Role of Precious Metals in the Foundation of Generational Wealth

Are you beginning to feel as if what we are being told about the health of the United States and Canadian economies is in no way matching the data that continues to come out? On one hand, we were told that inflation from the lockdowns of 2020 would be transitory and would leave as quickly as it came. Then we were told it is being stickier or staying higher than anticipated for longer, but fear not because the economy is running hot and is in good shape. We have covered in previous newsletters that that statement is only true for a small percentage of the world’s largest companies, while the rest continue to struggle under immense financial burden. The consumer is in bad shape, regardless of what we are told, and that is leading to far less spending, and the spending that is taking place is largely done on credit as many people can no longer afford what they require to live daily.

The scariest part about what is unfolding is the sheer magnitude of the next crash. It is like a storm on the gulf slowly, but surely, picking up speed. The reason we say that is because you can see countries all around the world begin to crack under the might of the “strong dollar”. As these national currencies hasten their loss in value, and costs to borrow United States Dollars continues to rise, these countries slowly lose their ability to finance their debt leading to more printing and a further depreciation of citizen savings held in their national fiat currency. The United States, however, is not left unimpacted by a stronger dollar, they are merely the last domino to fall, and there too, you are beginning to see seismic cracks.

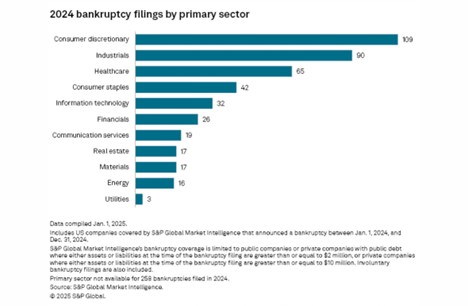

The first crack in the United States economy highlighted today is the number of corporate bankruptcies we saw through 2024. In total, the United States saw 694 bankruptcies, surpassing the 638 seen in 2020 when the economy was essentially shutdown. For further context, 2023 fell just shy of 2020 with 635 bankruptcies of its own; 1329 bankruptcies in 2 years, all while the economy is in “good shape”. The last time there were more than 600 in a single year was in 2010 and 2011, 14 years ago, with 2010 holding the high of 828 corporate bankruptcies, which as a reminder, was in the aftermath of the 2008 Great Recession. Again, 2024 has set a 14-year high for corporate bankruptcies in the United States and no such collapse has even taken place yet.

Looking at the breakdown of which sectors these bankruptcies appeared in only further highlights the difficulty citizens are facing.

Leading the way are Consumer Discretionary businesses, which are classified as such because they sell goods or services that consumers don’t need, but rather simply want. Whereas the Consumer Staples category would cover essentials such as grocery stores. Nevertheless, citizens have rapidly tightened their budgets and have begun cutting out luxury items to the detriment of those company’s consumers previously enjoyed; Party City being an example of a December 2024 bankruptcy with 700 locations being closed.

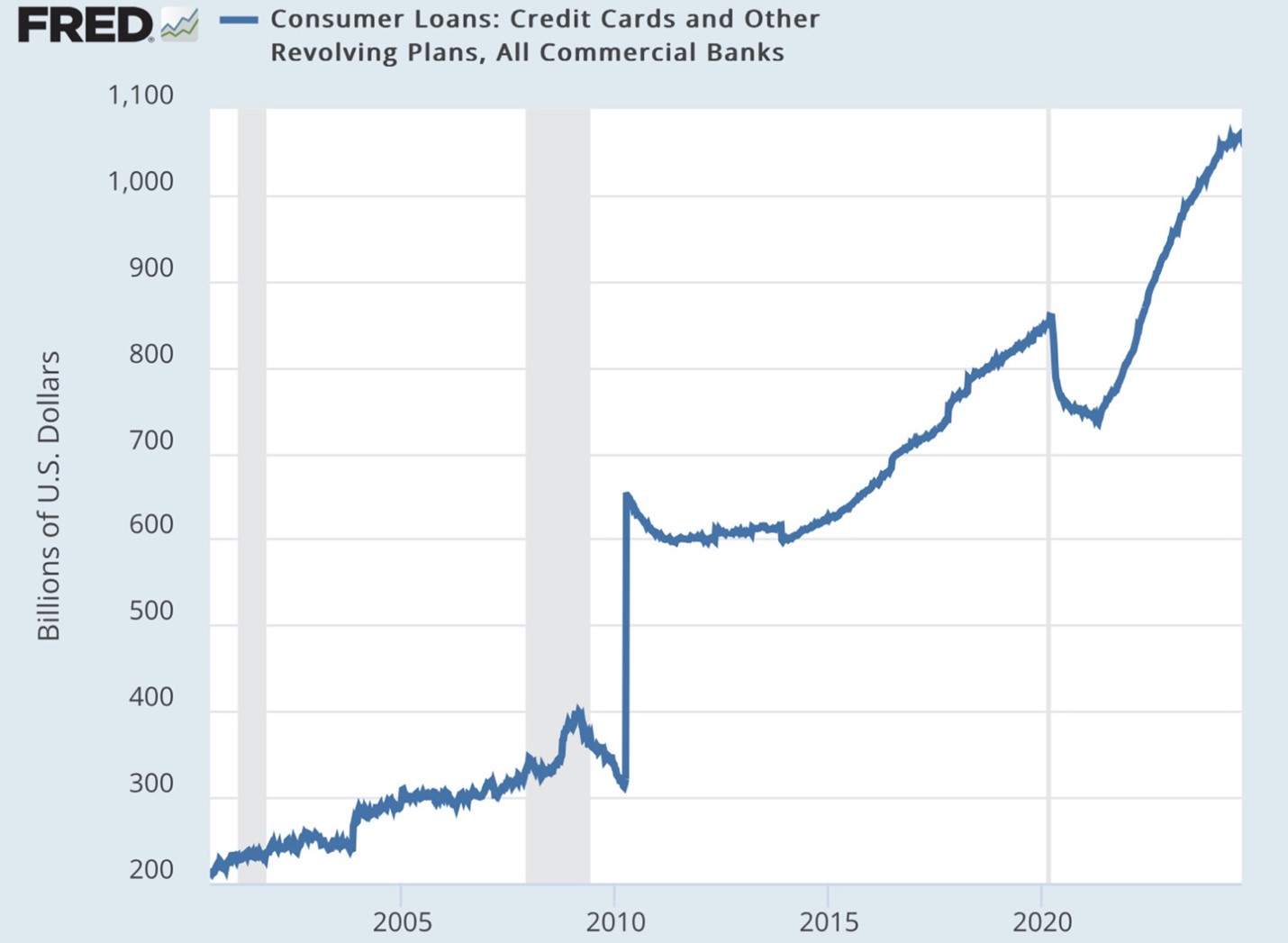

The second crack we will highlight emphasizes that the United States economy is in a bad place, not only for businesses, but consumers alike. In the first 9 months of 2024, credit card defaults reached $46 BILLION USD, 50% higher than the same time in 2023, and is a high unseen since again, 2010 during the aftermath of The Great Recession of 2008. When you look at the chart below, your jaw can’t help but hit the floor. You can clearly see the massive spike in consumer debt that took place after 2010, however, it just never stopped moving higher. Something we can all agree is simply unsustainable and if financial history has taught us anything it is that the economy is due for a sizable correction back toward fair value to weed out decades of high inflation and bad debt.

Yes, you are seeing that correctly. There is over $1 TRILLION USD in consumer debt currently floating in the market. Truly eyewatering numbers.

So, based off the title of this newsletter, you may be wondering, “what does this have to do with precious metals?”. Well, the reason so many people find themselves in such a bind today is because most people have a pervasive problem with buying things they don’t need for instant gratification rather than buying something that would benefit their future self or those they love. When looking at the trouble we see in the global economy, the countries that will come out of this looming financial transition on top will be those that hold items of real value. Most gold held by governments and central banks was purchased when it was $35 USD/oz and sits in a revaluation account because their profits have not been realized at today’s prices, but of course, the profits are there when they need them, and they soon will. Even still, that doesn’t stop them from purchasing record amounts of gold today because they also know in 50 years, they will have another revaluation account when gold is hypothetically over $20,000 USD/oz up from $2600+ USD/oz. Which, that number may seem outlandish, but as we have seen, gold has precedent for climbing higher over time meaning that number may even be far too low, which is also why it is viewed as the best safe haven asset in the world today.

In 1981, there were 230 million Americans and $1.6 trillion USD in the M2 circulating money supply. Fast forward to present day, there are 341 million Americans and $21.6 trillion USD in the M2 circulating money supply. Broken down, there is right around 50% more people, however, the money supply has gone up by right around 2000%. Someone with no financial background would think, well, that would mean everyone is far wealthier today. Wrong. This is the foundation for why everyone feels so much poorer. The supply of goods has not increased by 2000%, and therefore goods continue to appreciate while the value of each dollar continues to depreciate at an even more rapid pace. Many people just getting started often elect to save in cash (more commonly in an online savings account).

Going back to just the year 2000, gold has risen 890% meaning those that simply bought gold and held it continue to get ahead of those that grow their savings account online as although the dollar amount rises, its purchasing power falls. This is the same reason countries are buying mines, rare earth metals, precious metals, farmland, real estate, etc. They know these things will continue to appreciate over time and are not just thinking about how to get rich quick. If each citizen did the same thing today and started with small purchases of silver and gold, that would put in motion a plan for building generational wealth for your family. It is certain that you will not see the peak in the value of precious metals during your lifetime because as we grow old and our children are passed wisdom along with the gold and silver we purchased, they will continue to see its value rise even after we are gone. Generations later, your family will be in a far better position today than had we simply passed down Canadian Dollars.

Hi,

Hi,