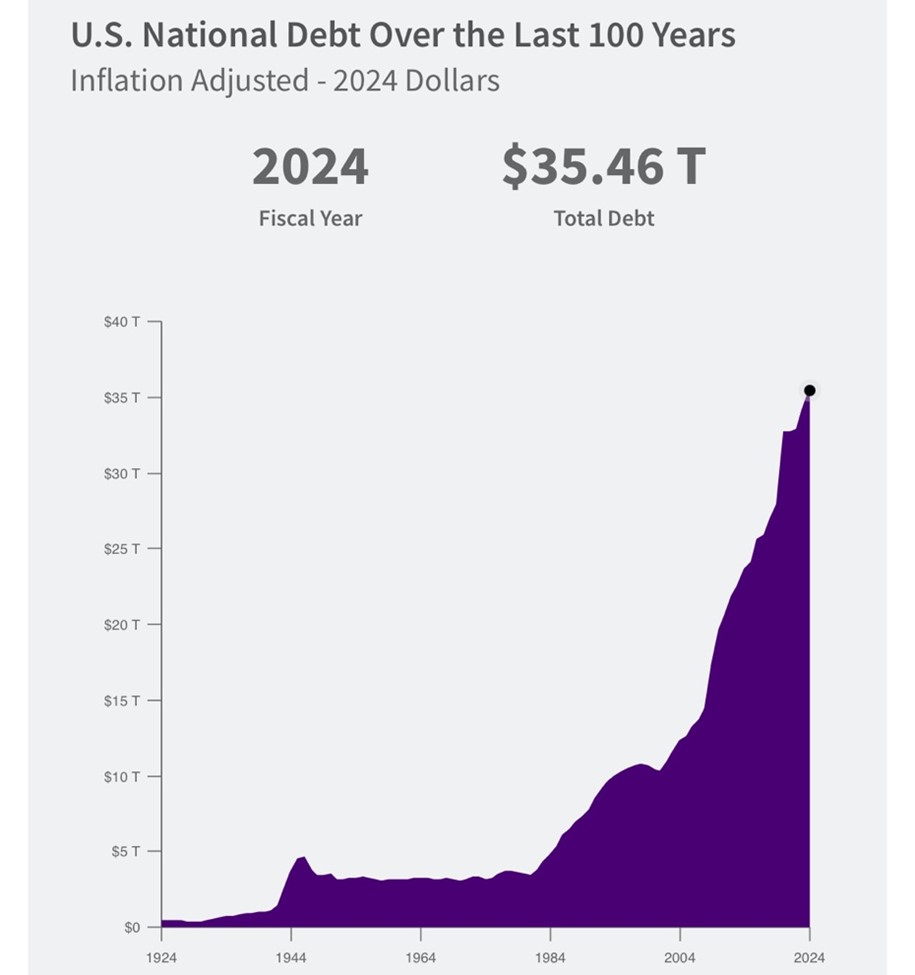

As you can see in both charts, right after the Gold Commission’s recommendations, government spending and therefore currency creation skyrocketed. Which is a perpetual cycle because as the government spends more, it must borrow more from the Federal Reserve meaning the government will owe more back to the Federal Reserve as interest payments to service their debt. As of today, the United States government must spend nearly $170 billion USD annually in interest payments. This represents 13% of their entire budget, simply spent to pay off past debts all the while taking on newer and larger debts, feeding the cycle. Further, the United States Congress must decide to raise the debt ceiling in the next 12 days allowing for the government to borrow more money after January 1st, 2025. If they don’t, they will default on their debt and United States Dollars everywhere will become valueless overnight.

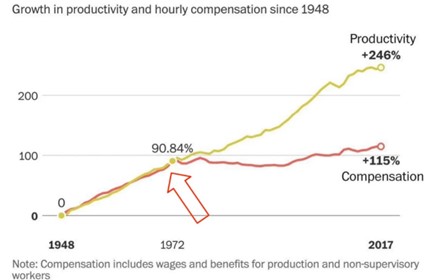

Continuing, the U.S. National Debt essentially moved in a vertical pattern along with the public’s debt as a percentage of GDP after 1981. Essentially meaning as currency was created, productivity waned, and to make it worse, workers were compensated less and less for that productivity. Which is further outlined below:

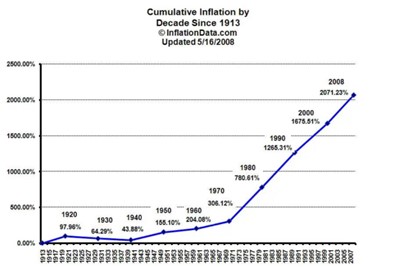

Further driving home the point of citizens losing their purchasing power along with being compensated less, the chart below outlines cumulative inflation the United States has faced due to the depreciation of their dollar. This also emphasizes the importance of gold as after 1971, inflation began to surge out of control and was only more normalized overtime, so citizens accepted this stealth tax without a fuss.

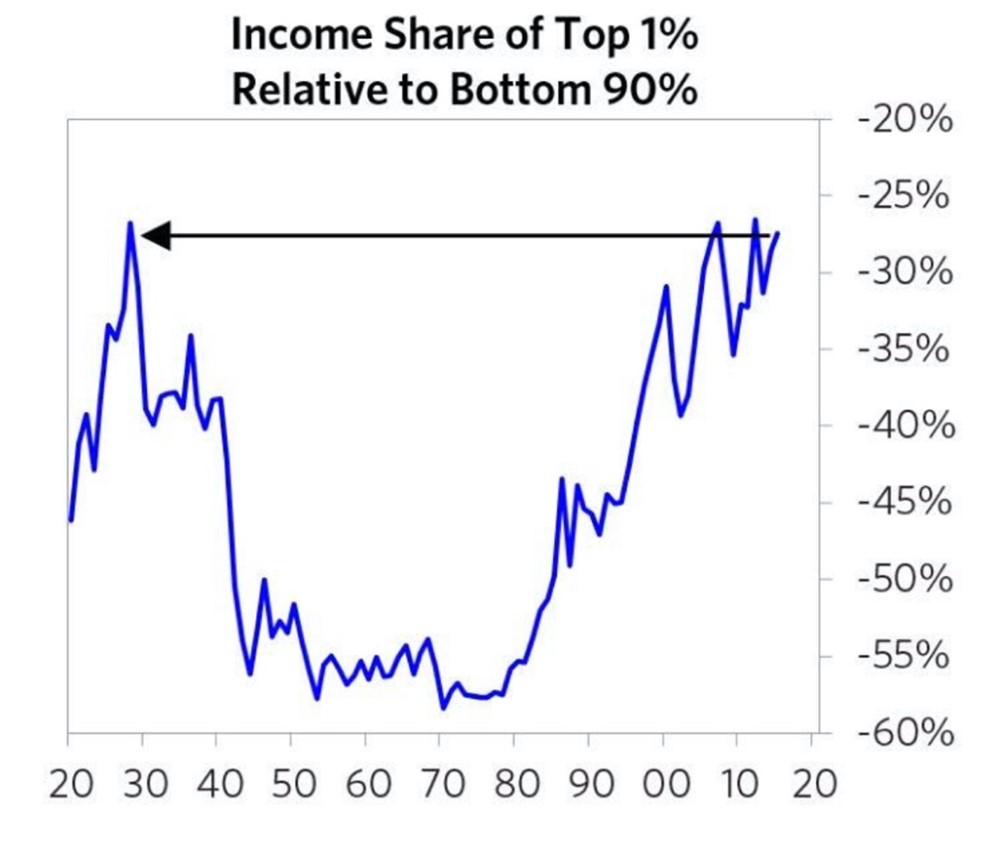

Finally, to finish off, we will show you the direct impact this has had on the balance of wealth. Remember, those who are wealthy are buying up physical assets with tangible value using their created currency, currency citizens don’t have near as much of. The reason for this was stated in our introduction. The plan has been simple, print to oblivion, buy up all the things of real value like silver, gold, farmland, and real estate, while pushing fantasy internet coins on the people until the day is upon us where gold’s enlarged role emerges as a phoenix rises from the ashes. By that time, prices will have risen substantially, governments again will own most of the gold and silver which is why it is vitally important for citizens in every country to begin to save in physical precious metals.

The share of wealth, when gold was being implemented as money and the people owned gold, had dropped down to stable levels where the 90% had over half of the world’s wealth for a period of 40 years. It wasn’t until 1981, when the printing of currency was turned on high, that the wealth imbalance swung back in favour of the top 1%, now sitting at its most imbalanced level in history. Even after gold has made over 30 all-time highs this year, it is still incredibly cheap relative to all the debt and all the currency circulating in the world today. In 10 years, even 5, and potentially even next year, today’s prices for both gold and silver are going to be looked back on in “awe” as people fight to grasp that these two vital metals were being sold for so cheap.

Hi,

Hi,