After threats of tariffs by United States President Donald Trump, the precious metals industry has been thrown in a frenzy with countries and citizens alike, in all corners of the world, scrambling to secure as much physical silver and gold as possible. Prior to the tariff threats being made it was seemingly only countries in the Eastern hemisphere that were prioritizing the purchase of these assets. However, as we briefly mentioned in our last newsletter the United States has started to blitz the market with purchases putting immense pressure on bullion banks that scramble to fulfill orders.

As a reminder, previously, when ordering delivery of your gold bullion from the Bank of England vaults, it would take a mere 2-3 days to receive your bullion. The recent demand surge has pushed this delivery time to 4-8 weeks!! Due to this massive backlog, the Bank of England has started offering to fulfill gold contracts for $5 below spot price per ounce as its services have become so unattractive. Historically, the lowest a discount would ever be for gold from the Bank of England would be 10-20 cents. This outlines just how untrustworthy the Bank of England has become in regard to gold deliveries due to these extended delays, now having to offer bullion at a discount. Mind you, bullion that may never arrive.

For added context, look at the graphic below highlighting deliveries of gold made from the COMEX in New York through the first 4 days of February. This clearly explains why the COMEX itself has been rushing to fill its vaults with gold from London:

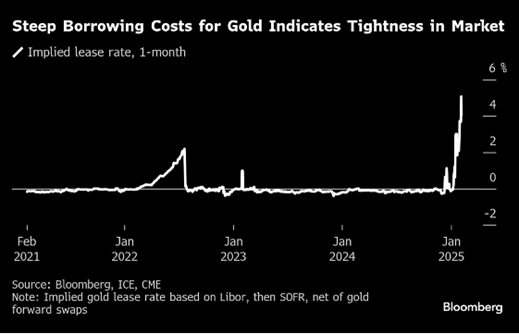

This represents an over 100% increase in gold delivery demands through just 4 days of February when compared to the entirety of January, which represented a high delivery month. With demand continuing to soar you are seeing short sellers of both gold and silver exit the market rapidly due to fears of being liquidated by rising prices in both metals. This has also caused the premiums short sellers must pay to borrow silver/gold to execute a short sell to fly to unseen heights.

(GOLD PREMIUMS SURGE TO NEARLY 6%)

(SILVER PREMIUMS SURGE TO OVER 12%)

As you can see above, premiums to borrow both gold and silver most often sat right above 0.0%. This allowed for short sellers to very easily take advantage of buying and selling silver contracts with no real silver backing them for next to no cost artificially putting downward pressure on prices, more commonly referred to as “naked shorts”. Now, with market demand for physical silver and gold going through the roof and short sellers fleeing the market, these premiums have spiked to nearly 6% for gold and over 12% for silver. To borrow either, there is now immense risk as you must pay far more upfront with the added risk of high demand pushing prices higher and higher.

When looking at the entire landscape for gold and silver you see that demand is not just centered in larger regions, but rather, the entire world is buying and buying in high quantities. The World Gold Council just recently reported that in 2024, Central Banks purchased 1045 tonnes of gold, representing the 3rd straight year over 1000 tonnes. Not only that, but they reported that world demand for gold hit a record high with 4974 tonnes, nearly 5000 tonnes of gold, being consumed in 2024; this including central bank purchases as well as over-the-counter purchases by citizens, similar to the transactions made at Au Bullion.

Focusing in on BRICS+ specifically, a report came out on Wednesday of this week that stated Russian citizens purchased 75.6 metric tonnes of gold or 2.43 million troy ounces of gold in 2024 alone: up 62% since 2021. Also, to no one’s surprise, the People’s Bank of China also announced they purchased 160,000 troy ounces of gold in January of 2025, raising their total reserves to 73.45 million troy ounces and further securing their countries financial future.

Looking at how major asset classes started 2025, we finish this newsletter with a list from best to worst performers measured in USD through January of 2025:

- SILVER (9.01%)

- GOLD (8.56%)

- PALLADIUM (8.47%)

- PLATINUM (5.51%)

- DOW JONES (3.95%)

- S&P 500 INDEX (0.92%)

- BITCOIN (0.23%)

- NASDAQ (0.07%)

- ETHEREUM (-23.30%)

When adding the first week of February, the list looks as such:

- SILVER (11.21%) +2.20%

- GOLD (9.04%) +0.48%

- PLATINUM (7.44%) +1.93%

- PALLADIUM (7.04%) -1.43%

- BITCOIN (4.80%) +4.57%

- DOW JONES (4.34%) +0.39%

- NASDAQ (2.61%) +2.54%

- S&P 500 INDEX (2.38%) +1.46%

- ETHEREUM (-19.28%) +4.02

At time of writing, precious metals claim the top 4 spots with silver running away with the race.

What has been long foreseen by precious metals owners will soon become clear to the rest of those that didn’t. Silver, gold, and other precious metals far and away perform the best during times of uncertainty as reflected above. The same could be said for 2024, and 2025 is shaping up to be far more chaotic from a geopolitical and global finance perspective. Long tested by time, and again to be proven true in the modern era, silver and gold will be the last assets standing as trade wars and other conflicts intensify.

Hi,

Hi,